For years, business founders in Europe have marveled at the caliber of the American tech companies emerging from Silicon Valley. Well, now the time is changing! The European tech landscape is expanding rapidly, signaling the start of a golden age of European tech entrepreneurship.

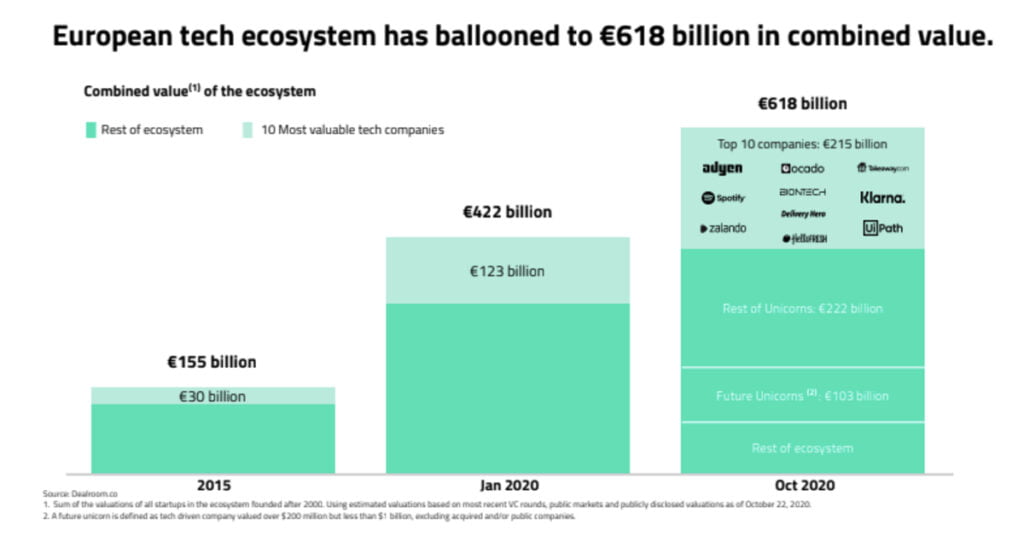

Europe tech sector value skyrockets

According to the latest report produced by Dealroom for Index Ventures, Europe’s tech sector is worth four times what it was five years ago, having lept from €155B in 2015 to €618B in 2020. The new data produced by Dealroom for the “Not Optional – Making Europe the Most Entrepreneurial Continent” summit – an event hosted by Index Ventures and Slush, reveals that the value of European tech companies has increased rapidly. The value of European tech companies skyrocketed by 46% in 2020 alone.

As of October 2020, a third of the combined value of companies is based on the top 10 leading tech businesses in Europe: Adyen, BioNtech, Delivery Hero, Klarna, Spotify, Ocado, HelloFresh, Takeaway.com, UiPath, and Zalando, says the report. The value of the top 10 companies has surged from €123B in January 2020 to €215B in October 2020.

The research also highlights the fact that 38% of global seed-stage capital is now raised by European startups. Notably, Europe received around 16% of global VC in 2019, a 10% increase from 2018. Since 2005, Europe has created 205 unicorns also.

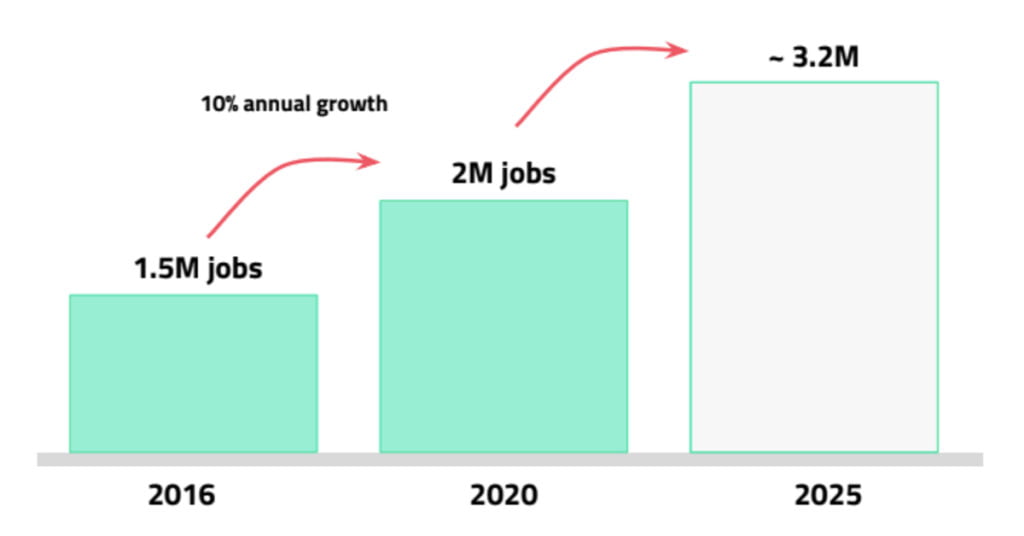

Job growth is rising at 10% YoY

Amid the COVID-19 pandemic, Europe’s tech sector continues to expand and create employment opportunities for people across Europe, adds the report. Around 2M people have been employed in the European tech scene in 2020, which is a 43% increase from 2016. Also, the startups are experiencing a 10% growth in job creation YoY.

Various industries like e-commerce, health tech, fintech, and food sectors are expected to expand. Provided this growth rate continues, as many as 3.2M people will be employed in European tech by as soon as 2025. The key stats in the report shows that 73% of European tech jobs are generated by 4,900+ startups.

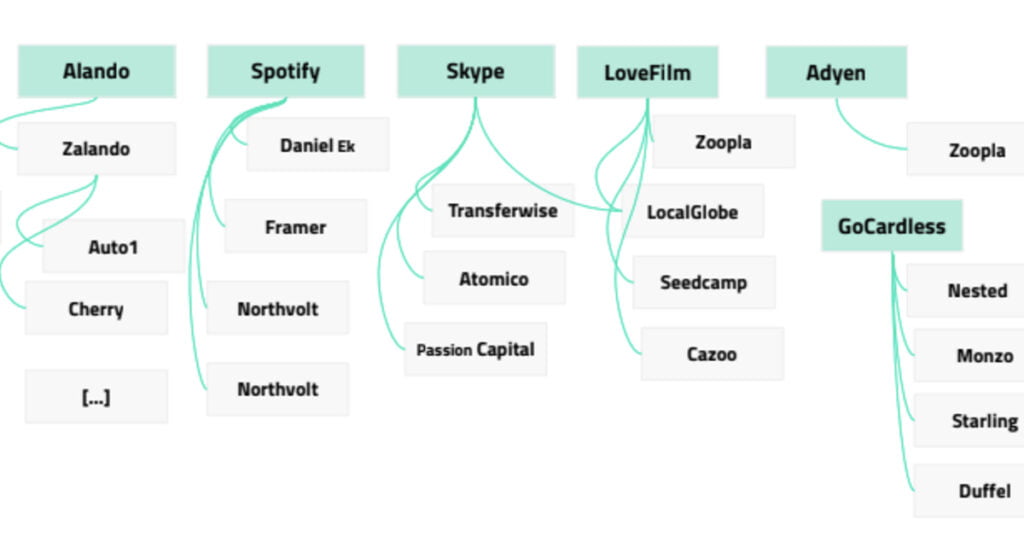

Snowball effect!

According to the report, founders, and early employees from Europe’s largest firms, including Skype, Spotify, Lovefilm, and Klarna are fuelling the next generation of startups, scaleups, and unicorns.

For example:

- Taavet Hinrikus, Skype’s former director of strategy, founded TransferWise in 2010 (valued at $5B (approx €4.2B) in July 2020).

- Niklas Zennström, Skype co-founder, is CEO and founding partner of Atomico.

- Alex Chesterman, the co-founder of LoveFilm and Zoopla, is CEO and founder of Cazoo.

“Just as a small group of alumni from PayPal went on to create a new generation of companies, Europe’s founders from companies like Spotify, Adyen and Skype have helped fuel a generation of entrepreneurship across Europe. They are continuing to create and invest in tens of new companies, helping to bring Europe to a new level of maturity. Europe has the talent, experience, funding and ambition to become one of the most entrepreneurial places on the planet,” says Peteris Zilgalvis, head of unit, “Digital Innovation and Blockchain”, DG CONNECT, European Commission.

On top of that, many European tech alumni have become active investors including Spotify founder Daniel Ek who has pledged to invest $1B (approx €4.2B) in European startups. The former LoveFilm alumni including Saul Klein and Alex Chesterman are both involved in funding the next-generation of tech companies, and in founding them.

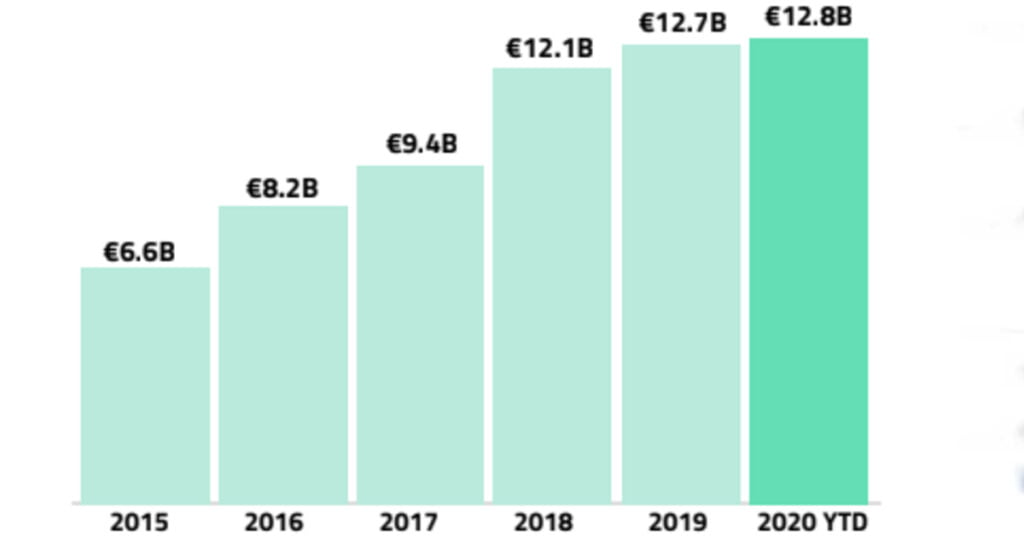

European VCs break record

European VCs have raised record-breaking amounts of new funds, year-on-year, since 2015. The VC investment in Europe reached a new record high of €10.2B across 1,024 deals in Q3, 2020. Despite COVID-19, European VCs are on course to continue this record-breaking trend in 2020 by raising a total of €13B by the end of the year.

Talking about European companies, according to this report, they have raised €29B in 2020 so far – expected to reach €35B by the end of the year. A decade ago, just 20% of unicorns were backed by venture capital, but in 2019, nearly 82% unicorns were backed by VCs. This indicates that the European tech system is becoming more dependent on venture capital.

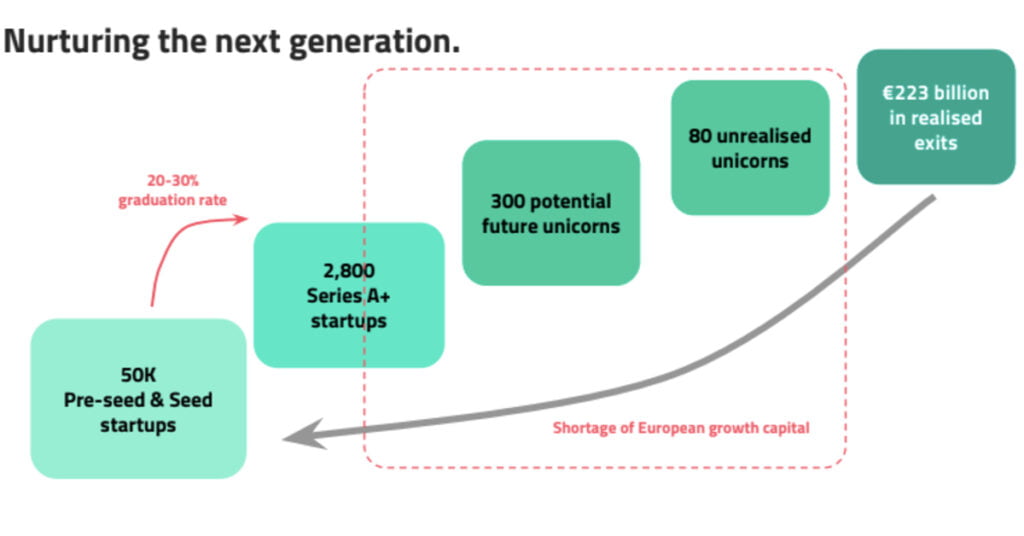

Funding gap

Many European companies still depend on foreign sources of capital, particularly as they grow in size and scale. Around 39% of total funding for European startups comes from outside Europe. For funding rounds above $100M (approx €85M), this proportion rises to 60%.

The data also reveals that the European startups need at least three times more capital than the amount raised by local VCs in recent years. In 2019, European VCs raised €13B, yet €38B was invested in European startups; the difference coming from foreign investors.

Consequently, as European tech companies grow in size over the next decade, the funding gap between what startups need to raise, and what is available in Europe becomes more evident.

Neil Rimer, co-founder of Index Ventures comments, “As Europeans, we need to do more to harness the energy and creativity of entrepreneurs, investors, and policymakers and ensure that they work together to usher in Europe’s tech-driven future. Europe will benefit from the innovation, growth, and jobs that this will bring, but only if it makes supporting startups a strategic priority across the continent that is essential — not optional.”

Main image credits: koya979/Shutterstock