The world of alternative investment is often seen as a glamorous world of private equity investors and venture capitalists. However, it is no longer dominated by LPs and GPs investing in fledgling startups in exchange for equity. In fact, the fastest-growing form of investment in the alternative investment space is private debt (or private credit).

In its 2024 alternative investment universe outlook, JP Morgan is overweight on the growth prospects of private credit, where the debt finance comes from funds, rather than banks, bank-led syndicates, or public markets. In May, we looked at how private debt has grown from billions to trillions in assets under management and the role of technology in making it “the primary strategy of the alternative investment funds across the globe.”

Norsad Capital, a Botswana-based impact investor and private creditor founded in 1990 as a Nordic-SADC multilateral entity, is not only proving that private debt financing can help mid-market companies grow but also writing a playbook on how private debt paired with technology solutions like PE Front Office can help build a resilient startup ecosystem.

What does Norsad Capital do?

As an impact investor and private credit provider, Norsad Capital offers tailor-made debt solutions to profitable growth companies delivering desirable social and environmental impact in Africa. Allan Mutenda, Chief Risk Officer at Norsad Capital, says their primary market is the SADC region with an interest in Eastern Africa. While its focus market is currently Southern Africa, it does have some investments in West Africa.

“Our goal is to positively impact the lives of 100 million Africans by 2030,” says Mutenda, before adding, “Our target market being mid-market growth companies within the region, the companies that generate strong financial returns, plus also positive impact.”

He adds that their private credit solutions have a ticket size between $5M and $15M but can consider investments below $5M to qualifying growth companies that generate turnover between $5 and $50M with EBITDA of $1.5B. From senior debt and mezzanine finance to unitranche, Mutenda says Norsad is all about extensive and flexible private credit offerings.

Why private credit? Mutenda explains that Norsad’s journey began in 1990 as a development finance focus and has grown and transitioned to private credit supported by eleven SADC DFIs, including its original four Nordic shareholders: Norfund, Swedfund, IFU, and Finnfund. Norsad has evolved from a sustainable investor into a thematic impact investor, concentrating on profitable ventures that tackle social and environmental challenges under the mantra of “profit with purpose.”

Our key priorities encompass sustainable livelihoods, financial inclusion, gender equality, and climate action, all of which align with the Sustainable Development Goals (SDGs). As we refine our strategy in 2024, we focus on thematic sectors that promise the most significant impact at scale for our shareholders. Additionally, private credit generally offers a pathway for delivering higher yields to our investors, contingent on effective risk management..

Private Credit: Attractive but challenging

We can all thank Shark Tank for imparting a basic understanding of how private equity works but it is relatively unknown that private debt is seen to be more attractive to early stage and growth companies providing them with the necessary capital to scale their operations and pursue opportunities. Mutenda says this is because of their flexibility.

“The deals are structured to accommodate the needs of the individual investing companies, which is not always possible when it comes to banks,” he says. “We can play across the capital stack from stretch senior, unitranche and mezzanine across various tenures up to 7 years. We also provide various payment options such as amortisation, PIK, equity kickers and deferred payments to meet the needs of our investee companies depending on their cash flow cycles.”

While the flexibility is attractive, private credit providers like Norsad must also contend with the added risk this flexibility entails. “At the basic, it all starts with structuring the investment to suit the needs of the investee companies while ensuring downside protection for our investors so we can still offer a pathway for investors to realise desired returns through various exit strategies,” explains Mutenda. “If risk is not adequately managed, more so in the highly uncertain poly-crisis environment, private credit providers may find it challenging to attain sustainability, leading to unmet impact objectives and difficulties in returning capital to funders with acceptable returns.”

“I think the added challenge in our region is how to grow our deal pipeline of potential investee companies across multiple countries and consistently select the good investments from the potentially bad ones. Doing business in Africa is not for the faint-hearted while it can be rewarding, especially when leveraging local knowledge and partnerships,” says Mutenda. Norsad has a rich history spanning over 32 years of impact investing in Africa working with a wide network of partners including its 11 SADC shareholders.

He adds, “Private credit is a relatively new phenomenon in some of our markets. In SADC, for instance, bank finance dominates.”

In the operations of private credit providers, the challenge is two-fold: mobility and compliance. In 2023, Norsad initiated business process reengineering to make its workflows and supporting systems more agile and responsive to the changing financial landscape. Key focus areas included refining and improving workflows, identifying, and adapting supporting technologies, and enhancing compliance—not merely as a check-box exercise but as an integral part of the value proposition to our investee businesses to help them achieve sustainability.

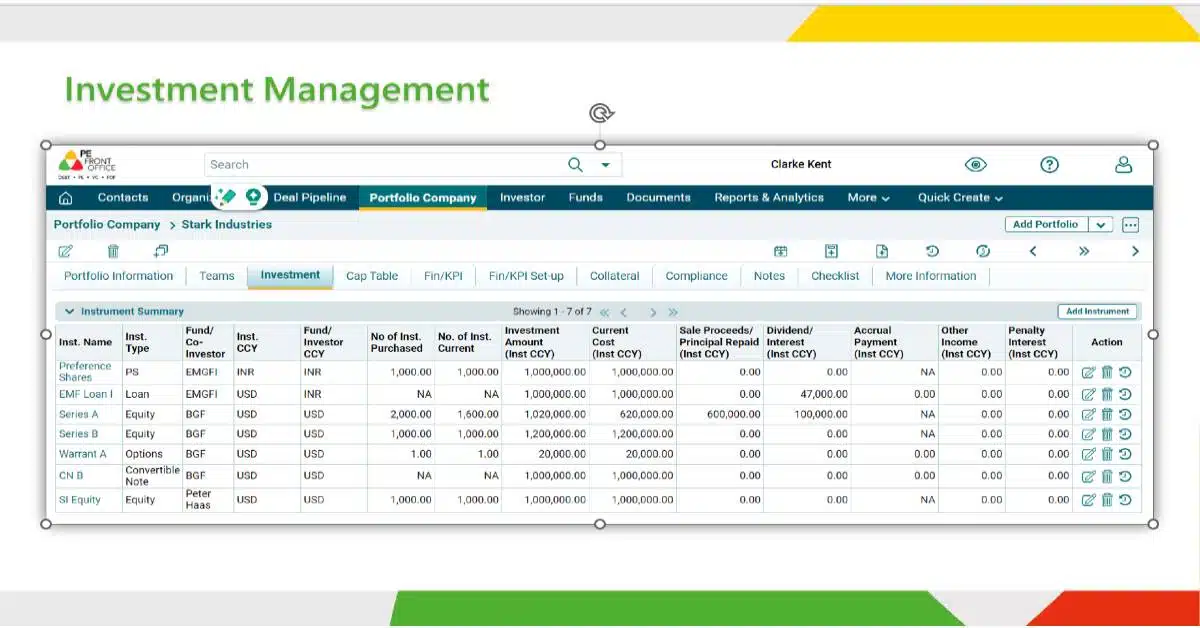

One other way that Norsad Capital meets this mobility and compliance challenge is by trusting PE Front Office. This SaaS platform serves as the back office of major equity and private credit providers.

Discover the strategic advantage: PE Front Office

Mutenda explains that Norsad Capital views the PE Front Office not merely as a technological solution for booking transactions – whether in credit or equity – for mid-growth companies. Instead, he emphasises that the software platform facilitates end-to-end business processes that support the execution of “the investment thesis” throughout the entire investment lifecycle, from origination to exit.

After switching to PE Front Office, Norsad Capital and its investment team are able to look at compliance beyond KYC and static data posting. Mutenda says they have been able to automate a number of erstwhile manual processes such as covenant testing. “There is quite a lot of rich information you can derive from the system on investee companies almost substituting dependence on excel spreadsheets for covenants testing as an example,” Mutenda quips.

Like many other PE Front Office clients, Norsad Capital previously relied on spreadsheets, and Mutenda openly acknowledges the typical risks associated with their use, including the potential for human and modelling errors. However, he notes that the immediate benefit of transitioning away from spreadsheets is eliminating concerns regarding “MIS reports not being produced on time and accurately.”

This shift will save significant time and effort, enabling portfolio managers to focus on more value-added activities with client data available at the click of a button. “Moving away from Excel will save us a lot of time in terms of man hours attached to processing data and financial spreadsheeting from audited AFS and also Management Accounts that we receive on a more regular basis,” he adds

When I spoke to Mutenda, Norsad Capital had not fully migrated its workflow from spreadsheets to PE Front Office. The private debt company aims to fully migrate to PE Front Office by the end of the third quarter but Mutenda says they have already automated some workflows such as invoicing and indicated that the migration was seamless with the support of the PE Front Office team during implementation, customisation and testing phases. “Our portfolio companies will receive their invoices on time, generated automatically by the system and delivered to the emails without the risk of back-office staff forgetting to perform these simple but critical tasks on time ahead of due dates,” explains Mutenda.

With the migration to PE Front Office, they are efficiently able to manage their deal flow from origination to exit. “I think we found the workflow in PE Front Office quite helpful, easy to follow, customise and meet our requirements as a business,” says Mutenda.

He further adds that they were able to download the historical information they had in their old system while also booking new deals that were still in the pipeline. This ability of PE Front Office to migrate historical data coming in various formats meant that Norsad Capital’s team only had to ensure that their records stayed up to date before data migration, with the PE team also troubleshooting and picking up data gaps for our records to be complete. Strong collaboration of the PE team was evident in their approach to project implementation, which Norsad continually values.

During our conversation, I found Mutenda to be both analytical and logical. While he seemed to have mastered the use of technology to make investment efficient at Norsad Capital, he was also sharp about the delay associated with manual systems and the techniques needed to circumvent those delays.

With PE Front Office, he says they will be able to achieve their goal of becoming more efficient, and agile, and also be closer to the client and answering the right questions at the right time to management, board and regulators, including investors. For Norsad Capital, Mutenda says PE Front Office was the only system that met their end-to-end requirements both now and in the long-term during the procurement process. “PE front office meets our business requirements now and into the future,” argues Mutenda. “From a risk management and compliance point of view, I also think the MIS capability provides a good foundation to support some of our modelling activity.”

Growth opportunity

Like JP Morgan, Mutenda is optimistic about the growth prospects of private credit, particularly in the SADC region. He anticipates that regulatory pressures will continue to affect banks’ ability to support riskier segments of the market, potentially constraining the supply of credit to mid-sized corporations and SMEs, which presents an opportunity for Norsad Capital to help bridge the credit supply gap.

“I believe we offer LPs and institutional investors the chance to invest with us in thematic funds we may launch in the future, such as climate funds. This collaboration can help them achieve their impact objectives by partnering with Norsad and leveraging our strong presence in the SADC region and our robust shareholder network with local knowledge and presence, rather than investing directly in a wide array of firms across various countries. Returns in Africa are still good, despite the high level of risk. We offer a partnership platform that enables us to distinguish the strong opportunities from the weaker ones, and we will be better able to assist investors in managing their investments using our PE Front Office platform,” he adds.

Despite the prevailing uncertainty and poly-crisis environment, Norsad Capital remains optimistic about the ongoing growth of private credit. As assets under management rise, they anticipate that software platforms like PE Front Office will become increasingly vital for lenders to be fit for growth with the right technology front and back-office functionality. For Mutenda, the future is about not only leveraging technology for efficient investment processes but also enhancing the effectiveness of that technology through the integration of artificial intelligence.

01

From telecom veteran to Dutch Startup Visa success: The Jignesh Dave story