With most countries struggling to uplift their economy and get job losses under control, saying that this year was rough would be an understatement. However, we’ve previously reported how the European startup ecosystem, especially Amsterdam, stayed strong during the pandemic. Now, a new report by Atomico sheds further light on the current situation with its report titled ‘The State of European Tech 2020’. It should be noted that the report delivers a macro snapshot of the European tech ecosystem. Here are 8 key takeaways from the report that you need to know.

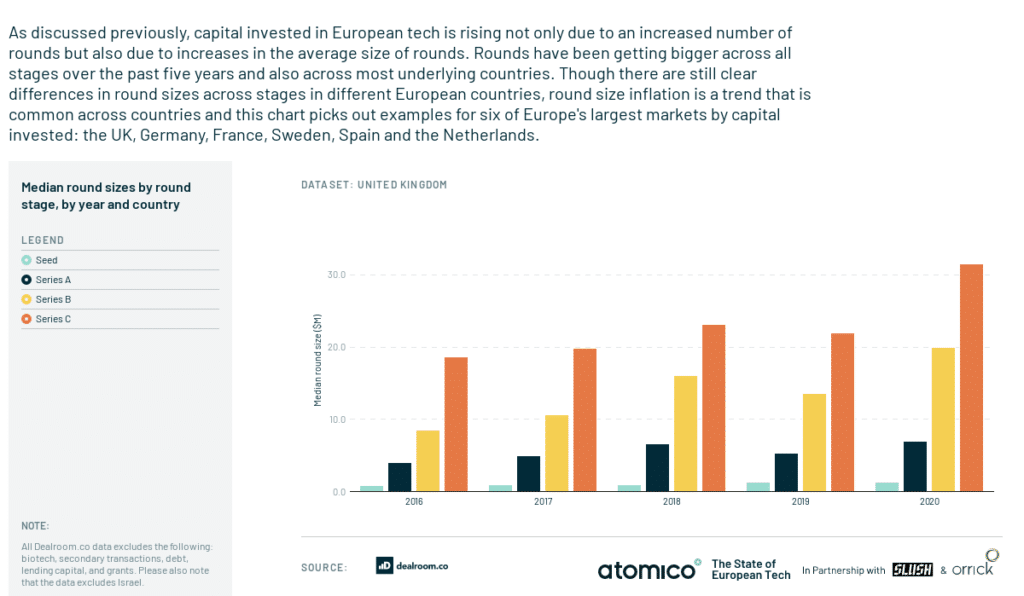

1 ‘Megarounds’ helped European Tech ecosystem grow

As per the report, total investment in the European tech ecosystem is estimated to exceed a record €33.81B in 2020. This growth is being attributed to an increase in “megarounds”, which are estimated to range between €82-€206M. This is noteworthy considering how back in 2016, a hot topic was “How To Raise Above €8M in Europe”. But in 2020, an €8M seed round is a normal occurrence.

2 Low capital, pivoting the product, and sales decline hit founders hardest in 2020

About 46% of founders participating in the report revealed that they found it difficult to access capital in 2020. Additionally, 32% faced challenges in pivoting the product and 30% of founders said that their new sales declined this year.

3 International investment hasn’t dried up

While many might believe that 2020 caused international investments to dry up in Europe, this is not the case. In fact, US investors participated in a record number of rounds this year. Cross-border investment accounts for two-thirds of all capital invested in the European tech ecosystem. Rounds of less than €1.65M mainly originated from domestic investors but for rounds of €82M or more, the larger share of the capital came from outside the continent and, most significantly, from the US.

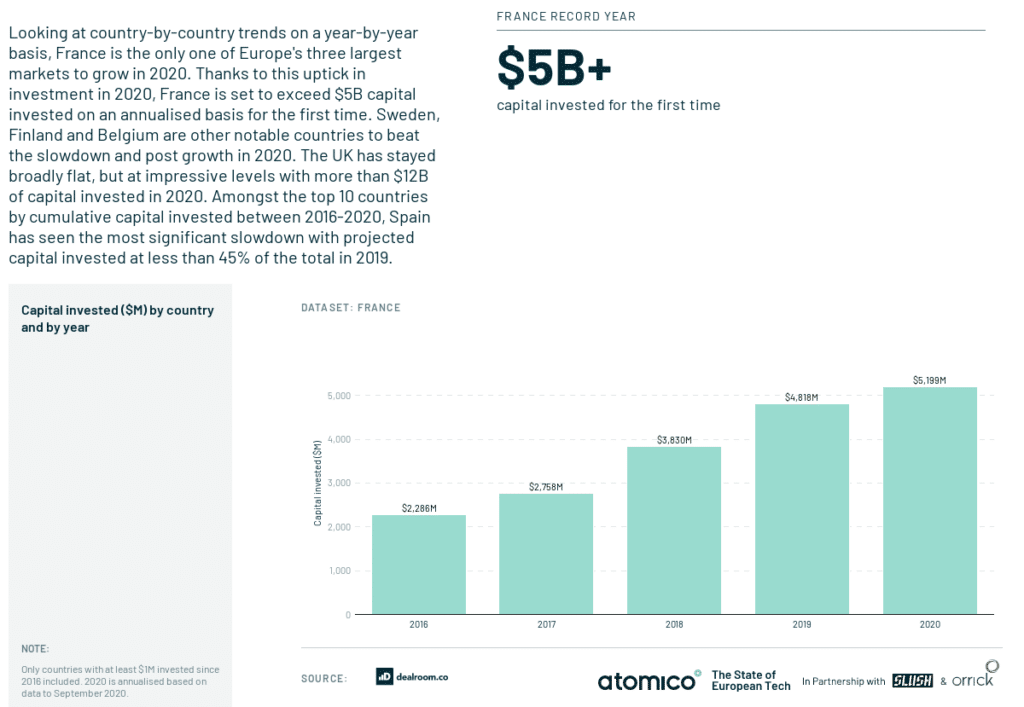

4 France is the only one of Europe’s three largest markets to grow in 2020.

The report looks at country-by-country trends on a year-by-year basis and finds that France is the only one of Europe’s three largest markets to grow in 2020. Due to a large rise in investments, France is set to exceed €4.12B capital invested on an annualised basis for the first time.

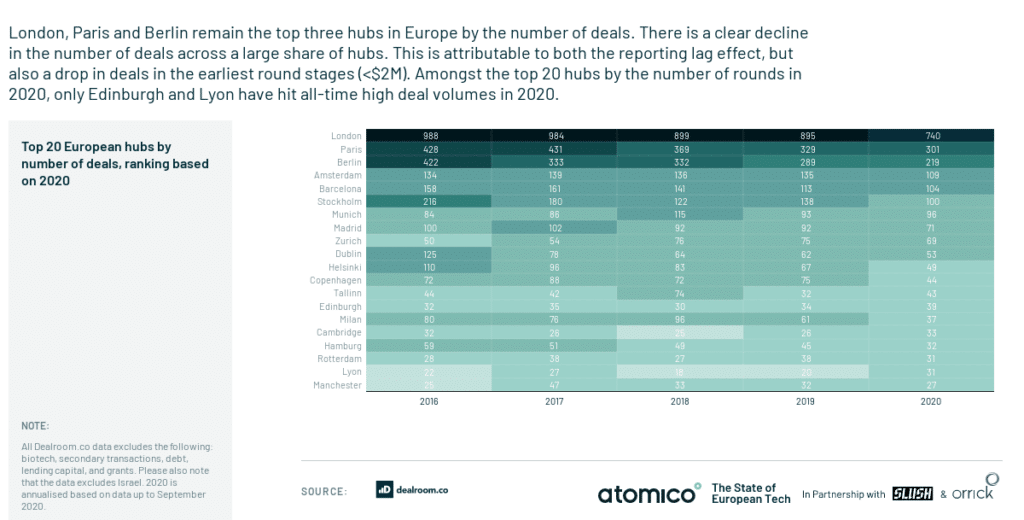

5 London remains the biggest investment hub in 2020

Based on the number of deals, London, Paris and Berlin remain the top three hubs in Europe in 2020. A notable decline in the total number of deals was also observed across a large share of hubs. The reason for it is being attributed to both, the reporting lag effect and a drop in deals in the earliest round stages.

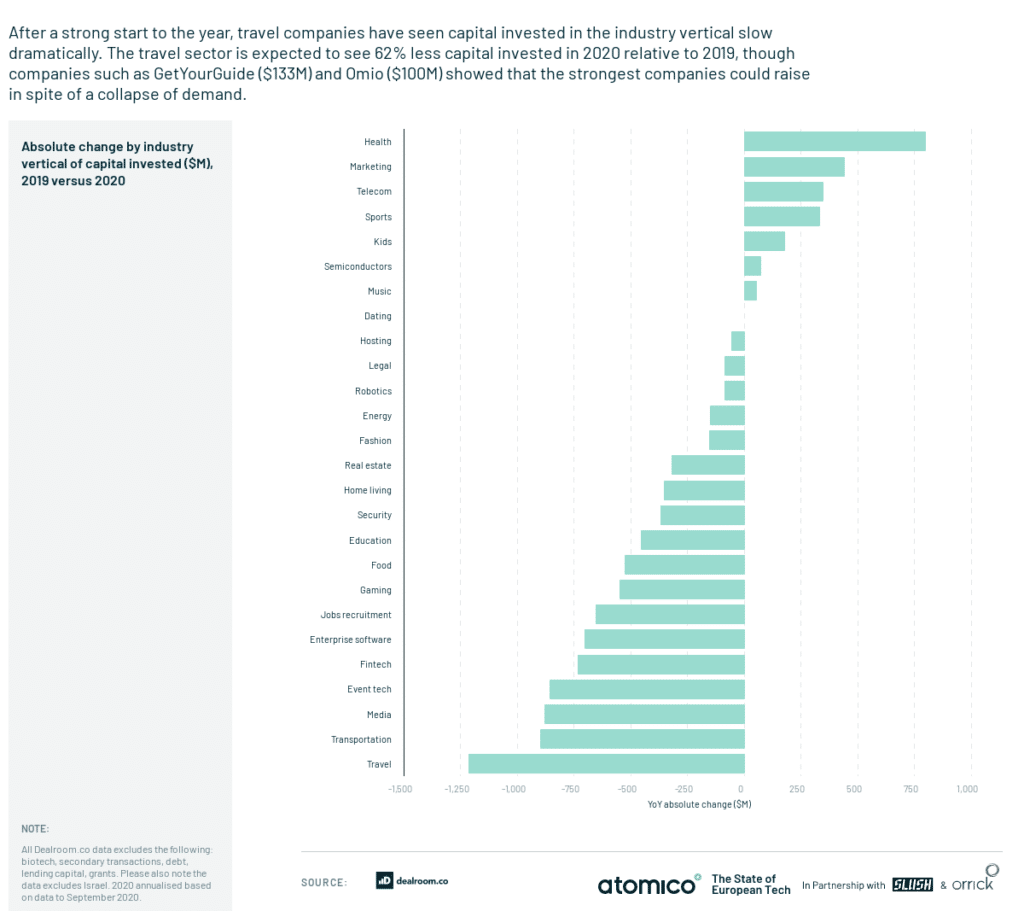

6 Travel sector gets notably low investments

With COVID-19 hitting hard early this year, it was not a surprise to see investments in travel startups plummet. After starting strong this year, travel companies noted capital investment slowed down dramatically. The report expects 62% less capital invested in 2020 relative to 2019. However, companies such as GetYourGuide (€109M) and Omio (€82.4M) demoed that the strongest companies could raise a notable amount despite the current scenario.

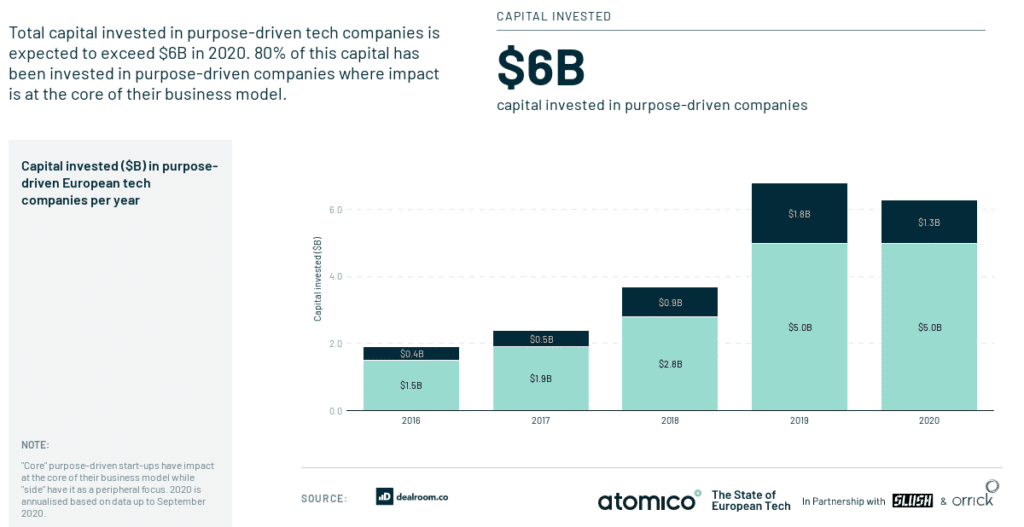

7 Investment in purpose-driven tech companies soars

The total investment in purpose-driven tech companies is said to exceed €4.95B in 2020. 80% of this capital has been invested in purpose-driven companies where impact is at the core of their business model. Over the last five years, more than €16.4B has been invested in purpose-driven tech companies in more than 3,000 rounds.

8 Gender and racial inequality still prevails in the European tech ecosystem

Gender disparity is also quite apparent as 91% of total capital invested in 2020 went to all-men founder teams while only 9% funding was allocated to teams with at least one woman founder. Another important thing to note in the report is the racial inequality that’s present in the European tech ecosystem. About 61% of Black/African/Caribbean tech workers believe their background and/or identity makes it harder to succeed in the European tech industry.

In addition to these 8 notable developments in the European tech ecosystem, there’s a lot more that has happened this year. You can dive deeper into the report here, to know more.

01

These are the top UK-based PR agencies for startups and scale-ups in 2025