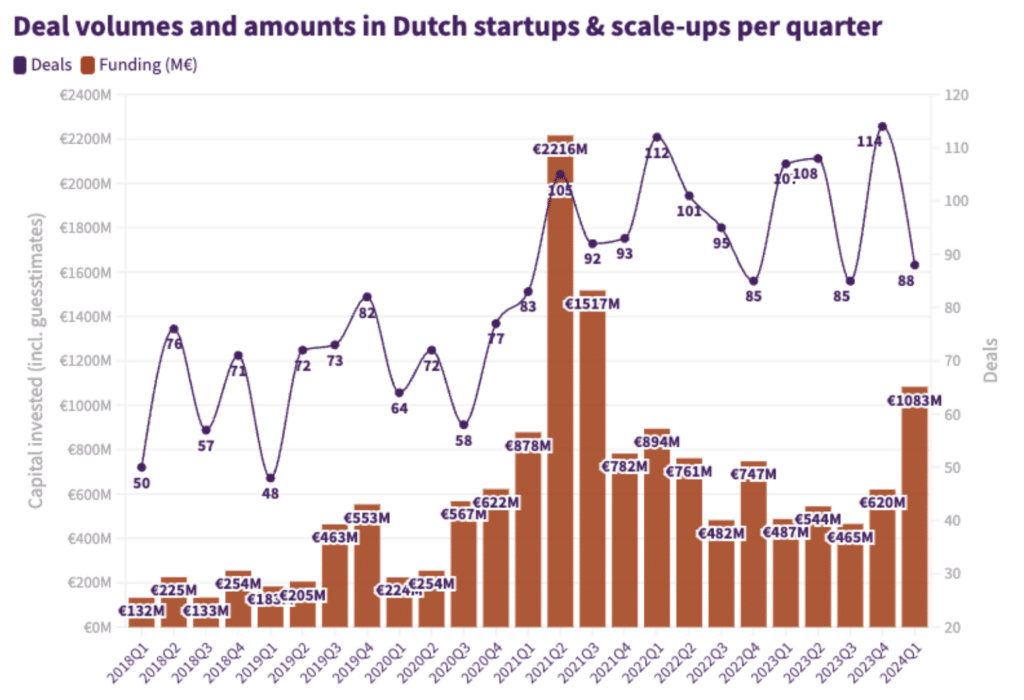

The Dutch startup ecosystem has witnessed a significant surge in investments, with a total of €1.05B invested in Q1 2024.

It represents the largest quarterly amount in two years, contributing to the emergence of two new unicorns, reveals Quarterly Startup Report.

Quarterly Startup Report is a collaborative effort by Dealroom.co, Golden Egg Check, KPMG, the Dutch Association of Participation Companies (NVP), the Dutch Startup Association (DSA), and Techleap.nl,

A year of robust growth for Dutch startup ecosystem

The first quarter of 2024 has kicked off to a robust start, with investments totalling €1.05B in Dutch startups. This is not only the highest amount in a quarter for the last two years, but it also represents a substantial increase compared to the previous year and quarter, says the report.

The investments in the first quarter of 2024 saw a staggering rise of 150 per cent compared to the same quarter the previous year, which stood at €422M.

This is an 83 per cent increase compared to the last quarter when €576M was invested.

Decrease in deal numbers

While the total investment amount has seen a sharp rise, the number of deals has decreased by 19 per cent compared to the same quarter the previous year.

This decrease is primarily due to a drop in the number of investments in the very early stages (pre-seed), from 21 to 14.

Rise in later stage deals

However, the number of deals in the later stages has increased. There has been a rise in deals above €15M (Series B+): 14 compared to 6 a year ago.

Three deals involving Picnic, Mews, and DataSnipper, were even above $100M.

The 10 largest deals of the past quarter (in millions):

- Picnic – €355M

- Mews – $110M

- DataSnipper – $100M

- Vico Therapeutics – $60M

- FINOM – €50M

- Eye Security – €36M

- EFFECT Photonics – $38M

- TheyDo – $34M

- Soly – €30M

- Onera – €30M

Broad structural growth

The report says that even when excluding the major deals of around and above €100M, the past quarter still showed growth compared to the previous quarter.

Factors contributing to this could include the prospect of more stability and lower interest rates, expectations around IPOs and strategic acquisitions, and the large amount of available funds that the ecosystem can absorb.

Diverse sector investment

Investments are again spread across sectors, with deep tech emerging as a theme. Notably, the number of investments from American investors has doubled.

While it fluctuated around 13 per cent in the past quarters, it currently stands above 28 per cent mirroring the record year of 2021.

Expert opinions

Experts from the Dutch Startup Association, Techleap, and Golden Egg Check have weighed in on the investment trends and the Dutch startup ecosystem.

Here’s what they are saying:

“It is a good signal that investments have increased so much. However, much of the growth comes from the United States, just as in good years before,” says Lucien Burm of the Dutch Startup Association.

“To ensure that more growth money becomes available from the Netherlands and returns flow back here, more institutional money will have to flow directly or indirectly to funds, for example from pension funds and the National Growth Fund,” adds Burn.

“This strong increase in investments is an important part of a good startup business climate for the Netherlands. This shows that we in the Netherlands still have the potential for a good climate for investing in the companies of the future. We must utilise this potential.” says Maarten Cleeren from Techleap.

“However, many elements still play a crucial role, which has recently come under pressure, such as the 30 per cent scheme for scarce talent or the lack of clarity surrounding the National Growth Fund. It is very important for the current social transitions that we maintain a stimulating business climate,” concludes Cleeren.

“The number of investments in the past quarter was significantly lower than in previous years. This is mainly due to a decrease in deals in the earliest phase, up to €1M. That is a point of attention,” says Thomas Mensink, analyst at Golden Egg Check. “The pipeline of startups ideally remains well filled in order to have a healthy ecosystem in the long term.”

01

From telecom veteran to Dutch Startup Visa success: The Jignesh Dave story