The startup investment landscape in 2023 witnessed remarkable growth and resilience despite the challenges posed by the global economic downturn.

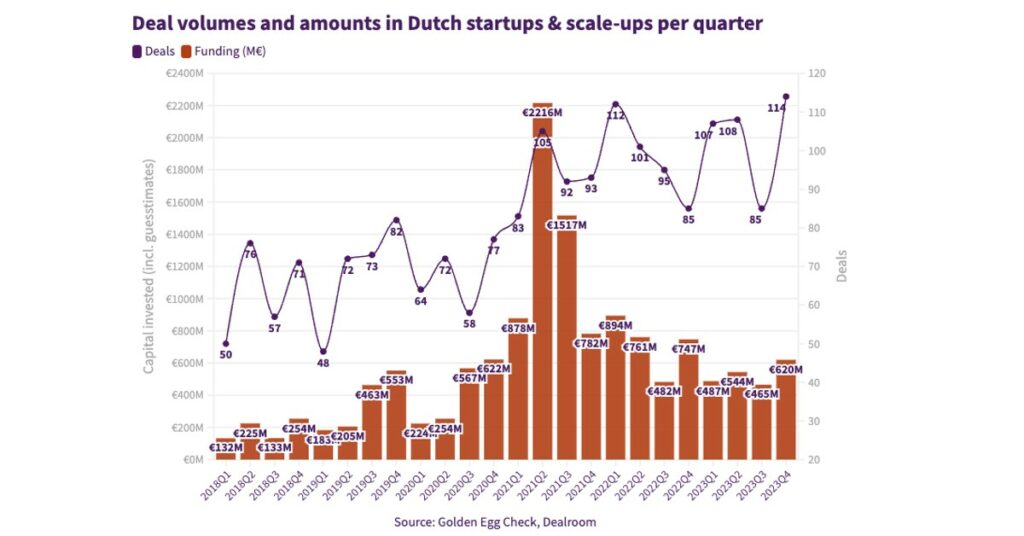

According to the Quarterly Startup Report, a collaborative effort by Dealroom.co, Golden Egg Check, KPMG, the Dutch Association of Participation Companies (NVP), the Dutch Startup Association (DSA), and Techleap.nl, the number of deals and total investments reached their peak in Q4, 2023.

Although there was a decrease of 27 per cent compared to the previous year, 2023 proved to be the best year yet for startup investments.

€576M was invested in the Q4

In total, at least €576M was invested in Q4, compared to €604M in Q4 2022, resulting in a decrease of 5 per cent.

Compared to Q3, 2023, this is 36 per cent growth in terms of amount, based on 33 per cent more deals.

Growing deals and investment

The number of deals is growing compared to a year earlier (from 88 to 114) and compared to the third quarter (which was 86).

Investments in the early phase, less than €1M, have increased relatively, from 27 per cent in all 2022 to 33 per cent in Q4 2023.

Large investments of €15M or more have again decreased relatively, from 14 per cent in the whole of 2022 to 10 per cent in Q4 2023.

Top 10 deals of Q4

Top 10 Deals of the Quarter (in millions):

- VectorY Therapeutics €129

- Kynexis €57

- Protix €55

- Microsure €38

- Crisp €35

- Cradle $24

- Rentman $22

- Silverflow €15

- SolarDuck €15

- Overstory $14

Biotech companies, including VectorY Therapeutics, dominated the top 10, securing a substantial €129M from a Life Sciences Investors consortium.

Fintech companies, such as Silverflow, Solvimon, Levenue, and Carbon Equity, experienced increased investment, while artificial intelligence startups received relatively modest funding with limited deals.

Scale-up investment declines

In 2023, Dutch startups and scale-ups attracted a minimum of €1.9B, marking a 27 per cent decrease from the previous year’s €2.6B.

However, this decline is less noticeable than the global average of 35 per cent.

The actual figure for 2023, considering undisclosed deals, likely hovers around €2.1B.

Despite the reduction, 2023 outperformed all pre-corona years, featuring 417 deals compared to 393 in 2022, with smaller deals under €1M growing from 27 per cent to 33 per cent.

Public investments from entities like Invest-NL and Regional Development Companies remained pivotal in supporting early-phase startups.

VC Fund emerges for the life sciences sector

Over the past year, several large venture capital funds have emerged, particularly in the life sciences sector, says the report.

For instance, Forbion Ventures Fund VI and Gilde Healthcare Venture & Growth VI have been established, with a size of around €750M each.

In certain industries, it has been a more challenging task to seek out new venture capital funds, depending on the specific sector, says the report.

However, there has been a greater commitment from Dutch pension funds, such as Gilde Healthcare, Forbion, and Innovation Industries, among others.

For example, PME and PMT, along with a British pension fund, invested approximately €110M in the Gilde Healthcare Fund and participated in the ‘first close’ of the new Innovation Industries fund, valued at €200M (with a ‘target’ of €475 million), which is focused on DeepTech investments.

Capital available to invest

There are still a number of funds that have available capital to invest.

For instance, Venture Capital Funds 2023 began with a significant amount of “Dry Powder” that was not fully utilized due to lower investments in 2023.

Wealthy individuals (High Net Worth Individuals, HNWIs) are increasingly interested in investing in funds, as evidenced by the rise of “umbrella funds” that allow for investment in venture capital and other ventures.

Furthermore, with expectations that the interest rate will not increase, there is a good opportunity for steady growth in investments in startups and scale-ups in 2024.

The year has started on a positive note, with Picnic receiving a €355M investment.

We saw only a few big surprises in the last quarter. After a difficult period, the market has appeared to stabilize, and we are seeing signs of growth. A positive development that one has not yet seen anywhere else in the world, “says Lucien Burm, president of the Dutch Startup Association.

“We are therefore optimistic as we dive into 2024. The interest rates seem to have reached their highest point, and there may be more ‘limited partners’ in venture capital funds. We expect Dutch startups to reap the benefits,” adds Burm.

“In the Netherlands, we see that private investor venture capitalists were less active in 2023, but this was partly compensated by the activities of InvestNL,” says Maaren Cleeren, managing director of Techleap.

“InvestNL is therefore increasingly emerging as the backbone of Dutch startup investments in DeepTech. Other local investments, such as those from regional development companies, have also remained relatively consistent. If investments follow from venture capitalists, then the coming year will look promising for Dutch startups,” adds Cleeren.

01

From telecom veteran to Dutch Startup Visa success: The Jignesh Dave story