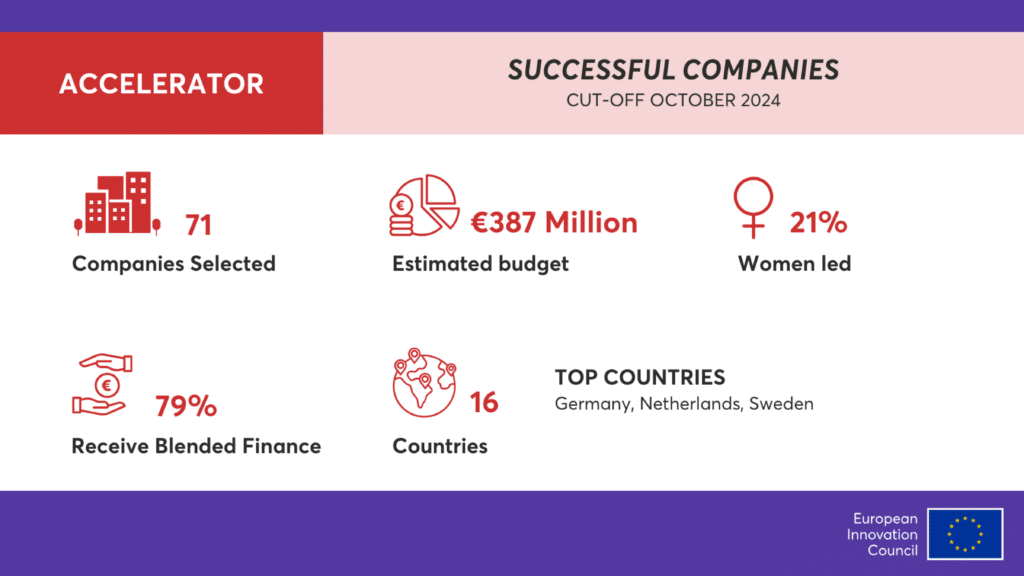

Eleven startups from the Netherlands have been selected among 71 innovative companies by the European Innovation Council (EIC) for funding, which includes both grants and equity, following the October 2024 EIC Accelerator cut-off.

These startups have been selected among 1211 submitted proposals, out of which 431 have been invited to the jury interviews.

The selected companies will collectively receive up to €161M in grants and approximately €226M in equity.

The equity investments will be made through the EIC Fund.

Notably, 79 per cent of the companies will benefit from the full blended finance option, which combines grants and equity investments.

Additionally, ten companies opted for grants only and five companies for equity-only funding.

Around 21 per cent of the selected companies are led by women (as CEO, CSO, or CTO), while there is a geographical spread spanning 16 countries.

In most cases, the companies will receive the grant financing within the next three months, while the investment decisions depend on the urgency of the companies’ needs.

‘Plug In’ scheme and Seal of Excellence

Four of the selected companies have benefitted from the ‘Plug In’ scheme.

The scheme allows funding bodies managing certified national/regional programmes to submit projects from their portfolio directly to the full application stage of the EIC Accelerator.

A further 330 applications that were assessed positively by the EIC jury, but for which there was insufficient funding available, will be awarded a Seal of Excellence.

This recognition helps these companies to find alternative funding sources, including the Recovery and Resilience Funds and European Regional Development Funds.

EIC Accelerator

The EIC Accelerator programme supports individual Small and Medium Enterprises (SMEs), particularly startups and spin-out companies, to develop and scale ground-breaking innovations.

The programme offers startups and SMEs grants of up to €2.5M combined with equity investments through the EIC Fund ranging from €0.5M to €15M.

In addition, EIC-selected companies also receive coaching, mentoring, access to investors and corporates, and other opportunities.

The next cut-off for EIC Accelerator full proposals, as announced in the EIC 2025 work programme, is scheduled for March 2025.

We have listed some innovative projects and companies from the Netherlands selected in the current cut-off. You can check out the entire list here.

Brineworks

Founder/s: Gudfinnur Sveinsson and Dr. Joseph Perryman

Recommended finance type: Blended finance

HQ: Amsterdam

Brineworks has developed seawater electrolysis technology that enables sustainable and affordable extraction of CO2 and H2 from the ocean.

C2CA TECHNOLOGY

CEO: Thomas Petithuguenin

Recommended finance type: Blended finance

HQ: Rotterdam

C2CA focuses on transforming waste concrete into sustainable building materials. The company is advancing sustainable solutions for the construction industry by replacing conventional concrete materials with upcycled waste concrete.

Deeploy

CEO: Bastiaan van de Rakt, Tim Kleinloog, Maarten Stolk, and Nick Jetten

Recommended finance type: Blended finance

Funding secured: €7.5M

HQ: Utrecht

Deeploy is a software company that makes Machine Learning (ML) deployments accountable by giving explainable AI (XAI) a central place in ML operations (MLOps). The company uses its software to make artificial intelligence understandable and transparent to businesses, their customers, and regulators.

CarbonX

Founder/s: Rutger Van Raalten and Daniela Sordi

Recommended finance type: Blended finance

HQ: Amsterdam

CarbonX offers an alternative: a locally produced carbon anode material that matches the cost of Chinese graphite while providing fast-charging capabilities, enhanced battery lifetime, and a reduced carbon footprint. With its proprietary feedstock technology, CarbonX enables cell manufacturers and EV OEMs to source critical anode materials locally in high volumes.

VarmX

Founder/s: Pieter Reitsma

Recommended finance type: Equity Only

HQ: Leiden

VarmX is a biotech company developing alternative approaches for the reversal of anticoagulation (also known as blood thinners). Its development aims to make it easier for people taking Direct Oral Anticoagulant Blood Thinners (DOACs) to quickly, safely, and effectively treat severe spontaneous bleeds.

Astrape

CEO: Francesco Pessolano,

Recommended finance type: Blended Finance

HQ: Eindhoven

Astrape Networks is a tech startup known for its work in integrated photonics to create faster and more sustainable optical networks. The company is on a mission to reduce the energy consumption of data centres by minimising electrical-optical conversions, opting to convert to optical signals only at the network edge.

Leyden Laboratories

Founder/s: Jaap Goudsmit, Koenraad Wiedhaup and Ronald Brus

Recommended finance type: Blended Finance

HQ: Amsterdam

Leyden Labs utilises its platform to target commonalities of viral families to protect against many viruses simultaneously as opposed to vaccines that typically protect against a specific virus variant. The company’s platform is built on two concepts: broad protection against known viruses, new variants, and newly emerging viruses, and protection at the gate, i.e. in the mucosa (e.g. in the nose and throat).

Nextkidney

CEO: Jérôme Augustin

Recommended finance type: Blended Finance

Fund secured: €2.5M

HQ: Bussum

NextKidney is a medical device company that has developed the first portable hemodialysis device. The company aims to provide a secure, useful, and simple-to-use solution, placing the patient and their quality of life at the centre of its approach.

QDI systems

Founder/s: Artem Shulga

Recommended finance type: Blended Finance

HQ: Groningen

QDI Systems is a deeptech startup that develops imaging devices for medical applications based on quantum dots. The company is driven by a mission to deliver high-quality images for radiologists, facilitating precise and early-stage diagnostics.

DELFT CIRCUITS

Founder/s:

Recommended finance type: Blended Finance

HQ: Delft

Delft Circuits specialises in the quantum industry i/o cabling solutions. The Dutch company has developed Cri/oFlex technology, which enables large-scale data transfer over the thermal bridge.

It has been crucial in facilitating the growth and advancement of quantum technologies, including quantum computing, communication, and sensing, which require cooperation between cold and warm parts of the system.

Veridi Technologies

Founder/s:

Recommended finance type: Blended Finance

Fund secured: €2.5M

HQ: The Hague

Veridi Technologies specialised in developing solutions for monitoring plant diseases and soil biodiversity on an industrial scale.

The company’s automated microscopy and AI-powered technology enable high throughput and high-accuracy diagnostics for soil microorganisms and plant pathogens. This allows for affordable, accurate, and scalable diagnostics.

01

From telecom veteran to Dutch Startup Visa success: The Jignesh Dave story