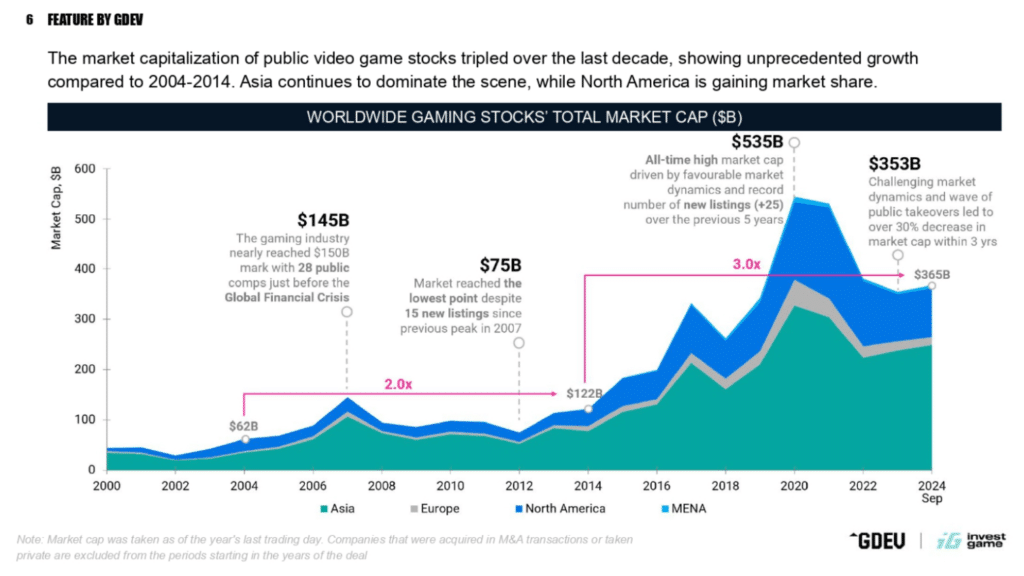

Becoming publicly traded is a pivotal moment for every gaming company. Nearly half of all publicly traded studios have emerged in the last decade, and their value has increased nearly fivefold in the last two decades.

However, the recent economic downturn and rising interest rates have complicated the listing process. Initial public offerings (IPOs) had slowed down. Despite these challenges, the video game industry remains promising for investments: it is expected to reach $213,3 billion by 2027, according to Newzoo.

Gaming Holding GDEV (went public on Nasdaq in 2021, ticker $GDEV), together with InvestGame, has analysed 87 gaming-only companies with a today’s valuation of over $350 billion. This article examines the evolution of the gaming IPO landscape and the latest trends.

Gaming IPOs through the years: Platform shifts and regional growth explored

The gaming industry has undergone a remarkable transformation over the past few decades, marked by significant shifts in platforms and notable regional growth. We witnessed first-hand how these changes have influenced investment opportunities and reshaped the market landscape. Let’s delve into the evolution of gaming IPOs, the impact of platform transitions, and the burgeoning growth in different regions, enriched with compelling data and statistics.

The Evolution of Gaming IPOs

- Initial Public Offerings (IPOs) have been instrumental in fuelling the expansion of gaming companies. One of the earliest pioneers was Nintendo, which transformed from a playing card company into a gaming giant. Nintendo went public in 1962 on the Osaka and Kyoto stock exchanges. This move was a significant milestone, providing the company with the capital to innovate and expand its gaming portfolio. Nintendo’s public listing laid the groundwork for future gaming companies to consider IPOs as a viable strategy for growth

- Since the 1980s, more than 150 gaming companies worldwide have gone public. Early IPOs were dominated by companies focusing on PC and console gaming. For example, Electronic Arts went public in 1989, raising approximately $8 million, which helped it become one of the leading game developers globally.

- The late 1990s and early 2000s saw significant IPOs like Activision in 1993 and Take-Two Interactive in 1997. By 2000, the global video game market was valued at around $20 billion, showcasing the growing investor confidence in the sector.

- The 2010s marked a surge in IPOs from online and mobile gaming companies. In 2011, Zynga, known for “FarmVille,” raised $1 billion in its IPO, making it one of the largest tech IPOs at the time. In 2014, King Digital Entertainment, creator of “Candy Crush Saga,” raised $500 million during its IPO, highlighting the lucrative potential of mobile gaming.

- Now, regarding recent IPOs, the period from 2016 to 2020 likely saw the largest boom in companies going public. During this time, several gaming companies went public, including Netmarble, Embracer, Paradox Interactive, Team17, and a few others.

- The most recent companies to go public, from 2021 to the present, include South Korea’s KRAFTON and Shift Up, Cyprus-based GDEV, Huuuge, and, rounding out the list, Israel’s Playtika.

How long foes it take for a gaming company to go public?

The industry is maturing: most public gaming companies are over 20 years old. Asian studios, on average, are even older than game developers in other parts of the world. Nintendo is the oldest gaming IPO – it went public in 1962 on the Osaka and Kyoto stock exchanges, and now it’s an industry leader with a market value of $61 billion.

On average, it takes 8–9 years for a gaming company to become publicly traded. Most IPOs occur between 4 and 10 years after founding. However, there are exceptions: Starbreeze Studios took 2 years to go public after being founded in 1998.

Market regions: Asian and MENA leadership

Asia dominates the global gaming IPO market: currently, thirteen gaming companies have reached market capitalization of more than $5 billion, with eight of them based in Asia. The region has 46% of all listed game developers, Europe follows it with 35% and the US with 18%.

Over the past 24 years, the number of public companies in Asia has more than quintupled, while in Europe it has almost quadrupled and in the US it has more than tripled.

North American and Western European public gaming studios are generally smaller in size, with market value in most cases not exceeding 1 billion dollars. In contrast, Asian and MENA companies are diverse, from small companies to unicorns.

Mobile rising: Diversification by core platforms

Before 2016, PC and console gaming were the main drivers of the industry. Today, 46% of all public companies specialize in this segment. However, the introduction of in-app purchases changed the picture, so many companies moved to mobile and diverse gaming platforms.

The mobile games market is growing: Today, they make up 47% of all gaming IPOs, and overall, they reach the market faster than PC companies.

01

From telecom veteran to Dutch Startup Visa success: The Jignesh Dave story