The COVID-19 pandemic has affected nearly every sector, including the P2P lending market, which demonstrated a decrease in funding volumes during March and April. However, analysts of Robo.cash are confident that the European P2P lending platforms will resume their growth in summer.

The first response of European P2P investors to the spread of COVID-19 was doubts about whether the borrowers will be able to pay out their debts. This was reasoned by the reduced level of population’s income and temporary measures to suspend debt liabilities introduced in some countries.

Investors’ doubts reflected in decreasing volumes of funding on European P2P lending platforms. Based on the statistics of p2p-banking.com, in March, they reduced by 38.5%, and in April – by another 74.5% compared to the previous month. Meantime, only 25% of platforms increased financing volumes during these two months.

Nevertheless, many arguments allow predicting that the P2P lending market will resume its growth already this summer. Thus, according to the same source, in May, the share of platforms, which increased volumes of funded loans grew to 43.2%. The total financing amount on European platforms increased by 33.6% last month compared to April.

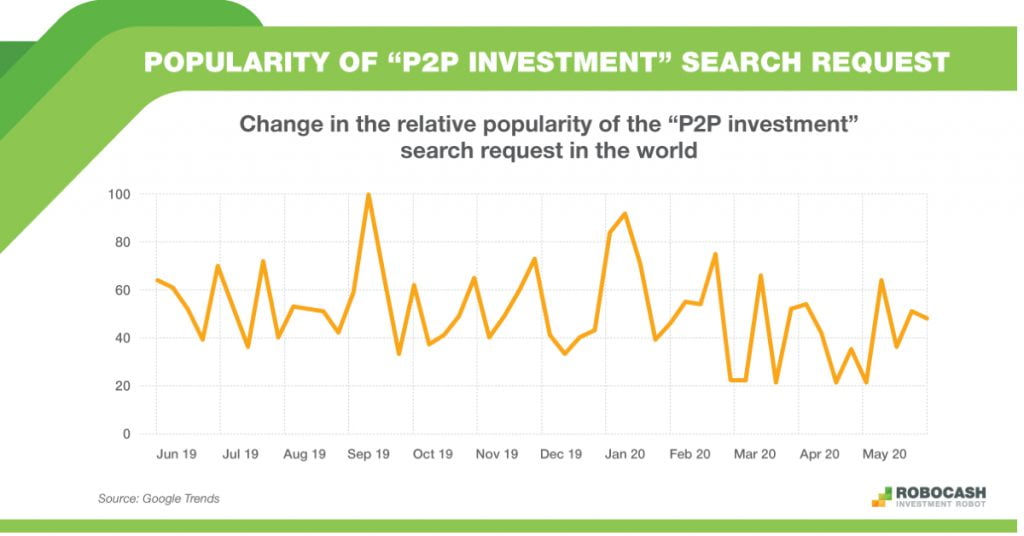

The positive tendency is also observed in Google Trends analytics. The data show that since the beginning of 2020, the relative popularity of P2P lending investments in the world was reducing, going down to 20 points in March and April. However, in May, it started rising again, reaching 64 points in the middle of month and maintaining its level above 36 points.

Sergey Sedov, CEO of Robocash Group, said: “March and April were challenging months for the segment. However, this period showed investors, which platforms could keep their positions and turned out to be the most viable. Obviously, they managed to regain investors’ trust. We have also noticed improvements on our P2P lending platform Robo.cash, with a number of new investors and funding volumes returning to the pre-crisis levels. We believe that this trend will continue in the next months facilitated by the high demand for online loans, as well as the general attractiveness and profitability of the sector,”

Main image credits: Vitalii Vodolazskyi / Shutterstock

Stay tuned to Silicon Canals for more European technology news