Airship’s analysis shows lower activation and engagement of app customers acquired at the peak of holiday shopping, when new installs spike 40%-100% over October averages

Airship’s insights, best practices and lifecycle benchmarks can help retailers drive customers through the app lifecycle to increase engagement, gain loyalty and accumulate value

PORTLAND, Ore.–(BUSINESS WIRE)–

For apps, peak install periods are the most significant value creation opportunities — and also the most costly due to more paid install competition. To quantify the opportunity and bring greater urgency to value-capture efforts, Airship analyzed mobile app lifecycle and retention data aggregated across more than 60 million new shopping apps first installed between Oct. 1 and Nov. 27 (Cyber Monday), 2023. Key app install findings include:

- Peak Day: Going on a decade, Black Friday is the top day of the year for customers to install a shopping app — double the daily average rate for October.

- Peak Week: Six of the top seven peak shopping app install days were Nov. 19-25, which is much more tightly grouped than prior years. This peak week saw 40% more app installs than October’s weekly average.

- Pre-Holiday: Five of the seven lowest daily app install days were Oct. 1-7, providing a one-week pre-holiday cohort to compare against peak-week customers.

“When acquisition costs are high, customer lifespans need a long enough runway to amortize those costs and generate returns. In other words, brands must hold on to newly acquired customers for dear life,” (Forrester Research, Inc., “Unlock Your Revenue Growth Potential,” June 4, 2023).

Wake Up, Retailers!

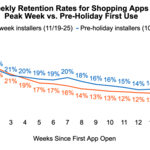

The core finding of Airship’s retention analysis should be a wake-up call to retailers everywhere: by Week 3 after install, any advantage gained in this merriest time of year is wiped out as peak-week customers go on to average 18% lower weekly retention rates than customers acquired pre-holiday. By Week 15, peak-week retention rates plummet further.

A three percentage point difference at Week 15 — +27% greater than peak week’s rate — can equate to massive future value. Research done by Frederick Reichheld of Bain & Company found a 5% increase in retained customers yields 25-95% more profit. More recently, Google/Ipsos found that 74% of retail decision-makers say investing in mobile apps is key to driving profitability and important for long-term success (85%).

Despite the peak growth opportunity and overall importance of apps, the two cohorts exhibit a similar retention pattern, suggesting retailers don’t treat peak-week app customers any differently from pre-holiday customers — despite the holiday frenzy’s urgent, transactional focus. Essentially, retailers allow peak-week customers to remain transactionally focused, which is reflected in lower retention rates before Christmas has even arrived. In addition, both cohorts see 38% of new users only open the app once within the analysis time frame (Week 0), helping to account for the Week 1 retention rate.

Capturing Value Requires Advancing Customers Through the App Lifecycle

Rather than focusing on rear-view retention rates, Airship recommends that retailers focus on advancing customers through the mobile app lifecycle — from acquisition to activation, engagement and loyalty. To help, Airship compared the peak-week and pre-holiday cohorts with a subset of metrics used to gauge and optimize progress through the activation and engagement lifecycle stages.

During activation (Day 1-30 after download), the most successful apps focus on understanding customers’ preferences and interests while gaining ways to communicate with them. Identified User Coverage, which is the number of devices with a unique customer ID divided by total devices, is a key metric as it allows brands to link customer data from prior interactions and across channels to better personalize and orchestrate future interactions. Customers gained during pre-holiday have 3% higher Identified User Coverage rates than peak-week adopters. Perhaps due to seasonality and promotions or rewards requiring registration, both cohorts come in above the February shopping category averages: 10% higher for pre-holiday customers and 7% higher for peak week.

Metric comparisons for the engagement lifecycle stage included Average Sessions Per Active User, Average Session Length (in minutes per month) and Airship’s Engagement Score, which indicates how many monthly active users return on a daily basis.

- Pre-holiday customers’ February 2024 Engagement Scores are 8% higher than the shopping category average and 14% higher than peak-week customers’, further illustrating the transitory, transactional nature of the latter cohort.

- Pre-holiday customers also lead in Average Sessions Per Active User, with February 2024 totals 17% higher than peak-week customers and 9% higher than the shopping category average.

- The only engagement metric where peak-week customers outperformed pre-holiday customers was Average Session Length, with .006 more monthly minutes in February 2024 (+.4%). Both cohorts are 9% below the February shopping category average for session duration.

For best practices, additional metrics and benchmarks to compare activation and engagement performance across app store categories, please download Airship’s reports: Mobile Lifecycle Benchmark: Activation and Mobile Lifecycle Benchmark: Engagement. Registration is now open for Airship’s April 11 webinar, Capture Customer Attention: 3 Strategies in 30 Days.

“Customers clearly flock to shopping apps to get the best deals, earn rewards and gain exclusive access, but it’s up to retailers to turn installs and first transactions into ongoing use where real value accumulates,” said Thomas Butta, Chief Strategy and Marketing Officer, Airship. “Brands should continually optimize onboarding experiences and reinforce value throughout the lifecycle and across channels for different types of customers. Above all, they need to capture customers’ attention in moments that matter — which calls for in-app experiences tailored to the individual, so brands can continually grow customer understanding, drive engagement and build loyalty over time.”

Methodology

Airship analyzed aggregate data from shopping apps with at least 100,000 monthly active users that also saw new installs and at least 1,000 device sessions within both the peak-week and pre-holiday cohorts. Analysis included 63 million new app users gained between October 1 and November 27, 2023. One-week pre-holiday and peak-week cohorts were established to track and compare monthly activation and engagement metrics through February 2024 and weekly retention rates through Week 15 following Week 0 installation.

About Airship

No one knows more, does more, or cares more than Airship when it comes to helping brands master mobile app experience (MAX).

From the beginning of apps, Airship powered the first commercial messages and then expanded its data-led approach to all re-engagement channels (mobile wallet, SMS, email), app UX experimentation, no-code native app experience creation and App Store Optimization (ASO).

Having powered trillions of mobile app interactions for thousands of global brands, Airship’s technology and deep industry expertise have enabled apps to become the digital center of customer experience, brand loyalty and monetization.

With the Airship App Experience Platform and Gummicube’s ASO technology and expertise, brands now have a complete set of solutions to optimize the entire mobile app customer journey – from the point of discovery to loyalty – driving greater value for everyone involved.

For more information, visit www.airship.com, read our blog or follow us on X (formerly Twitter), LinkedIn and Facebook.

Contacts

North America:

Deidre Wright

Airship

+1 415-223-0832

[email protected]

Kali Myrick

Kali Myrick Communications

+1 503-580-4645

[email protected]

EMEA:

Ana Williams

Airship

+44 (0)20 3405 5160

[email protected]

Pauline Delorme

Tyto PR

+44 (0)20 3934 8882

[email protected]

01

From telecom veteran to Dutch Startup Visa success: The Jignesh Dave story