Fintech companies have successfully made it easier to pay for and buy things. However, it is still not easier for an average person to invest their savings. Investing is often seen as complex, risky, and time consuming, where most people believe the barrier of entry is too high. But Dutch scaleup Peaks makes investing not only easy but paves the way for financial freedom.

Founded by Tom Arends, Rutger Beens, and Sijbrand Tieleman in 2015, and incorporated in 2017, the founders spent about a year researching the idea. Amsterdam-based Peaks serves a market that left young people and women out of the investment landscape. The story of Peaks is not only about making investment easy but also about financial inclusion.

A non-accessible investment landscape

The idea of Peaks stems from an investment landscape that primarily catered older, wealthier people and men. Tom Arends, with experience in the retail investment space, says he has given many presentations in his previous career to retail investors, but almost never young people or women. Tieleman and Beens leading a digital agency that helped financial organisations innovate.

The pivotal moment came from combining their experiences with creating financial savings and investments apps for banks. “Bringing our experiences together was the Eureka moment for Peaks as we saw the vast blue ocean of consumers who weren’t served by the market,” says Arends, CEO of Peaks. “It also led to our mission to make investing accessible for everyone, everyday.”

He adds that Tieleman had the idea of creating a simple investment app that enabled everyone to start investment. They were also inspired by the success of Acorns, the spare change investment app that launched in the US and gained a lot of traction attracting a number of users.

Peaks takes the Dutch habit of filling a tube with your remaining change to the investment world. “With Peaks we’ve built an app that makes saving and investing as simple as paying with your debit card,” adds Arends.

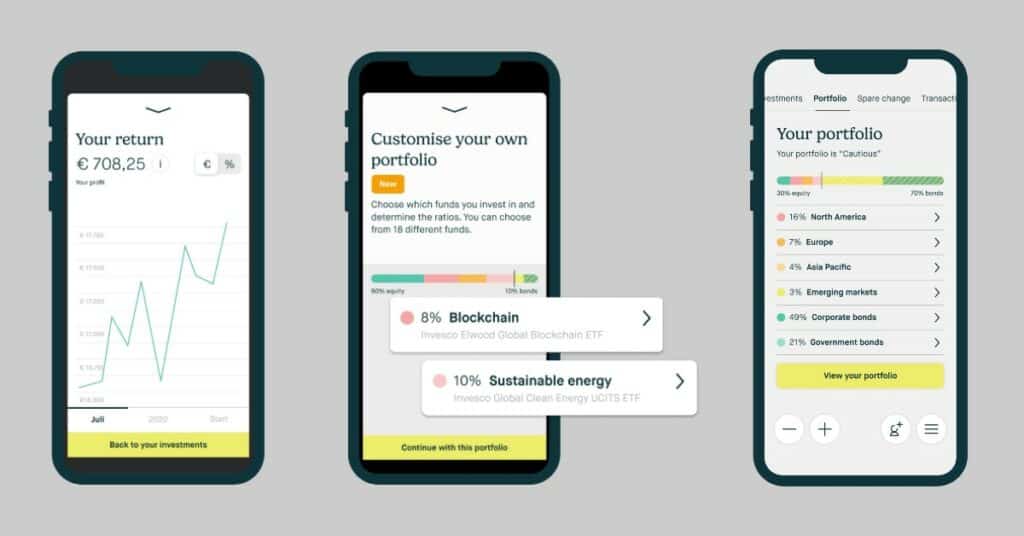

It started with a roundup feature that automatically rounds up the amount spent by you with your debit card to the next euro and invests the difference in a well-diversified and sustainable portfolio of exchange-traded funds (ETFs). The feature allowed users to invest with small amounts regularly.

Arends says, “It worked as we grew our customer base quickly and were reaching our initial target group of (relatively) young people and women.”

While ease and simplicity remain the key USP of Peaks, the company has now grown into an international wealth building platform. With a subscription business model and an asset-under-management fee, Peaks has a revenue stream that grows as customers grow their wealth on the platform.

Leap of faith to attain financial freedom

Arends, Beens, and Tieleman began working on Peaks in 2015 while continuing with their primary jobs. Once they knew their idea of a simplified investment app would work, they left their jobs to spend all of their energy on their startup.

“I switched my career and salary at a major bank to become a fintech founder. I moved closer to Amsterdam, leaving Rotterdam behind where I lived for almost 16 years,” he says.

On the business front, Arends acknowledges the challenge they faced with the delay of the PSD2 legislation. The PSD2 legislation required banks to offer an API access to customer’s payment transaction data after approval of the customer. “We needed these APIs to make our roundup feature work and offer our key feature to customers of all banks,” Arends says.

He adds, “The legislation was delayed and it took a lot of time for the banks to get the quality of the APIs to the right level. As a consequence we had to wait almost 2 years before being able to offer our key feature to all consumers.”

This leap of faith is not just restricted to the founders of Peaks but also the customers. Arends says a lot of people postpone their decision to start investing because they find investing “complex, boring, and costs a lot of time” but they also know that “investing is the best way to attain financial freedom.”

He further adds that by making it easier to start and automating the savings discipline for customers, Peaks allows users to focus on things that are urgent or interesting to them.

Democratising the world of investing

In a nutshell, Peaks is trying to democratise the world of investing where opening an account takes only about five minutes and one can invest with any amount. To further simplify, Peaks offers its users the option to choose from four different portfolios that are well-diversified, sustainable, and invest in the ETFs of world class asset managers such as iShares, UBS, and DWS.

“Basically you cannot make a mistake, as what we offer is based on the most important investment lessons: diversify your investments globally, deposit regularly, and stay disciplined,” Arends.

He calls this the best way to build up wealth over time and take advantage of the compounding return effect whether you invest €100 or €1,000,000. At the core of this investment philosophy is an application that is rooted in fundamentals such as design, development, and product.

With most important hires being in those areas, Arends calls them the core of their product and platform. “We found our most important first hires in our own network via former colleagues, friends, and family,” he says.

Rise is about learning and sharing

Peaks joined nine other Dutch fintech scaleups to form batch #9 of Techleap.nl’s Rise programme. Arends says they joined the programme since it offered them the opportunity to learn from the best tech entrepreneurs in the Netherlands and its peers.

“Building a fintech company is all about learning, iterating your way forward,” he says. “[Rise programme] helps us in our process of scaling Peaks further and building a sustainable business.”

He also adds that the experience and insights from other scaleups in the programme has been valuable. “Running a scaleup as a CEO is challenging and sometimes lonely,” Arends says before adding that sharing experiences at the Rise programme helps navigate the future better for entrepreneurs.

With access to the broader BOLD community of Techleap.nl connecting all Dutch tech scaleups, Arends says all the sessions of the Rise programme has been a great networking opportunity that will help all the participating companies build their scaleups.

A pan-European wealth building platform

Arends envisions Peaks becoming one of the leading wealth building and pension platforms in Europe. The pain point solved by Peaks is not only for Dutch people but also one that is true for Europe.

Arends says, “We tested our solution in multiple countries and we know customers all face similar obstacles when it comes to investing. At the same time, there is no truly simple and easy European platform that is focussed on wealth building.”

In Europe, there are neo-brokers focussed on short term trading and active investors, offering too much choice for the average consumer. Arends says these brokers can offer over 2,000 savings plans and more than 10,000 ETF options. These brokers are into trading as opposed to Peaks, which uses investing as a means to building wealth and which tries to keep it as simple and easy as possible for the user.

Peaks is active in the Netherlands and Germany, and has executed pilots in Spain and France. Arends says the platform is ready to scale internationally and the company aims to raise funds in the course of this year to fund the European expansion.

The mission, according to Arends, is to improve the financial lives of at least one million people. He sees Peaks becoming a company that “is able to sustain itself so the mission can continue indefinitely.”

Arends says they have been able to get to this point by testing their product rigorously and thinking early on how to sell their product and viability of their business model. “It is not easy to build a regulated fintech, but it is worth the effort,” he says.

01

From telecom veteran to Dutch Startup Visa success: The Jignesh Dave story