The Scaleup Report, a collaborative effort between Startup Genome, Global Entrepreneurship Network, and Dealroom, was officially launched on Wednesday at the Global Entrepreneurship Congress in Melbourne.

The report provides valuable insights into the characteristics that separate startups that successfully scaled from those that failed.

It also provides actionable insights for entrepreneurs, enterprise support organisations, and policymakers seeking to increase the proportion of startups scaling to $50M+ valuation.

Powered by the most comprehensive dataset on startup ecosystems, it draws from a decade of longitudinal scaleup research examining hundreds of objective metrics available on tens of thousands of startups that have taken Startup Genome’s founder survey.

Here are the key takeaways:

ESOP dramatically increase chance of scaling

Founders looking to improve their chances of scaling should ensure that they offer stock options for all employees, have more than five global connections to top ecosystems, and have at least three advisors for their startup.

Offering employee stock options (ESOP) increases the motivation of employees, increases retention, and builds team spirit and commitment, adds the report.

Local Connectedness Index leads to higher success rate

Startups with a Local Connectedness Index score of 6 or above achieve a scale-up of 5.1 per cent compared to 3.8 per cent for those with a score of 2 to 4, a 34 per cent boost.

The Local Connectedness Index measures the size, density, and quality of a startup’s local network.

Early-stage startups with a higher Local Connectedness Index see their revenue grow twice as fast as those with the lower Local Connectedness Index.

Global Connectedness

Scaleup success rate clearly increases with Global Connectedness, and startups that develop a high level of Global Connectedness have a 3.25x higher chance of scaling than those with a low level.

Ecosystems that are more connected to top global ecosystems, such as Silicon Valley, New York City, and London, see their startups go global at a much higher rate on average, reveals the report.

Higher Global Connectedness provides a startup with scale-up potential — the potential to knowingly develop a globally leading business model — whether inherited by being based in a top ecosystem or developed by a single founder through networking.

Early-stage startups that go global (more than 50 per cent of foreign customers) are on a revenue growth curve 2X faster than those that do not (less than 50 per cent of foreign customers).

For non-US startups that target the global market first, the scale-up rate doubles.

Founders with hypergrowth experience have brighter chance

Founders with previous hypergrowth experience have an 85 per cent higher scaleup rate compared to founders without this experience.

It indicates that not just previous experience, but experience specifically related to a successful past startup is a critical factor in achieving scaleup success.

In this context, a hypergrowth startup is defined as a startup that scaled rapidly to a very large size.

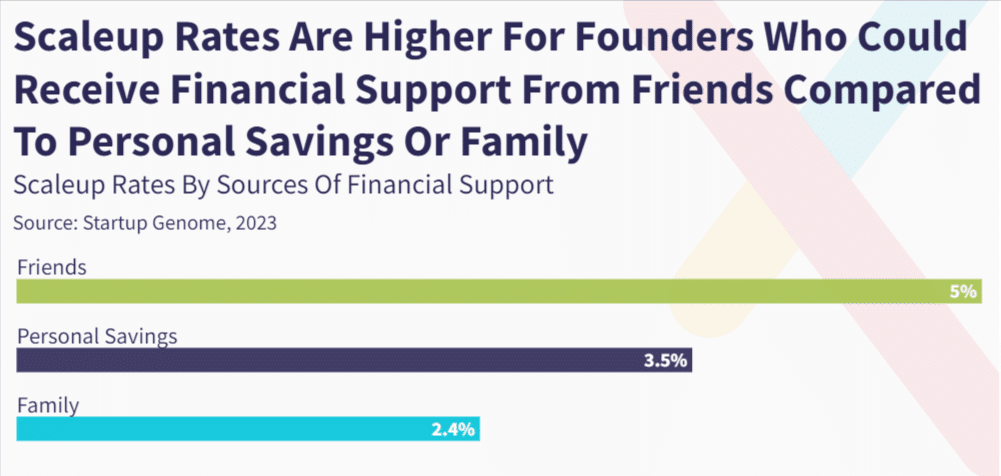

Scaleup rates by sources of financial support

According to the report, founders who can rely on friends for funds were more likely to produce a scaleup than those with their own or family resources.

Scaleup success is most common among founders in the 26–40 age bracket, in terms of scaleup rate and absolute number of scale-ups.

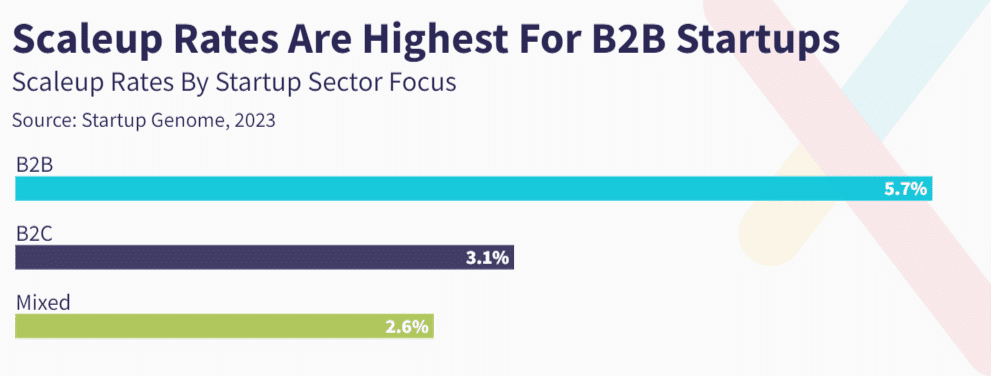

Scaleup rates are higher for B2B-only startups

B2B-only startups have higher scaleup rates than those that are B2C-only or mixed.

B2B startups that focus on foreign customers (more than 50per cent of foreign customers) at an early stage see their revenues grow 2.1x faster rate.

Deepdive into deep tech scaleups in Europe

In Europe, data from the European Scaleup Monitor 2023 reveals that only around 10 per cent of firms achieve annual growth rates exceeding 10 per cent.

This “scaleup gap” is particularly prevalent in Europe due to smaller typical fund sizes compared to the United States and Asia.

Deep Tech scaleups in Europe: Around 13.79 per cent of hypergrowers in Europe can be categorised as Deep Tech scaleups. These hypergrowers are defined as companies ten years or younger with average annualised growth exceeding 40 per cent over three years.

Deep Tech scaleups tend to have valuations of over €50M, similar to other scaleups.

Funding Trends in Deep Tech: Deep Tech scaleups secure a substantial portion of their funding from external sources, with 71 per cent relying on external funding, compared to 48.54 per cent of non-Deep Tech scaleups in Europe.

Deep Tech scaleups also dominate in total Deep Tech funding, securing an impressive 91.51 per cent.

Sector-Specific Funding: Funding in Deep Tech scaleups is concentrated in energy (44.58 per cent) and transport (43.87 per cent), while health (15.15 per cent) and robotics (13.64 per cent) are the top industries in terms of the number of Deep Tech scaleups.

Funding Dynamics: The European Scaleup Monitor 2023 reveals that Deep Tech scaleups experience steady investment rounds throughout their hypergrowth, while non-Deep Tech scaleups see a surge in later-stage rounds in their third year of hypergrowth, particularly in Series C rounds.

01

From telecom veteran to Dutch Startup Visa success: The Jignesh Dave story