When the pandemic hit in 2020, many market researchers predicted that funding could dry up for startups and companies. While we reported that it wouldn’t be the case, the well-known data provider SaaS company PitchBook has published its 2020 Annual European Venture report, which indicates the same. The report finds that VC deal value didn’t dip in 2020, despite COVID-19 and it set a new annual record. Here are some key findings from the new PitchBook report.

European VC deals set a new annual record in 2020

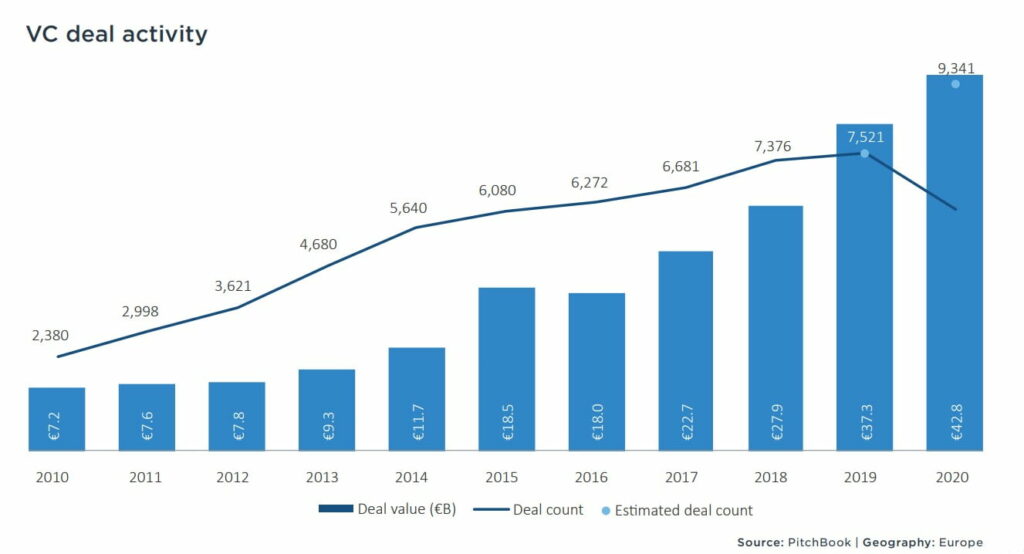

Despite COVID-19 and its detrimental macroeconomic damage, VC deal value reached a new annual record of €42.8B in 2020. As per the PitchBook report, 9,341 deals happened last year, and the huge number represents a 14.8 per cent year-over-year increase in value. In addition, driven CVC investment was observed in companies across flourishing segments such as e-commerce and remote-working tools.

VC investment into UK-based companies didn’t falter despite Brexit, and capital from the US flowed freely into Europe in 2020. The companies that have survived and flourished during the pandemic are expected to lead CVC investment for the next few quarters, the PitchBook report suggests.

“Few predicted the insatiable appetite to commit to and invest in VC in 2020. While other asset classes crumbled amid widespread volatility, Europe’s maturing VC ecosystem – and venture as an investment strategy – showed remarkable resilience with dealmaking, fundraising and CVC participation reaching record highs,” says Nalin Patel, PitchBook EMEA Private Capital Analyst.

He further adds, “We believe capital will continue to pour into pandemic-driven areas as recoveries commence and the allure of a return to normality will drive capital into resurgent pre-pandemic trends, both of which will combine to hold overall VC activity aloft in 2021.”

Exit amidst volatility

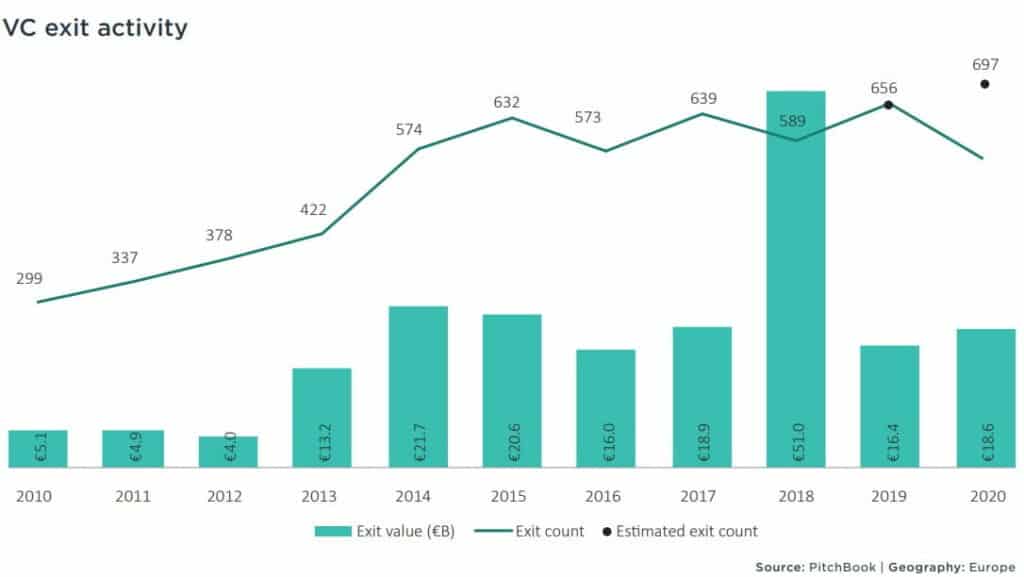

Exit values picked up momentum after a lethargic start to 2020. For exits, Q4 2020 was one of the strongest quarterly showings. The pandemic is said to have created favourable market conditions for VC-backed companies that were seeking an exit in sectors such as biotech and pharma, which secured €6.7B in venture exit value in 2020, or 35.9 per cent of Europe’s total. Total European VC exit value rose 13.9 per cent year-over-year to €18.6B across 697 deals.

VC-backed IPOs grew from 46 in 2019 to 50 in 2020, suggesting some startups were willing to list even amid such a turbulent year. Public equities and lack of listings in Q2 and Q3 created pent-up demand for IPOs, and healthcare startups such as Compass Pathways, Freeline and Nanox decided it was the perfect time to exit. The study predicts that the exit flow would still be ‘lumpy’ in 2021 as exit decisions are influenced by news linked to restrictions, additional waves of COVID-19, vaccine rollouts, and underlying macroeconomic issues.

VC fundraising achieved a record high in 2020

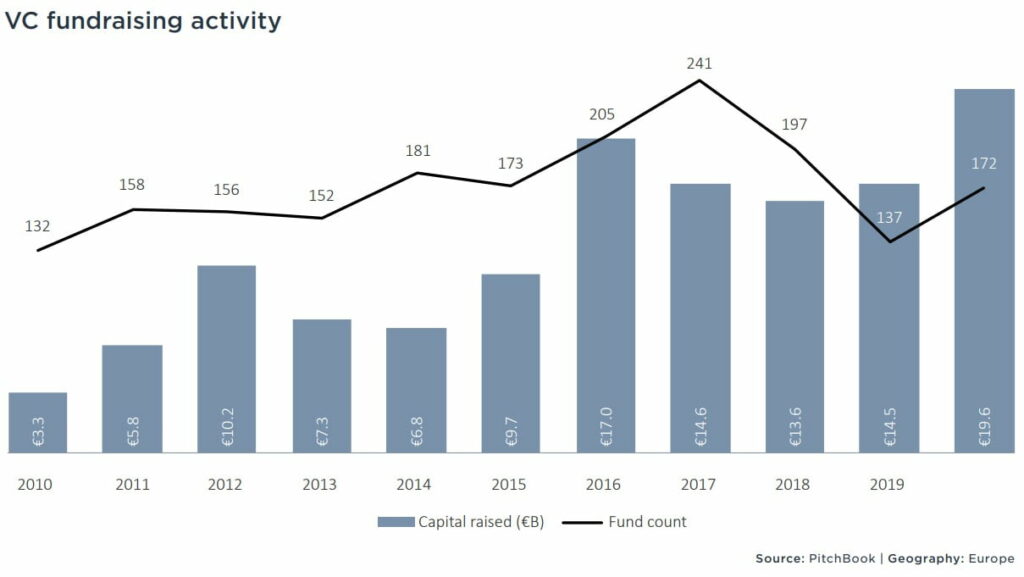

European VC funds raised a record €19.6B in 2020, which represents a 35.2 per cent year-over-year increase. LPs and GPs seem to have shrugged off long-term apprehension posed by COVID-19 as the quantity of closed VC funds shot up to 172, reversing a two-year decline.

While people adapted to working from home, fundraising processes also successfully adapted to remote tools. Pandemic-proof and pandemic-induced opportunities by larger VC vehicles attracted notable capital from existing and nontraditional investors. VC funds with a value over €100M represented 82.0 per cent of the total capital raised in Europe in 2020, just below the peak of 83.8 per cent set in 2019, the PitchBook report expects they will continue gaining share in 2021.

01

From telecom veteran to Dutch Startup Visa success: The Jignesh Dave story