Digital banking is the recent rage in the global finance domain as this disrupts the concept of traditional banking. Talking about digital banking, Germany has witnessed noticeable growth and innovation in the fintech sector, especially in digital banking in recent years.

To be adopted by German businesses, digital and challenger banks in the country must focus on providing solutions that consider the unique features of the market. Also, challenger banks must make sure they stand out ahead of the competition that exists in the market and addresses key pain points by offering seamless cross-border payments among other services.

It is common for businesses to prefer banking services that offer frictionless and simple global payments and those that give them the ability to track payments and have better control over their money. As the challenger banks bring these benefits for businesses, there is a huge shift from traditional to challenger banks. Having said that, here we have listed the top challenger banks in Germany right now as sourced from Dealroom.

N26

Founder/s: Valentin Stalf, Maximilian Tayenthal

Founded year: 2013

Funding: €711M

N26 claims to be the mobile bank that helps you manage your bank account on-the-go, track your expenses and set aside money in real-time. You can open your bank account within seconds from your smartphone and spend instantly before getting your hands on the physical card. N26 provides a free MasterCard and lets you enjoy free ATM withdrawals sans any hidden charges or foreign exchange fees.

Recently, the Berlin-based challenger bank hit the headlines as it introduced N26 Smart, which is a premium monthly subscription service priced at €4.90 per month. This service gives you more control over your money, and you get to choose a MasterCard colour as per your choice. You can access up to 10 ‘Spaces’ – N26’s sub-accounts along with Shared Spaces – that will let you save, spend and manage money with a maximum of 10 people.

Penta

Founder/s: Aleksandar Orlic, Igor Kuschnir, Jessica Holzbach, Lav Odorovic, Luka Ivicevic, Sir Gabriel Holbach

Founded year: 2016

Funding: €39.7M

Berlin-based Penta is a business banking challenger that provides banking services to small and medium-sized enterprises. As per the company, they are building a platform that will meet all your financial needs, be it simple banking or help customers get loans. This fintech startup automates bank accounts and invoices and offers online cashless banking services to startups and SMEs. Based in Berlin, Penta has offices in Belgrade and Milan too.

Back in October, the German digital bank Penta announced that it would accept overnight and term deposits from WeltSparen, which lets clients’ interest rates. The new services are introduced in partnership with Raisin, another fintech. This enables companies to avoid negative interest rates and invest at attractive interest rates.

Fidor Bank

Founder/s: Matthias Kroener

Founded year: 2009

Funding: NA

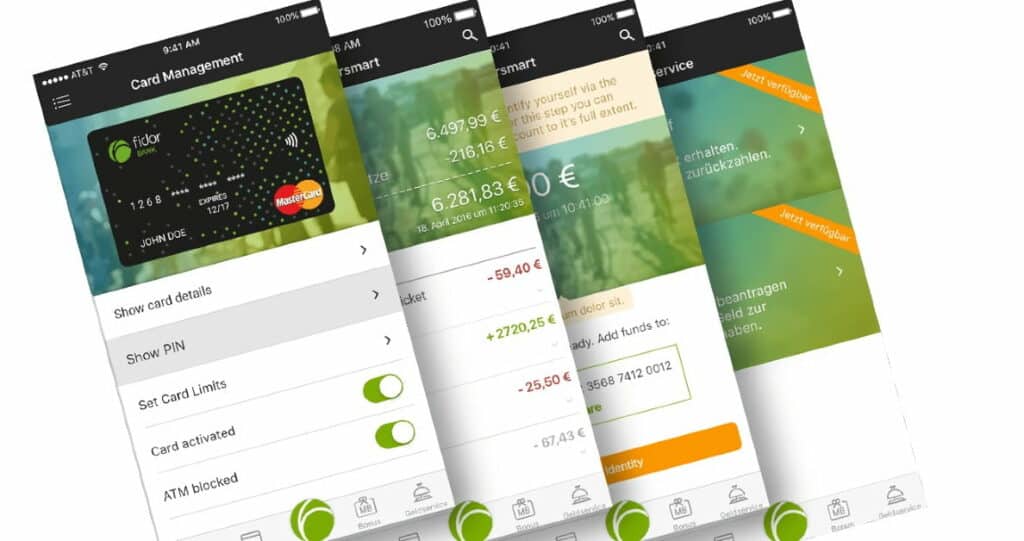

Fidor Bank claims to be one of the world’s most innovative banks. The fintech has received several international awards for its disruptive, transparent approach to banking. Fidor Bank is a digital bank that works with the intention to re-establish lost confidence in banking with new and customer-focused services and enable its customers to actively participate in the bank’s decision-making processes, claims the company. Its product portfolio covers retail and business banking ranging from basic bank accounts and savings bonds to various lending offers. In Germany, Fidor says it has around 100,000 clients and over 300,000 community members.

Solaris Bank

Founder/s: Andreas Bittner, Marko Wenthin

Founded year: 2016

Total funding: €155M

Solaris Bank possesses a German banking licence and has built an API-accessible banking platform to meet the requirements of the digital economy. This platform lets digital businesses create custom solutions as per their unique financial needs. Its vision is to boost the growth of the digital economy with its banking services, payment services and add-on services, adds the company.

In June 2020, Solaris Bank raised €60M Series C funding taking its valuation to €320M. HV Holtzbrinck Ventures led this investment round, existing investor yabeo, BBVA, ABN AMRO Ventures, SBI Group, Hegus, Global Brain and Lakestar, and new investors Storm Ventures, Samsung Catalyst Fund, and Vulcan Capital.

Kontist

Founder/s: Alexander Baatz, Christopher Plantener, Sebastian Galonska

Founded year: 2016

Funding: €3M

Kontist, a Berlin-based fintech startup is one of the key players in the transition towards end-to-end automation of business processes via a central ecosystem. This company makes managing finances much easier with features such as paperless bank account opening, mobile banking and much more. Kontist offers mobile banking services for the self-employed and has teamed up with Solaris Bank for a German banking license and modular banking platform technology.

Tomorrow

Founder/s: Inas Nureldin, Jakob Berndt, Michael Schweikart

Founded year: 2018

Funding: €11.5M

Munich-based Tomorrow is quite different from traditional banks as it uses your money only to fund sustainable projects. Eventually, it claims to be an easy way to support a positive change. As per the company, for every euro you spend with your Tomorrow card, you protect 1 square metre of the rainforest.

Besides focusing on the environment and sustainability, Tomorrow also offers many other notable benefits as well. With the Visa debit card from the fintech, you can shop all over the world sans any additional charges. Also, you get up to three free withdrawals in euros each month.

01

From telecom veteran to Dutch Startup Visa success: The Jignesh Dave story