The Netherlands contains the most successful ecosystem in the EU, but is falling behind its competitors in the US and Asia. And to remain competitive, concrete efforts must be made on specific aspects, says Techleap in its annual State of Dutch Tech 2023 report.

Here are the key takeaways from the report.

Scaleup to startup ratio

According to the report, the scaleup-to-startup ratio in the Netherlands is lower than peers due to a lack of capital.

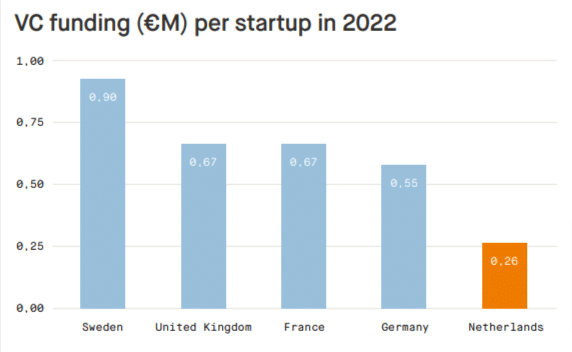

In 2022, total VC funding in the Netherlands was €2.6B and the average funding of all startups was €0.26M per startup.

It was significantly lower than other major EU startup ecosystems, including the UK (€0.67M), France (€0.67M), and Germany (€0.55M).

Meanwhile, Sweden stands out with €0.9M in VC funding per startup.

Financing growth

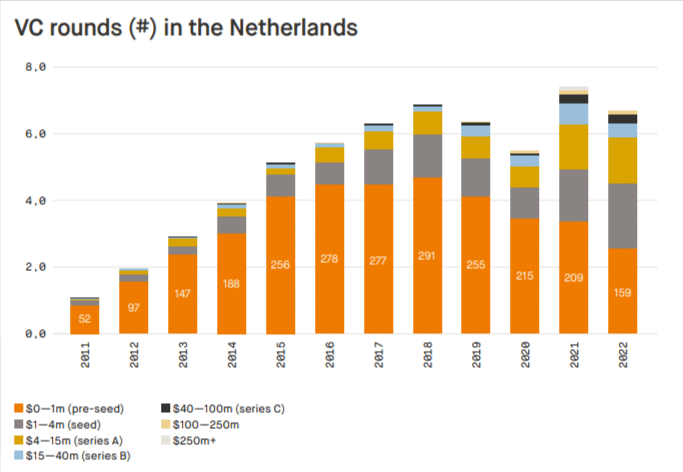

Investments: The report says that 2022 saw a drop in investment levels at all stages except early-stage capital (pre-seed: €0-1M) compared to 2021.

While the rise in pre-seed funding was positive, fewer deals were made, with 159 deals in 2022 (-24 per cent) compared to 209 in 2021.

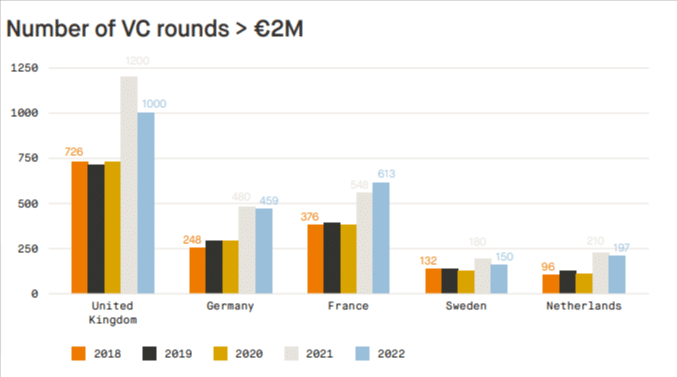

According to the report, VC funding rounds above €2M dropped by 6 per cent for the Netherlands, but are still nearly double 2020 levels. France stands tall in the total number of VC funding rounds above €2M by 12 per cent growth in 2022 compared to 2021.

Meanwhile, the UK and Sweden dropped 17 per cent, and Germany saw a 4 per cent decline.

There was a big drop in ‘large investment rounds above €100M,’ setting the Netherlands back to 2020 levels, shows the report. In 2022, there were 6 rounds above €100M compared to 14 in 2021.

VC investment: €1.4B in funding came from Dutch investors in 2021 and 2022. Also, investment from US funds is down from 49 per cent to 23 per cent of all investments.

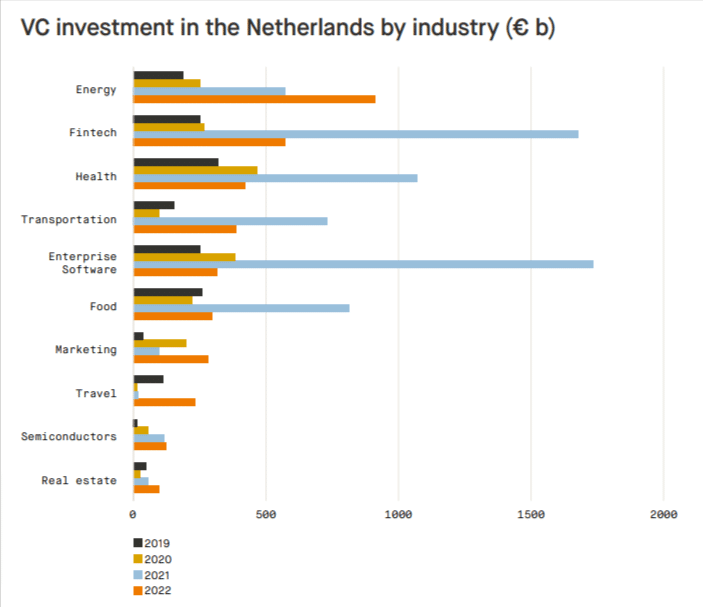

Sector: Most sectors have taken a hit compared to 2021 but are still performing above 2020 levels. While the energy sector soared in 2022, Fintech, enterprise software, and the health sector declined compared to 2021.

Despite a looming economic crisis, Impact investments are on the rise, as investors are willing to bet on sustainable companies. VC funds invested €1B in Dutch impact startups in 2022.

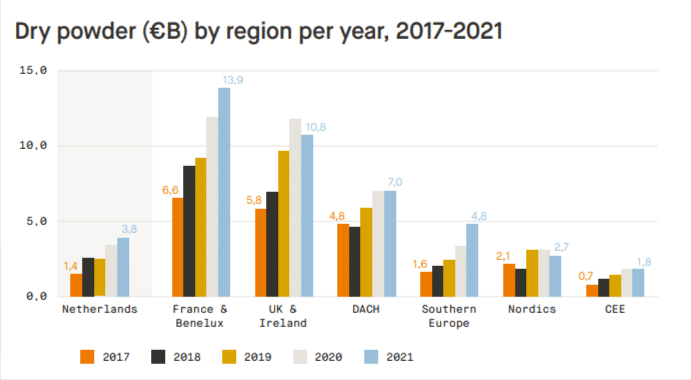

Dry powder: Dry powder levels have reached €3.8B in the Netherlands, more than doubling over the past five years.

Talent attraction and inclusion

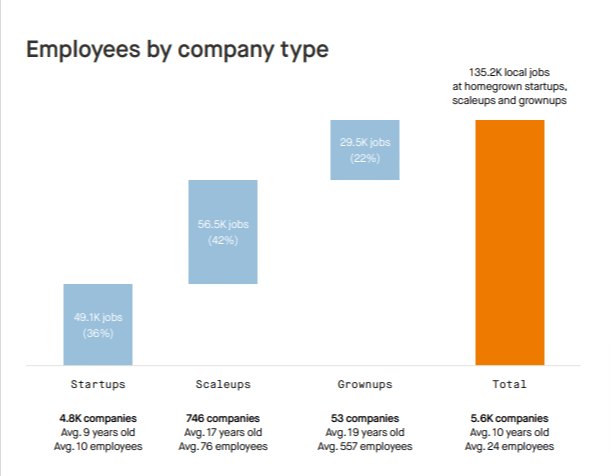

Employment: According to the report, startups remain a driver of employment growth in the Netherlands with annual job growth in the tech sector in 2022 at 7.6 per cent.

The number of employees at startups, scaleups, and grownups has been steadily increasing over the past few years from 109K jobs in 2020 to 130K in 2021 and 135K in 2022.

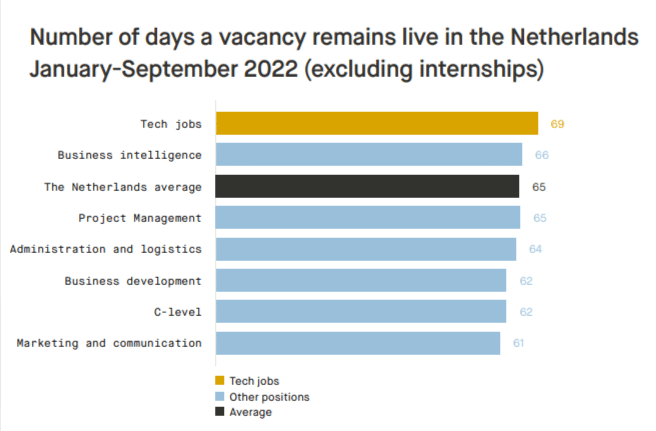

Talent attraction: Attracting tech talents in the Netherlands remains a concern for several startups.

According to the report, Dutch tech job openings take more than 60 days to fill and the percentage of hard-to-fill jobs in tech rose to 59 per cent in 2022 compared to 58 per cent in 2021.

In 2022, Belgium overtook the Netherlands with the highest percentage of hard-to-fill jobs.

Inclusion: 10% of tech founders in the Netherlands have a migrant background and the sector attracts more foreign talent than other sectors.

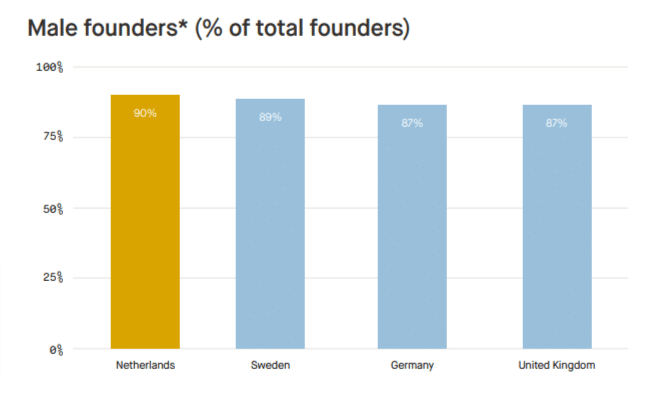

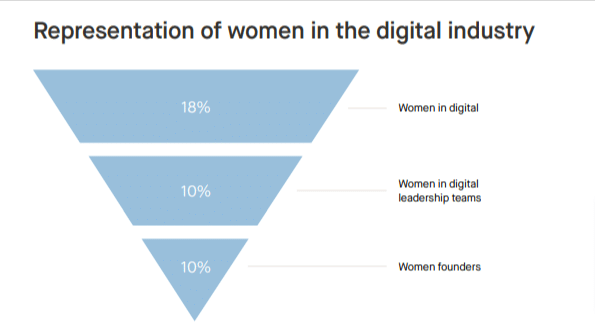

The Dutch tech sector is still dominated by male founders and employees, says the report.

Around 90 per cent of Dutch founders in the startup ecosystem are male, making it less gender diverse than Germany (87%), Sweden (89%), and the UK (87%).

Meanwhile, 10 per cent of all (co)founders in the Dutch startup ecosystem are female, while women make up 18 per cent of the total Dutch digital industry.

Female-only founder teams in the Netherlands account for 5.2 per cent of all VC deals and 0.7 per cent of VC funding raised, below EU peers.

Techleap suggests creating a “people-first culture that empowers growth with more consistent strategy and accountability. More privacy-friendly data is needed to create effective, people-first cultures.”

Deep tech ecosystem

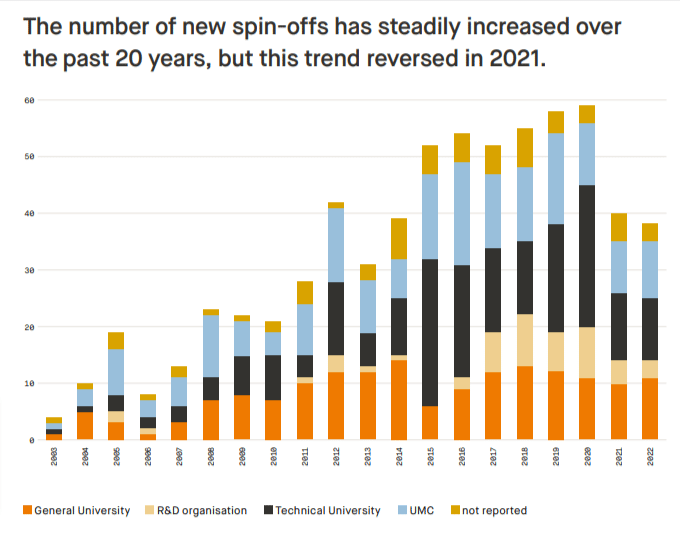

Spin-offs: The Netherlands is a high-performing research nation, affirms the report. As a result, the number of new spin-offs has steadily increased over the past 20 years, but this trend reversed in 2021.

According to the report, 674 spin-offs were founded over the past 20 years. This is 90 per cent of the 745 confirmed spin-offs.

Of all 745 Dutch spin-offs, 80 per cent are still active.

The scientific spin-offs from Dutch academic institutions develop and apply a broad range of technologies to serve many different industries.

The report reveals that technical universities are the most common source of spin-offs, accounting for 30 per cent of all spin-offs, followed by UMC’s (28 per cent), general universities (25 per cent), and research organisations (7 per cent).

Spin-offs are mostly funded by public funds, except in life science.

Deep tech startups: “Dutch deeptech startups are resilient, but they take time to scale,” adds the report.

This is because, in general, deeptech companies typically go through lengthy research and development (R&D) trajectories with relatively small teams.

Of companies still active that were founded in the last 5 years, only 28 per cent have more than 10 employees. For companies founded 5-10 years and 10+ years ago, this number is 46 and 51 per cent, respectively.

Regional analysis

The report cites that the Netherlands is focusing on building a nationwide ecosystem through public initiatives that drive connections between key startup hubs.

“The Netherlands is at an advantage here with many small, specialised ecosystem hubs across the country,” reads the report.

North Holland: North Holland is home to over 3.4K startups and 51.6K startup jobs, representing 38 per cent of the startup workforce in the country. Amsterdam stands on top for generating most of North Holland’s startup jobs.

In 2022, the majority of funding rounds were centred in North and South Holland and driven by foreign investment, shows the research.

Last year, the North Holland region also raised €2B in VC funding.

South Holland: South Holland is a hub for impact-focused startups.

South Holland has over 2K startups supporting over 26.1K local jobs. The region has a combined value of nearly €50B.

The region raised €419M in VC funding in 2022. The research also added that startup jobs grew in the province by 8 per cent in 2022.

North Brabant: North Brabant is home to nearly 1.1K startups, making it the third-largest province in the number of startups. It has 172 deeptech startups generating over 5K jobs, representing more than a quarter of the region’s startup workforce.

North Brabant raised €440M in VC funding in 2022.

Utrecht: Utrecht stands at 4th in terms of the region by a number of startup jobs. This region has 900+ startups, creating over 16.4K jobs in 2022.

Utrecht raised €226M in VC funding in 2022.

However, it ranks second in startup jobs per 1M inhabitants, states the report.

Groningen: Groningen is the engine of startup development in the North Netherlands.

The region is home to around 230 startups, creating 3.3K jobs.

Since 2018, the province has increased startup jobs by 12 per cent — growing faster than any other province in the country.

Startups in Groningen raised €14.7M in VC funding in 2022.

Gelderland: Gelderland is a leader in foodtech with large startups driving growth, adds the report.

Between 2021 and 2022, foodtech startups accounted for nearly one-fifth of new jobs in the region.

The region raised €66M in VC funding in 2022.

Conclusion

According to the report, the Netherlands is well-positioned to be a tech leader, however, it has to address some key challenges such as:

- Realign strategic tech policy

- Connect the community

- Increase capital

- Boost regional development

- Develop and attract more talent

- Support deeptech

- Grow the base

01

From telecom veteran to Dutch Startup Visa success: The Jignesh Dave story