Cryptocurrency has rapidly gained popularity and it has begun affecting the economy of some countries. It is a much-talked-about technology right now. Even Facebook has come up with details of its cryptocurrency called Libra. With Libra, it is possible to buy products or transfer money to people sans any additional fees.

Not only Facebook but also many other tech giants and startups are focusing on launching cryptocurrency as this is the next big transformation in the fintech industry. The reason for this adoption and utilisation of cryptocurrencies is that it has the potential to transform the way we do business.

Having said that, it is notable that the cryptocurrency is gaining traction and momentum right now. And, this particular technology is all set to change the future of fintech startups in Europe as sourced from Dealroom.

SEBA Bank AG (Switzerland)

Founders: Guido Buehler

Funding: 2018

Founded year: €88 million

Why its hot: SEBA Bank AG aims to provide corporate financing, including banking services to corporate clients, advising on initial coin offerings, and other cryptocurrencies. The other core values such as performance, transparency, and safety. The Zug-based group got the banking and securities dealer license in August 2019 and started the first licensed bank for digital and traditional assets with the onboarding of Swiss clients this month.

Elliptic (London)

Founders: Adam Joyce, James Smith, Tom Robinson

Funding: €27.3 million

Founded year: 2013

Why its hot: Elliptic’s platform identifies illicit activity on the bitcoin blockchain and provides actionable intelligence to financial institutions and law enforcement agencies to reduce bitcoin transaction risk. Elliptic makes cryptocurrency transaction activity more transparent and accountable.

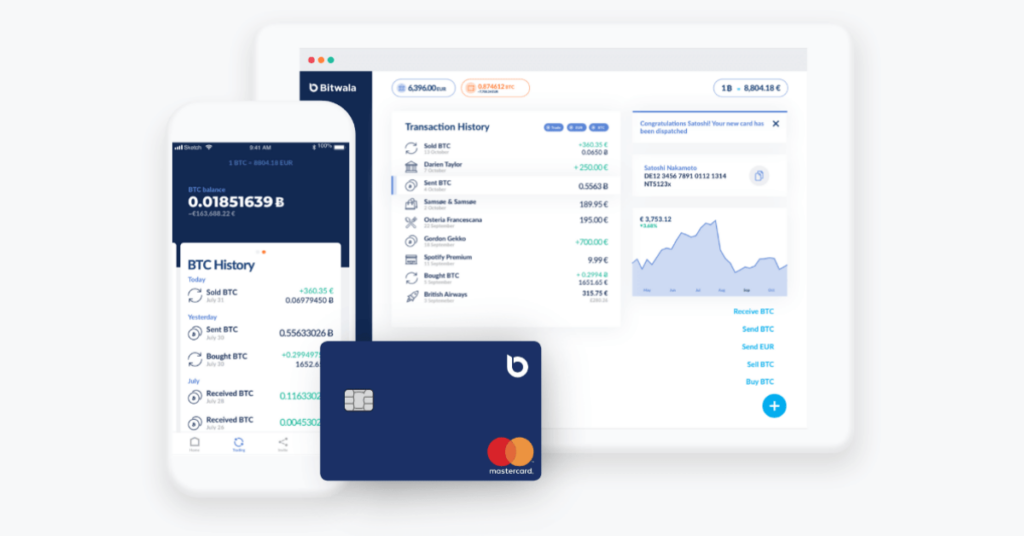

Bitwala (Germany)

Founders: Jan Goslicki, Benjamin Jones, Jörg von Minckwitz

Funding: €19.4 million

Founded year: 2015

Why its hot: German startup Bitwala operates with the mission to disrupt banking by building an account to seamlessly transition between the cryptocurrency and fiat worlds. It offers a bank account connected to crypto. You can manage everyday banking, trade cryptocurrencies and also store bitcoins using the same account.

Kaiko (France)

Founders: Ambre Soubiran, Pascal Gauthier

Funding: €5 million

Founded year: 2014

Why its hot: Kaiko is a digital assets data provider that covers top cryptocurrency exchanges. The startup collects, normalises and distributes cryptocurrency and provides raw and aggregated data that is needed to gain a competitive advantage in the market. The company has a team with expertise in finance, data science, and distributed systems to optimise work.

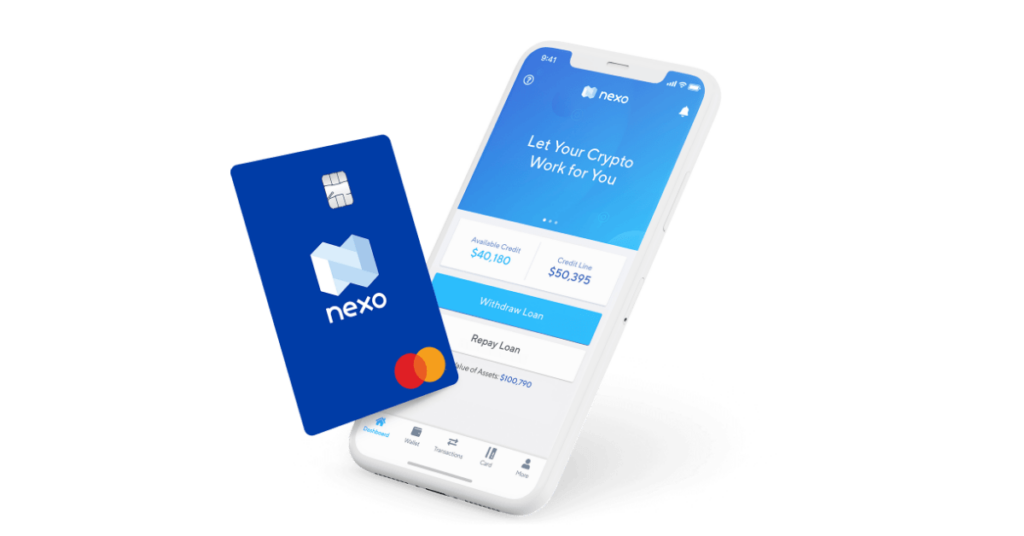

Nexo (Switzerland)

Founders: Antoni Trenchev, Georgi Shulev, Kosta Kantchev

Funding: €47.7 million

Founded year: 2017

Why its hot: Nexo lets you enjoy your crypto wealth today without selling your assets. It provides the world’s first instant crypto-backed loans. With Nexo, you can let your crypto work for you. It is the only insured account that lets you borrow instantly. Also, you can earn daily interest on idle assets.

Bitstamp (Luxembourg)

Founders: Damijan Merlak, Nejc Kodric

Funding: €11.3 million

Founded year:2011

Why its hot: Bitstamp is one of the world’s longest-standing cryptocurrency exchanges continuously supporting the Bitcoin economy since its inception. With a proven track record and mature approach to the industry, Bitstamp provides a secure and transparent venue to over four million customers and enables partners to access emerging crypto markets through time-proven infrastructure.

Ledger (France)

Founders: Eric Larchevêque, Joel Pobeda, Nicolas Bacca, Thomas France

Funding: €86.7 million

Founded year: 2014

Why its hot: Ledger develops security and infrastructure solutions for cryptocurrencies as well as blockchain applications for both individuals and companies alike. Earlier this year, the company launched a new cryptocurrency hardware wallet ‘Nano X. It has a ‘Ledger Live Mobile App’ through which users can seamlessly manage their tokens.

Luno (London)

Founders: Marcus Swanepoel, Pieter Heyns, Timothy Stranex, Carel van Wyk

Funding: €12.7 million

Founded year: 2013

Why its hot: Luno offers products and services that make it safe and easy to buy, store and learn about cryptocurrencies like Bitcoin and Ethereum. The company is working on a vision to upgrade the world to a better financial system. Luno is one of the leading global cryptocurrency companies with over 2 million customers in 40 countries. Headquartered in London, Luno operates across Africa, South East Asia, and Europe.

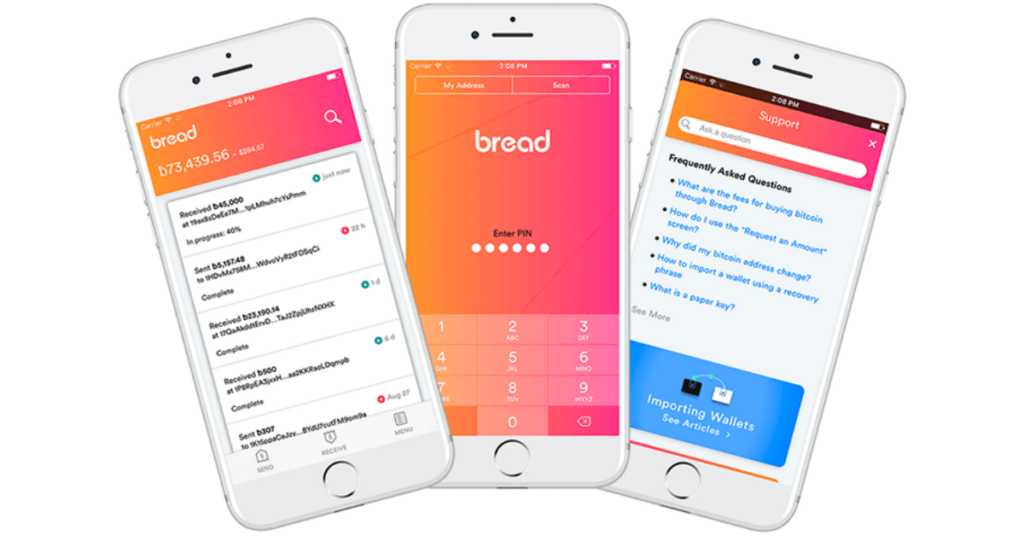

Breadwallet (Switzerland)

Founders: Aaron Voisine, Adam Traidman

Founded year: 2015

Why its hot: Breadwallet provides wallet to store send and receive money anytime, anywhere, with complete financial privacy with no sign-ups, logins or personal information required. With over 2.5 million users in 170+ countries, and protecting over $6 billion, It is the world’s largest and most trusted cryptocurrency wallet.

Gem (Italy)

Founders: Micah Winkelspecht

Funding: €19.1 million

Founded year: 2013

Why its hot: Gem makes investing in crypto easy, and accessible to all. The app gives crypto enthusiasts a single entry point for tracking all their crypto investments and net worth. Additionally, it offers curated discovery of new tokens and decentralized apps, and a connection to the larger crypto community with a secure universal wallet coming soon.

Main image picture credits: Bitwala

Stay tuned to Silicon Canals for more European technology news.

01

From telecom veteran to Dutch Startup Visa success: The Jignesh Dave story