This year, the market for European IPOs (Initial Public Offerings) has been stifled until now due to the current pandemic crisis. Though many companies hinted their intention to float, a majority of them had to change their minds due to the economic slowdown across the world. Many of these companies that haven’t made their shares public until now are expected to come back later this year.

European tech IPOs of 2020

Having said that, we at Silicon Canals have listed the European tech IPOs of 2020 so far as sourced from Dealroom.

ADC Therapeutics (Switzerland)

Founder/s: Chris Martin

Founded year: 2011

Funding: €478 million

Switzerland-based ADC Therapeutics, a clinical-stage oncology-focused biotech company that pioneers in the development and commercialisation of potent and targeted antibody drug conjugates for those suffering from solid tumours and haematological malignancies. Back in May this year, ADC Therapeutics announced the pricing of its IPO of 12,245,631 shares of its common shares priced at $19 (nearly €16.9) per share. BofA Securities, Morgan Stanley and Cowen are the joint book-running managers for the offering. The Swiss biotech firm will use the $125 million IPO to further develop the antibody conjugates drugs.

GAN (UK)

Founder/s: David McDowell

Founded year: 2002

Funding: NA

GAN is a business-to-business supplier of internet gambling SaaS solutions predominantly to the US land-based casino industry. GAN has developed a proprietary internet gambling enterprise software system dubbed GameSTACK, which it licenses to land-based casino operators as a turnkey technology solution for regulated real-money internet gambling, encompassing internet gaming, internet sports gaming and virtual Simulated Gaming. In May, GAN announced the closing of the previous IPO offering of 7,337,000 ordinary shares at $8.5 (nearly €7.5) per share. This includes the underwriters’ option to purchase 957,000 ordinary shares.

Nacon (France)

Founder/s: Alain Falc

Founded year: 2019

Funding: NA

French video game developer Nacon is a subsidiary of BIGBEN group. It specialises in two areas of the video gaming industry including video game publishing and gaming accessories. With the acquisition of four game development studios that specialise in different genres, Nacon is a major player in the video gaming industry with a network that spans across 100 countries. Early in March this year, Nacon concluded its listing on the Paris stock exchange. The global coordinators of the same are Berenberg, Midcap Partners and Gilbert Dupont and the IPO round involves selling 20 million shares at €5.5 per share.

Munic.io (France)

Founder/s: Aaron Solomon

Founded year: 2002

Funding: NA

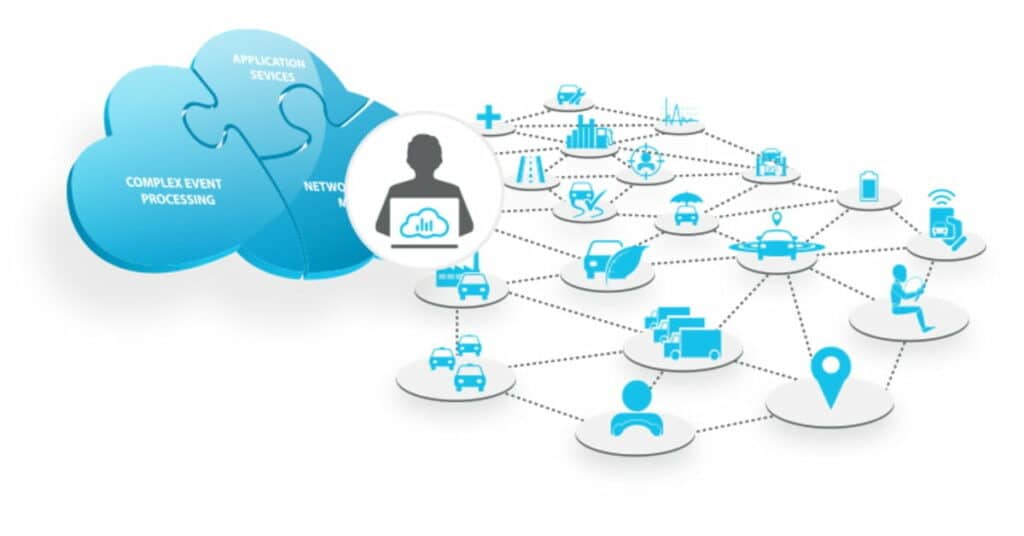

Munic designs and develops technological solutions that combine Smart Dongles that are capable of collecting and decoding thousands of data from motor vehicle sensors and an AI Edge Computing platform, Munic.io to analyse and process the same. Based in Villejuif, France, Munic has offices in the USA and China. The company that specialises in on-board technology and artificial intelligence for car data processing announced the success of its IPO in February. Its 2,744,665 shares are listing for €7.95 per share.

Stock photo from Panchenko Vladimir/Shutterstock

01

From telecom veteran to Dutch Startup Visa success: The Jignesh Dave story