The COVID-19 crisis has had a devastating impact on the financial health of people around the world. However, the digitalisation of the finance and banking sector has definitely helped in mitigating the impact. As the world slowly tries to recover, governments and industry stakeholders, realising the benefits of digitalisation, are ensuring that the sector undergoes rapid digital transformation. A number of innovative startups are also helping with this endeavour.

Most investment-ready fintech startups

Finance Forward Europe 2020 is an investment-readiness program, which is a part of Finance Forward, a multi-year global coalition led by founding partners MetLife Foundation and PayPal. The objective of the program is to support entrepreneurs in building tech-enabled solutions to challenges around financial health.

This program just unveiled the winners of $150,000 (nearly €130,00) funding. Two startups – CreditStretcher and Finclude – that ranked first and second, respectively, will receive $45,000 (nearly €39,000) each in grant funding from the MetLife Foundation. The next three startups from rank 3 to 5 – Vested, Libeen, and Pip – will receive $20,000 (nearly €17,000) each. It is a five-week virtual venture development program managed by Village Capital, in collaboration with MetLife Foundation and PayPal.

The ten entrepreneurs that participated in the accelerator program evaluated each other on the basis of eight specific investment criteria. Going by the same, CreditStretcher and Finclude were ranked the “most investment ready” startups. Below are the ten fintech startups that were ranked in the peer-review process.

Creditstretcher (Denmark)

Founder/s: Jacob Pedersen, Christian Thisted, Lars Andersen

Founded year: 2017

CreditStretcher is building a solution, which enables SMEs to grow by providing fair access to credit via upfront financing on invoices. It also extends interest-free credit to the buyer by 60 days. With this solution, it is no longer necessary to compromise the credit. CreditStretcher is a customer-centric company enabling people and businesses all over the world to realise their full potential via technological and innovative financial solutions.

Finclude (Ireland)

Founder/s: Ioanna Stanegloudi, Yiannis Giokas

Founded year: 2018

Dublin-based fintech Finclude provides a pan-European creditworthiness and affordability score, which lets financial institutions and individuals assess the financial standing of a user by utilising transactional behaviour analysis and machine learning. The company offers financial well-being services that empower EU citizens with fair access to credit. Also, it will expand the retail credit markets for financial institutions. The fintech platform is claimed to be secure and fully automated as well.

Vested (UK)

Founder/s: Kimberley Abbott

Founded year: NA

Vested is a London-based fintech startup, which provides an impact investing platform, which uses a proprietary algorithm to assess and track the impact of an investment. This way, Vested lets people invest their money in companies and assets with the biggest positive impact on society. Vested provides simple, comparable, and embedded metrics for your existing assets and platforms to help you and your clients make better investment decisions aligned with values and goals.

Libeen (Spain)

Founder/s: José Manuel Cartes González

Founded year: 2019

Libeen, a Madrid-based fintech startup enables individuals irrespective of income level or savings to access affordable homeownership via a simple, smart, and flexible rent-to-buy lease format. Its #SmartHousing model is claimed to make homeownership affordable thereby letting them use the monthly rent to buy fully furnished and renovated houses in the centre of the city. The company believes that everyone should buy a home sans sacrificing their finances or giving up what they like.

Pipit (Ireland)

Founder/s: Ollie Walsh

Founded year: 2014

Pipit lets migrants living in Europe to send cross-border payments in cash to pay the bills of their family members more affordably and control how the money is being spent. It is a Digital Cash Collection platform, which enables loading cash into e-wallets, paying e-bills with cash, and paying in cash for online orders. By enabling cash payments, customers can avoid fraud or identity theft and need no credit card or bank account. Also, businesses benefit as they get easy and secure payments.

Elifinity (UK)

Founder/s: Maysam Rizvi

Founded year: 2018

Elifinity solves the problem of financial vulnerability with its AI-driven platform. It connects with an individual’s data in a secure way to predict existing and upcoming financial challenges. It is an app, which lets individuals take control of their finances and create a better tomorrow. The company helps banks minimise losses on tough or loss-making accounts. Also, it improves customer engagement.

FinMarie (Germany)

Founder/s: Karolina Decker, Caroline Bell

Founded year: 2017

Berlin-based FinMarie empowers women to achieve financial independence. It does this by one-stop financial advice and a cost-effective investment solution, which provides an online investment platform using robo-advisor tools. Also, this startup educates them about money and investing through one on one advice sessions and corporate workshops. The mission of this firm is to support clients with financial and wealth management projects and help them find solutions that are right for their personal situations.

Portabl (England)

Founder/s: Mike Minett

Founded year: 2018

Portabl is building a smart financial services SaaS platform that provides flexible insurance, benefits, and financial packages. These will address systemic bias issues that freelance and gig-economy workers face all over the world. With real-time data and machine learning, it is possible to understand and present optimum levels of cover and benefits that suit them. Portabl also rewards users for good behaviours by minimising their monthly subscription fee.

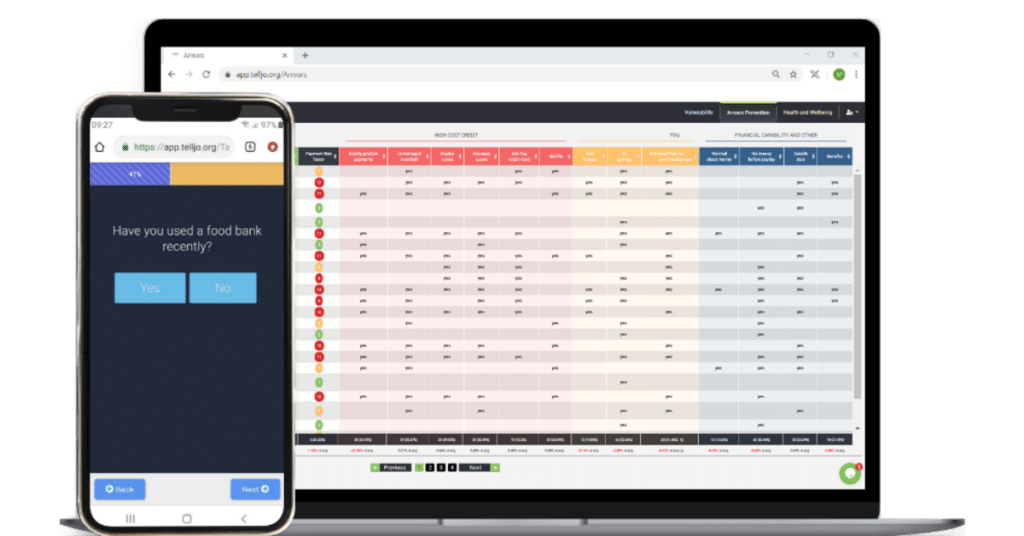

TellJO (UK)

Founder/s: Dominic Maxwell, Rob Harlow

Founded year: 2017

TellJO‘s customer wellbeing assessment empowers social landlords, utilities, and financial institutions to better understand and serve vulnerable customers. It is a digital assessment tool that helps prevent payment arrears and minimise financial exclusion by helping customers assess their vulnerability levels and financial capability. TellJO works with the mission to help as many people struggling with the difficulties that come along in their life.

Worig (Croatia)

Founder/s: Deni Ćosić, Nino Cosic

Founded year: 2019

Worig builds a solution for tenants to simplify access to the housing market by removing the high costs and risks associated with renting a new home. Its solution helps build trust between landlords and tenants by providing secure downpayment options as well as verifiable credit scores with its tenant scoring system. It also lets homeowners check if the tenant is employed or has an income source and know if the person is reliable.

Main image picture credits: FinMarie

01

From telecom veteran to Dutch Startup Visa success: The Jignesh Dave story