PitchBook, the venture capital, private equity and M&A database, released its Global Private Fund Strategies, summarising private capital fundraising activity.

According to the report, Q1 2022 private fundraising figures were less than one-quarter of total 2021 fundraising, indicating a slowdown.

However, funds are increasingly growing in size. Those who have had prior funds in a fund family, increased the size of their next fund 82.2 per cent of the time in Q1, 2022, adds to the report.

The report from Pitchbook breaks down the key fundraising and cash flow across strategies, including private equity, venture capital, and real estate. Here’re the key takeaways from the report:

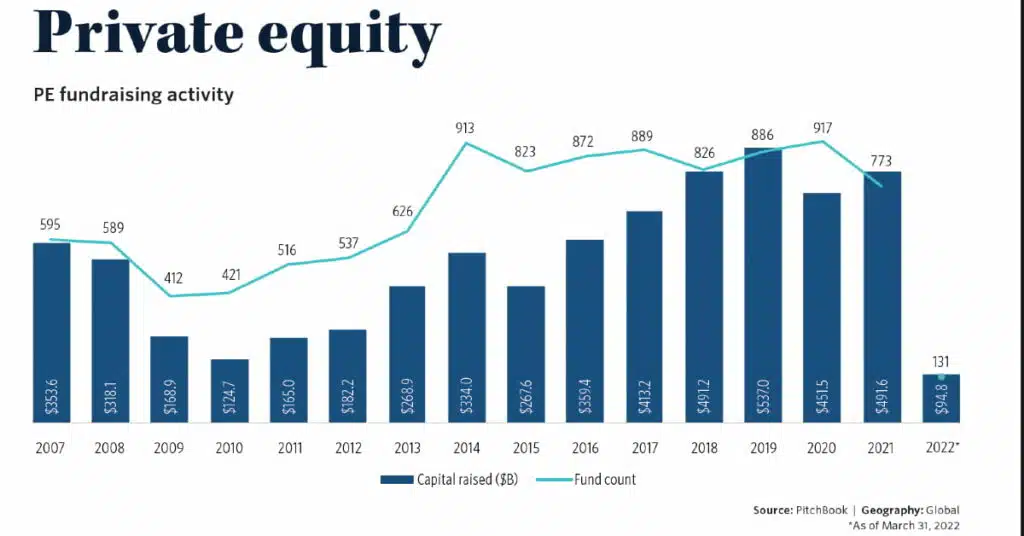

Private Equity (PE) fundraising activity

Global PE fundraising kept a steady pace through Q1 2022, with $94.8B committed across 131 vehicles.

“Fund count continued to dip for a consecutive quarter while both average and median fund sizes ticked upward, demonstrating the continued shift in PE toward larger vehicles,” says the report.

Around 77.8 per cent of the PE funds closed during the quarter were larger than their predecessors.

Further, the average months to close increased to 21.8 months in Q1, suggesting that the fundraising pace is already starting to slow as Limited Partners (LPs) struggle to supply capital as quickly as General Partners (GPs) come back to the market.

First-time funds raised $6.7B this quarter while emerging managers raised $17.8B.

The report also adds that emerging managers are likely to face difficulty fundraising this year in the highly competitive market since they lack various factors like performance track records and established relationships with LPs.

Capital raised by emerging managers represented 18.8 per cent of the total in Q1, says the report.

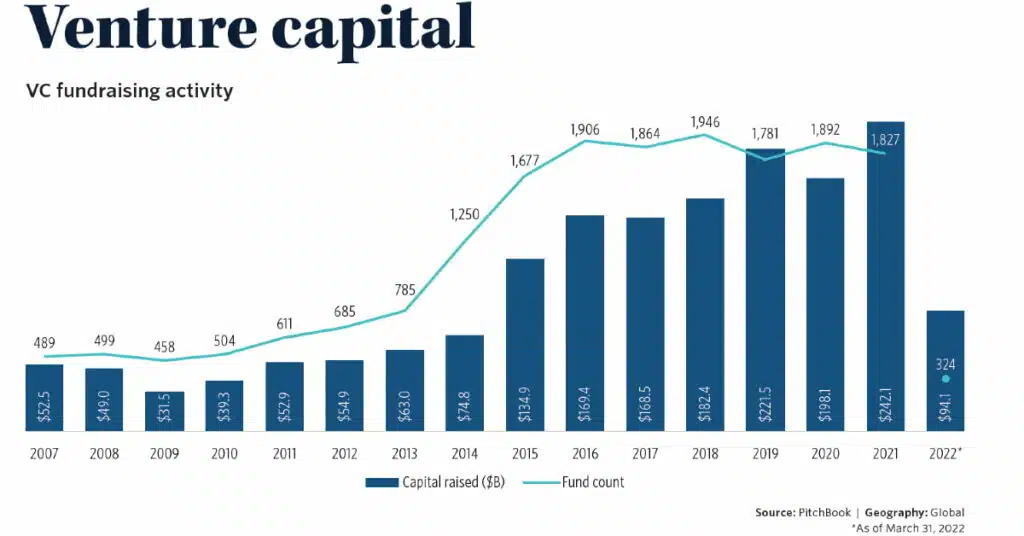

VC fundraising activity

According to the report, global VC fundraising reached $94.1B across 324 funds in Q1 2022. At the current rate, capital raised at 2022’s end could surpass the record total from 2021, adds the report.

First-time funds raised $6B and emerging managers raised $22B in Q1 2022.

In contrast, experienced VC firms raised $72.1B, representing 76.6 per cent of the total, as significant amounts of capital were committed to funds raised by managers with notable fund families and strong track records.

In Q1 2022, 80 per cent of the global total, equivalent to $75.3B, was raised in North America.

By comparison, $7.1B and $8.3B were raised in Asia and Europe, respectively.

The largest funds to close in Q1 2022 included Tiger Global Private Investment Partners XV at $12.7B and Alpha Wave Ventures II at $10B.

The closing of these mega-funds helped VC AUM top $1.9T in Q1 2022, adds the report.

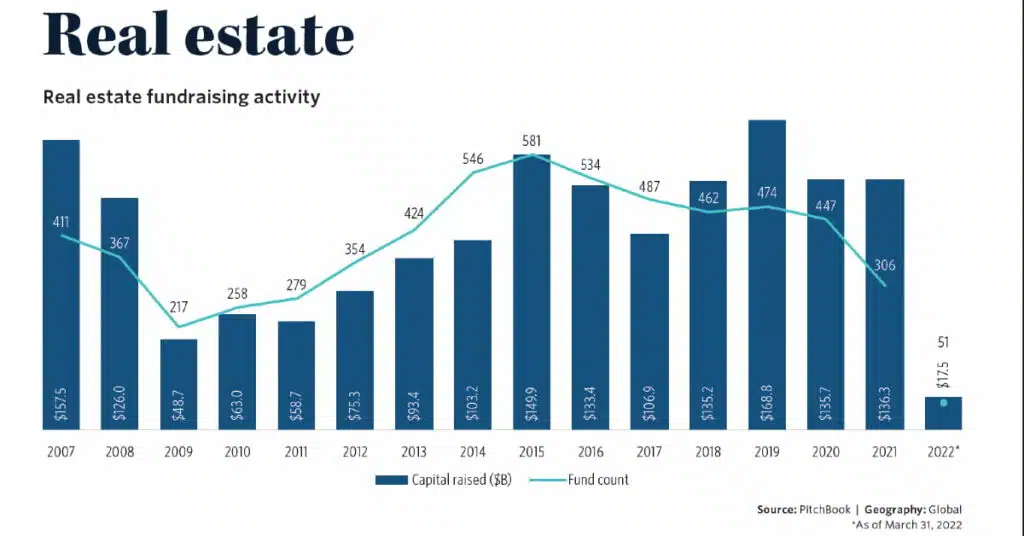

Real estate fundraising activity

Real Estate fundraising in Q1 2022 has returned to fewer fund sizes after the average for the asset class hit an all-time high in 2021.

However, the funds raised in the $500M to $1B bucket in Q1 2022 garnered a larger proportion of total dollars raised than in any year in the last decade. Funds in the $1B to $5B range received the greatest percentage of capital committed at 44.3 per cent.

While no mega-funds were raised in Q1 2022, one or two could turn the tides of average fund sizes later in the year, notes the report.

In terms of strategy, 55.9 per cent of capital raised went to opportunistic funds and 41.8 per cent went to value-add funds in Q1 2022.

Geographically, fundraising was concentrated in North America and, surprisingly, Asia.

The $4.8B raised by Asian funds, making up 27.7 per cent of capital committed in Q1. goes entirely to two logistics funds, both from GLP.

The rest of the top 10 funds raised in Q1 were US-based, but like the two GLP funds, demonstrated a continuation of recent trends in the space, focusing on life sciences and self-storage.

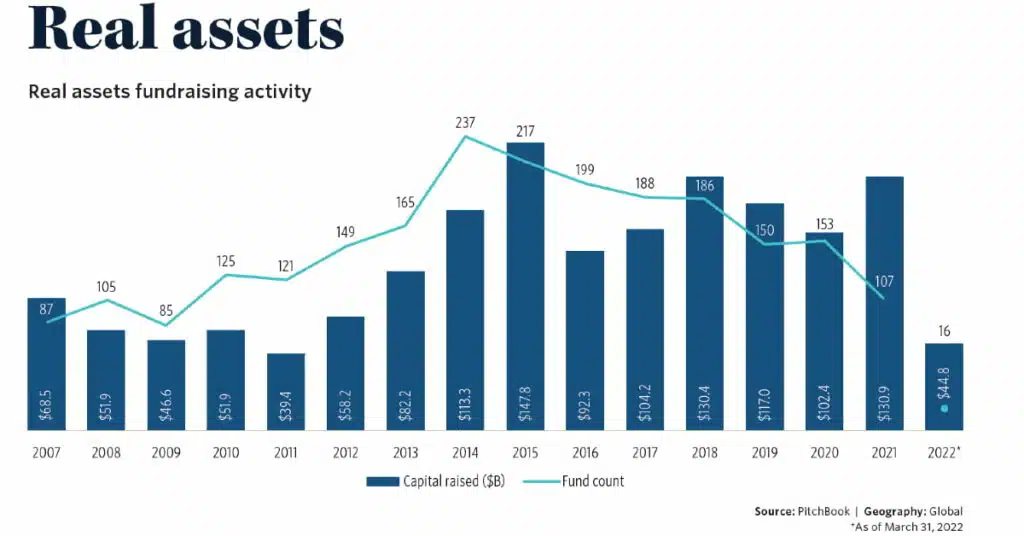

Real assets fundraising activity

Real assets’ strong fundraising spell carried through to Q1 2022 driven by large fund sizes hitting new highs. If Q1 is any indication, this may be one of the best years for real assets fundraising in the past decade and a half.

Infrastructure commanded 95.6 per cent of capital raised in this segment, with core and value-added infrastructure strategies coming in at 40.5 per cent and 34.2 per cent of the asset class’s total.

The top funds closed in Q1 include a mammoth $17B infrastructure core fund from KKR and a $14B infrastructure value-added fund from Stonepeak Infrastructure Partners.

Oil & gas comprised a meagre 1.8 per cent of raised capital, influenced in part by the slew of climate commitments from investors in 2020 and 2021, and pleas for fossil fuel divestment from the public.

Several of the top 10 real assets funds raised during the quarter are sustainable infrastructure-focused or aim to further the transition to the green economy, including Infravia European Fund V, Hull Street Energy Partners II, EIV Capital Fund IV, and Prime Green Energy Infrastructure Fund.

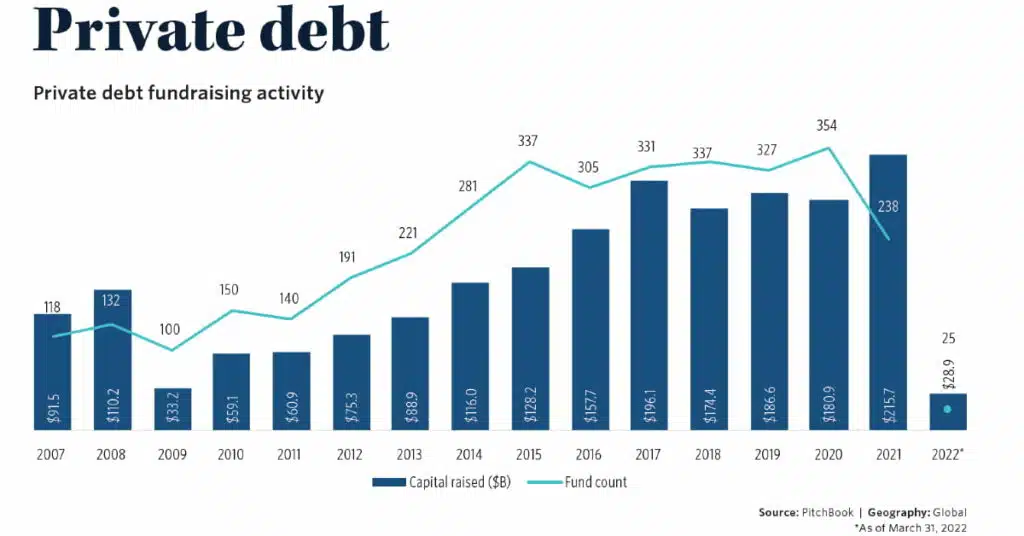

Private debt fundraising activity

As per the report, just $28.9B in private debt fundraising has been recorded for Q1 2022, which is a steep decline in debt fundraising compared to its record $72.8B raised in Q4 2021.

“Over the past year, the debt fundraising figure for Q1 2021 has more than doubled as more data has been collected, while Q4 data has even seen a growth of $13B over our reporting from

last quarter. Such an addition to Q1 data would put its figure squarely in line with the highest quarters of 2021,” says the report.

Nearly $200B has been raised by private debt funds in the past 12 months.

Private debt overhang stood at $446B as of December 31, 2021, though this notched its first YoY decline since 2009 due to high deployment throughout the year.

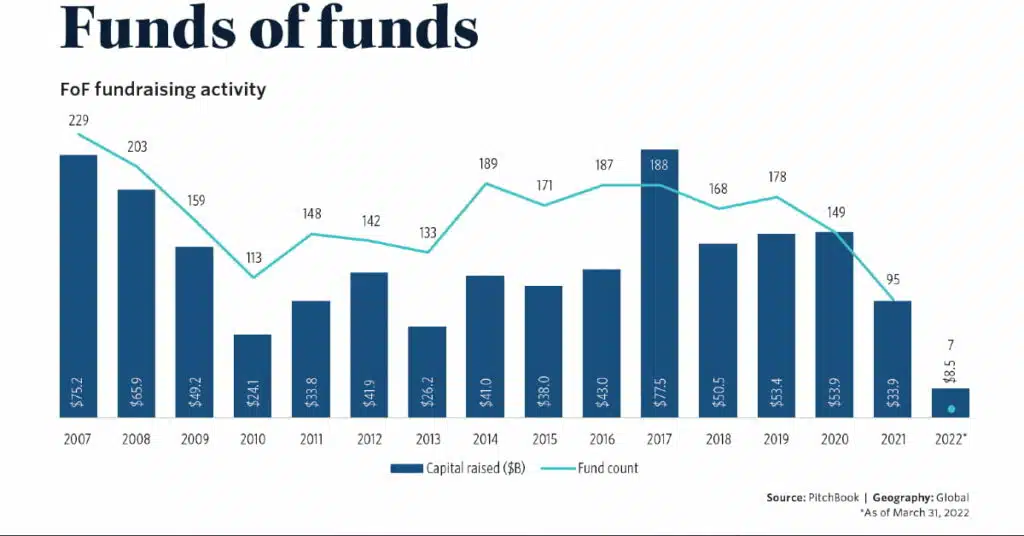

FoF fundraising activity

As per the report, only seven FoF had closed in Q1 2022.

The rolling 12-month chart shows that FoF has been on a declining path since the middle of 2020, both in terms of assets committed and the number of funds closed.

“We are aware of over 300 FoF in the market open to new commitments, representing many geographies, specialties, and sizes, so there is certainly potential for a turnaround,” says Hilary Wiek, CFA, CAIA.

Performance since 2020 has been phenomenal and net cash flows to FoF investors have been positive since 2013, claims the report.

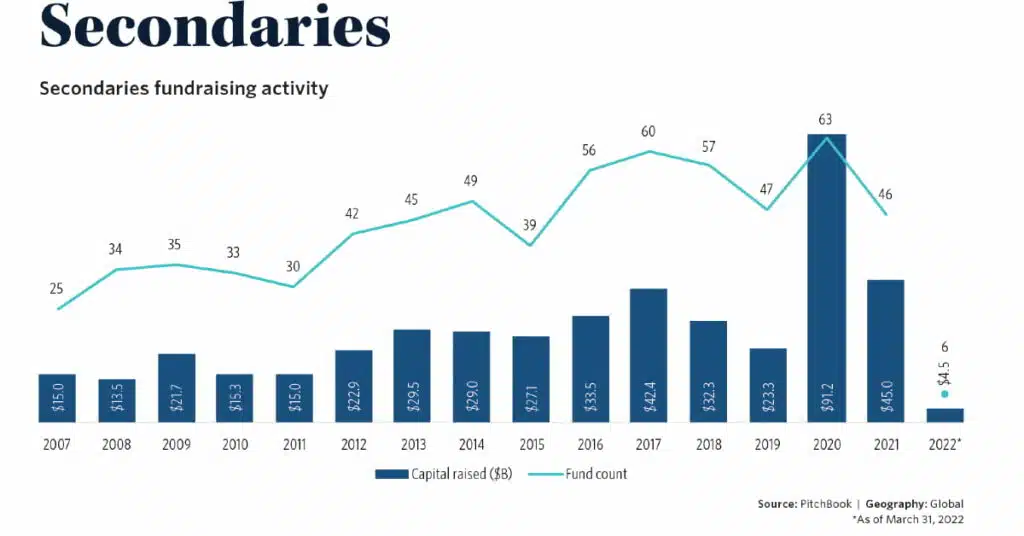

Secondaries fundraising activity

The rise of GP-led secondaries brought about a massive wave of fundraising for secondaries funds in 2020, claims the report.

However, it has declined from that year, but when such a wave happens, those managers will generally come back to market two to three years later with a successor fund.

As a result, we can expect another wave later in 2022 or 2023, adds the report.

There have been six secondary funds closing in Q1 2022, with the size ranging from $70M to $1.8B. The $70M funds were closed by US-based Argosy Strategic Partners, while the one on the high-end was closed by the Accel-KKR Capital Partners CV IV fund.

01

From telecom veteran to Dutch Startup Visa success: The Jignesh Dave story