Antler, a global early-stage venture capital firm, announced on Wednesday that it has published “The 2022 Benelux Unicorn Founder Roadmap” report, delving upon the characteristics and experience of unicorn founders in the Benelux region.

The report analyses 123 founders across 33 unicorns and 21 ‘soonicorns’ based out of the Benelux region. The unicorns are primarily based in the Netherlands, however, all three countries are represented: Netherlands (25), Belgium (7), and Luxembourg (1).

Here’re a few key findings from the report.

Key finding #1

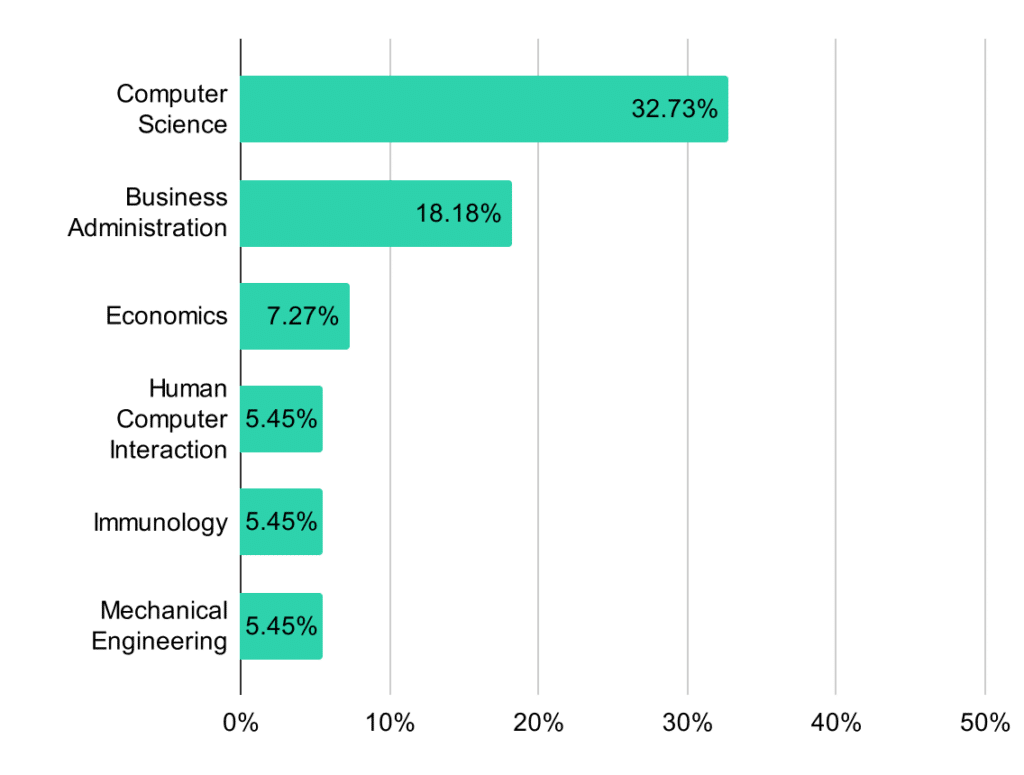

According to the report, computer science (31 per cent) is the most common degree studied by unicorn founders in Benelux, followed by Business Administration (18 per cent).

One-third of founders have a Computer Science degree, and almost a fifth have a degree in Business Administration, shows the research.

Key finding #2

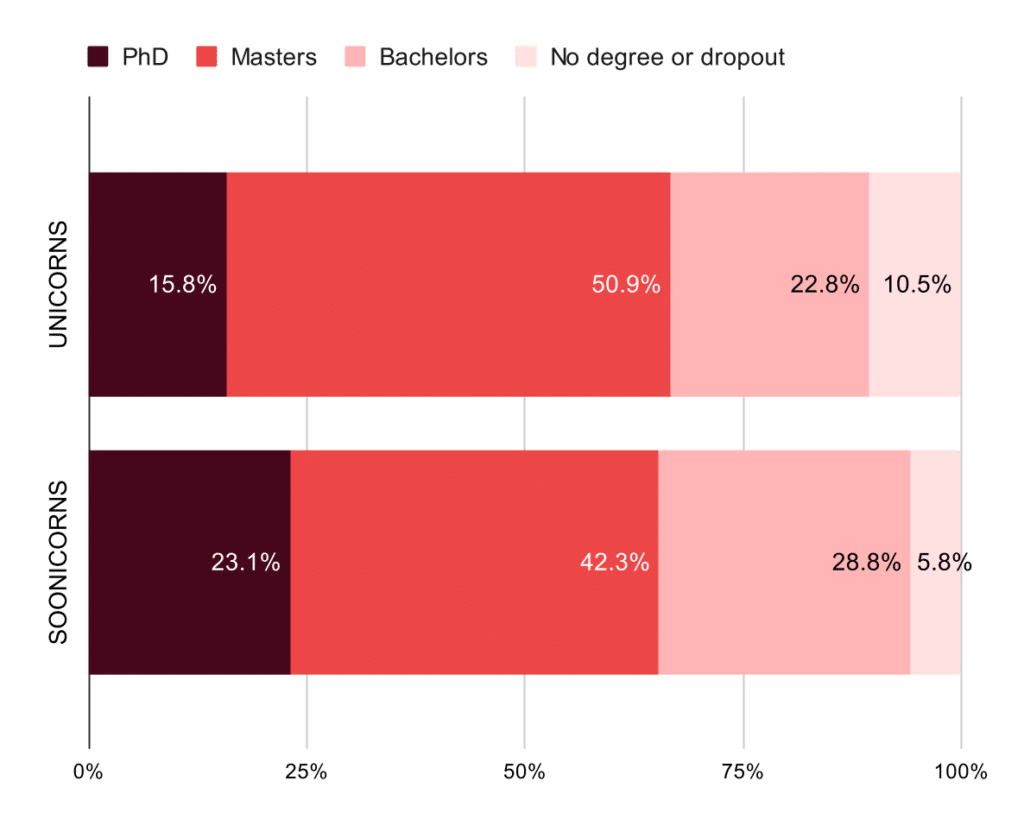

The research shows that Benelux unicorn founders have higher academic qualifications than average across Europe.

Around 65 per cent of Benelux unicorn and soonicorn founders have a Master’s degree or Ph.D., compared to 55 per cent across the rest of the continent.

However, the report reveals that 10.5 per cent of unicorn founders do not have a higher education degree.

Key finding #3

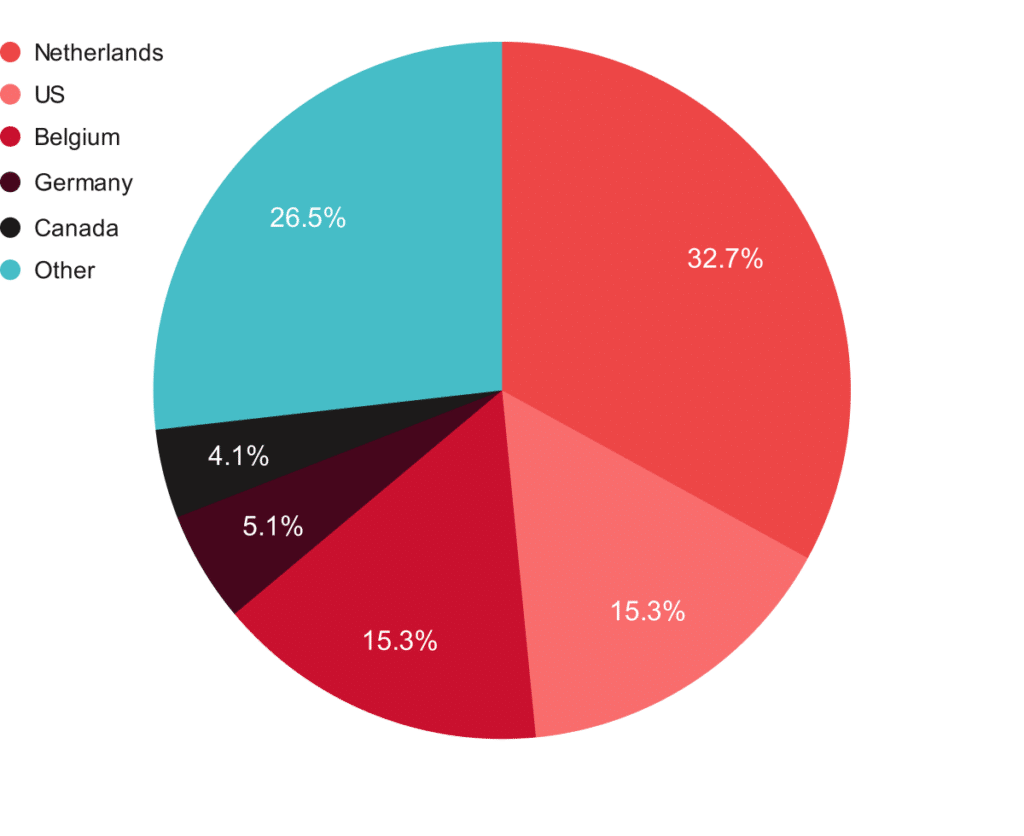

Antler’s report shows that 48 per cent of Benelux unicorn founders are graduates from local universities in the Netherlands or Belgium.

The Netherlands tops the charts with 32.7 per cent of the founders graduating from Dutch universities.

The US and Belgium are in second place, with universities producing 15.3 per cent of unicorn founders in each country.

The Delft University of Technology tops the charts with five unicorn founder graduates, followed by Vrije Universiteit Brussel and HOGENT in Belgium (both produced four graduates)

Key finding #4

However, higher education is not a prerequisite to unicorn success, says the latest report from Antler. The research shows that one in ten (10.5 per cent) unicorn founders in the Benelux region have no higher education.

Key finding #5

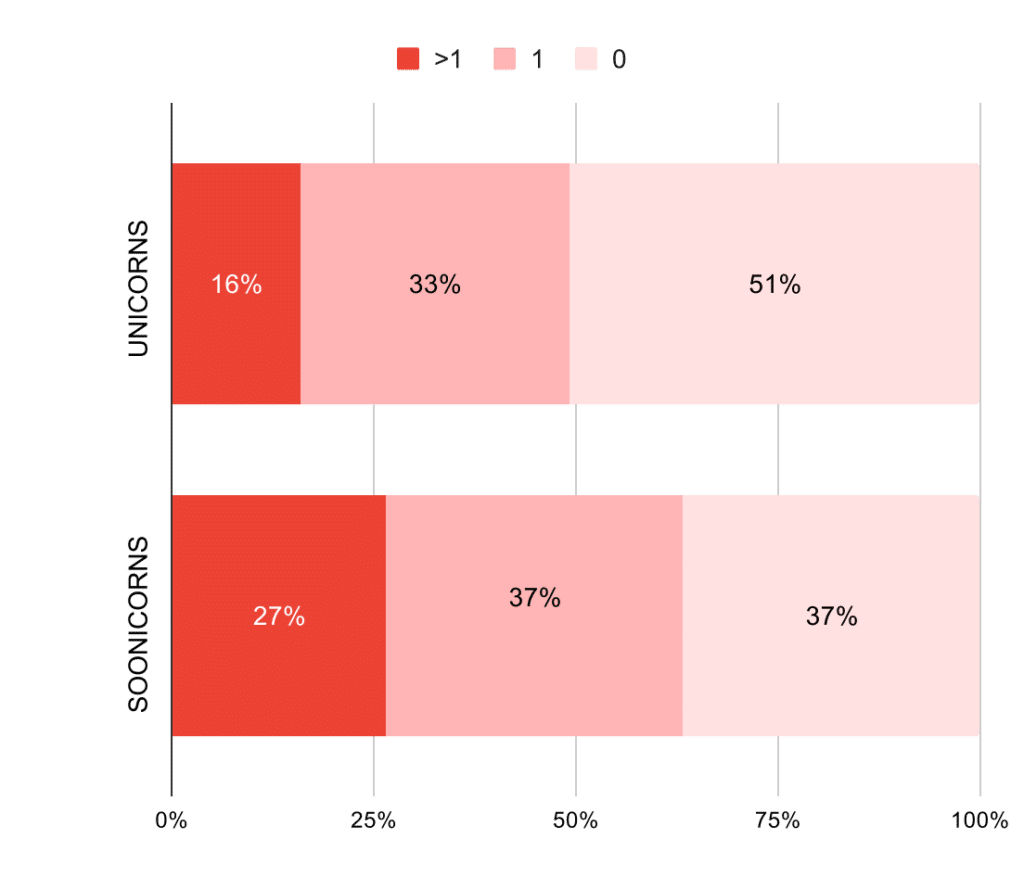

As per the report, most Benelux unicorn founders have previous business experience, with nearly half (49 per cent) having created and built startups before.

Around 16 per cent of unicorn founders have founded more than one company before launching the unicorn. Additionally, 51 per cent of the unicorn founders have reported that they did not have previous founding experience.

63 per cent of soonicorns have at least one previously founded company on their resumes, shows the report.

Key finding #6

The majority of the Benelux unicorns are founded by small teams of one or two founders.

Around 36 per cent of Benelux unicorns are founded by a solo founder, making it the most common founding team size. In addition, 33 per cent of unicorns are founded by a co-founder couple and 12 per cent by a co-founder trio.

However, the report shows that 38 per cent of soonicorns are founded by two co-founders, making it the most common soonicorn founding size.

Key finding #7

The report also highlights that Benelux unicorn founding teams are still largely dominated by men. Only 4 per cent of unicorn and soonicorn founders in the Benelux are women.

There are no unicorn teams that were founded by only women and no teams that would have more than one woman as a founder. 91 per cent of the teams are all men, 9 per cent are mixed, and 0 per cent all women.

The report adds that only four out of 54 (7 per cent) of the soonicorn founders are women. According to the report, AgomAb Therapeutics is the only soonicon founded by two women.

Key finding #8

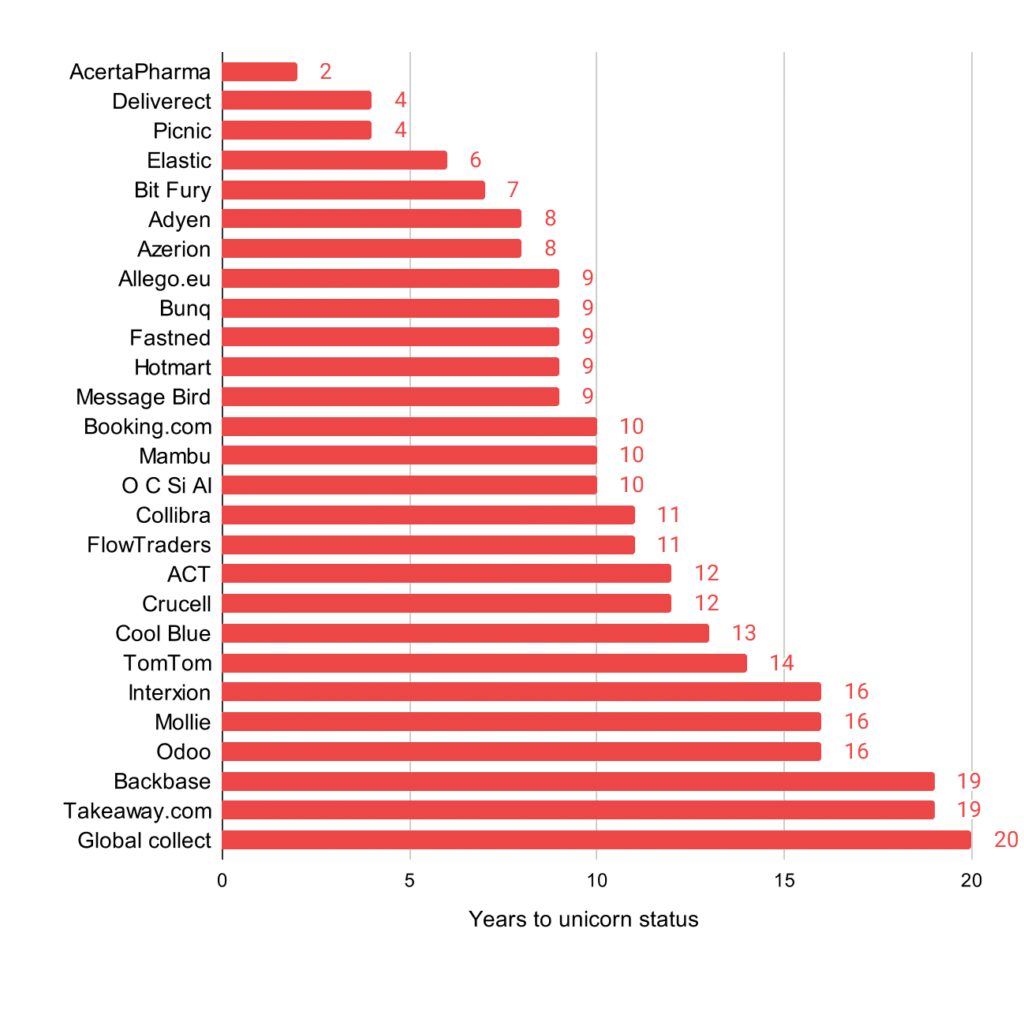

Antler’s report says that Benelux startups are taking less and less time to turn into unicorns. On average, it takes Benelux unicorns 10.9 years to reach a unicorn valuation, which has halved in the past 30 years.

The fastest five companies took an average of 4.6 years to achieve unicorn status. The fastest time to unicorn valuation has been from AcertaPharma (two years) followed by Deliverect and Picnic (four years).

Key Finding #9

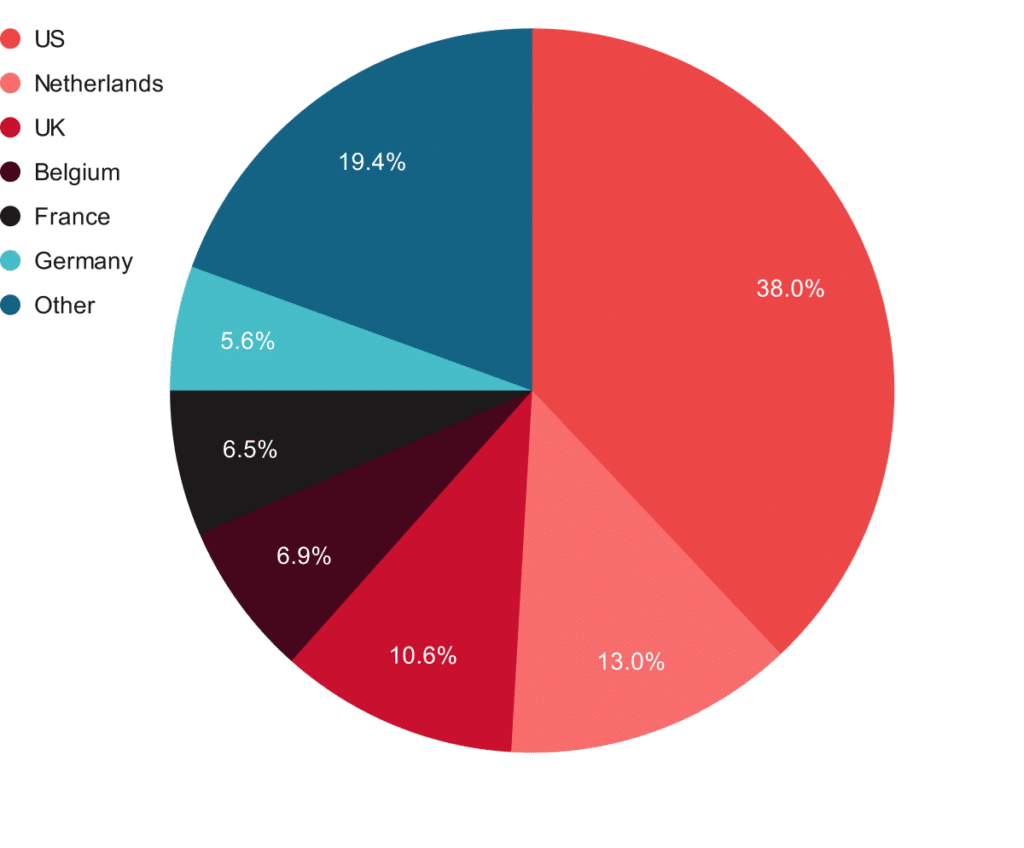

Benelux unicorns have raised over one-third of their funding from US-based investors. The top three countries where Benelux unicorn investors are from:

- US (38 per cent)

- Netherlands (13 per cent)

- UK (10.6 per cent)

21.3 per cent of Benelux unicorn investors are from Benelux, out of which:

- 13 per cent from the Netherlands

- 6.9 per cent from Belgium

- 1.4 per cent from Luxembourg

For soonicorns, Netherland-based investors take the lead (29 per cent), followed by the US (21 per cent) and Belgium (12 per cent).

Also, 42 per cent of investors for soonicorns are from the Benelux region, out of which

- 29 per cent from the Netherlands

- 12 per cent from Belgium

- 1 per cent from Luxembourg

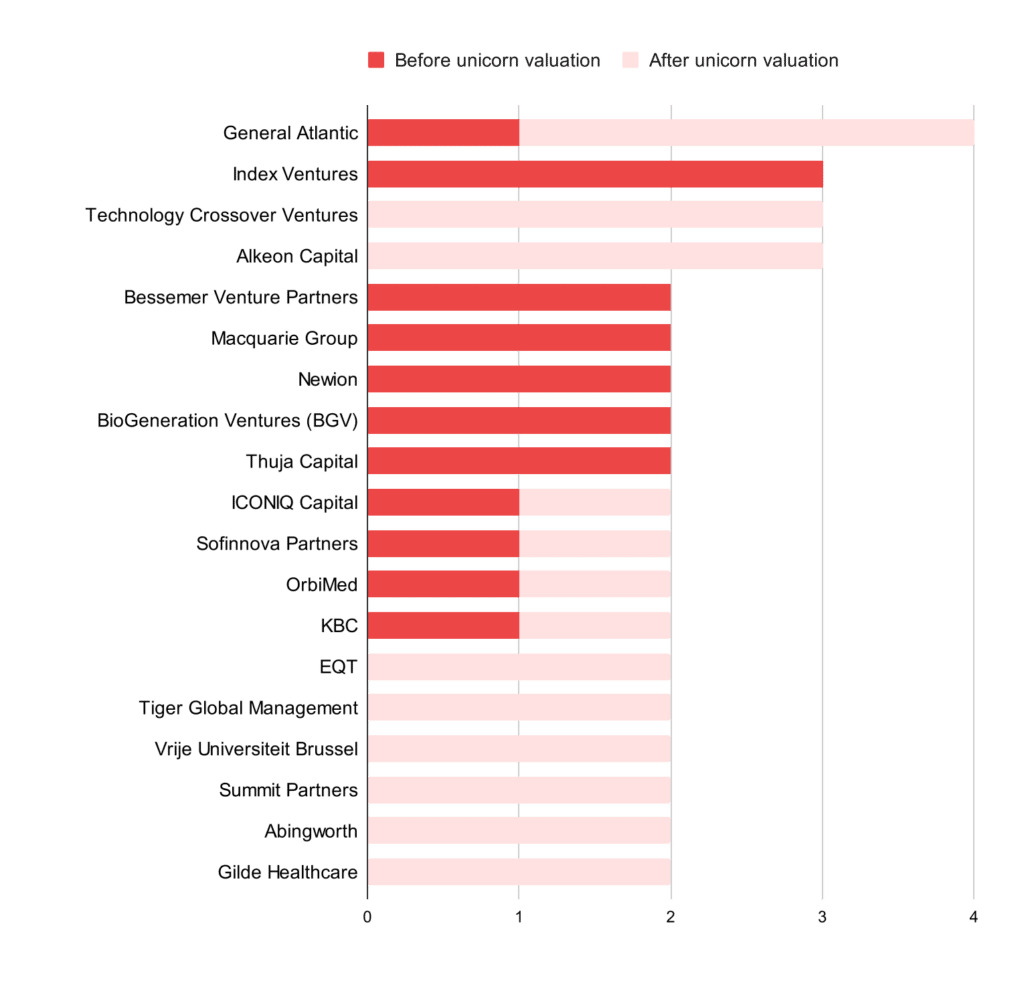

Key Finding #10

Six investors have found more than one Benelux unicorn before their unicorn valuation round. They are:

- Index Ventures

- Macquaire

- Bessemer Venture Partners

- Newion

- Thuja Healthcare Investors

Index Ventures leads the list with three Benelux unicorns. It has made the highest number of investments in Benelux unicorns before they reached their billion-dollar valuation, the report indicates.

General Atlantic has invested in four Benelux unicorns overall, however, three of these investments were made after the companies had achieved billion-dollar valuations.

Key finding #11

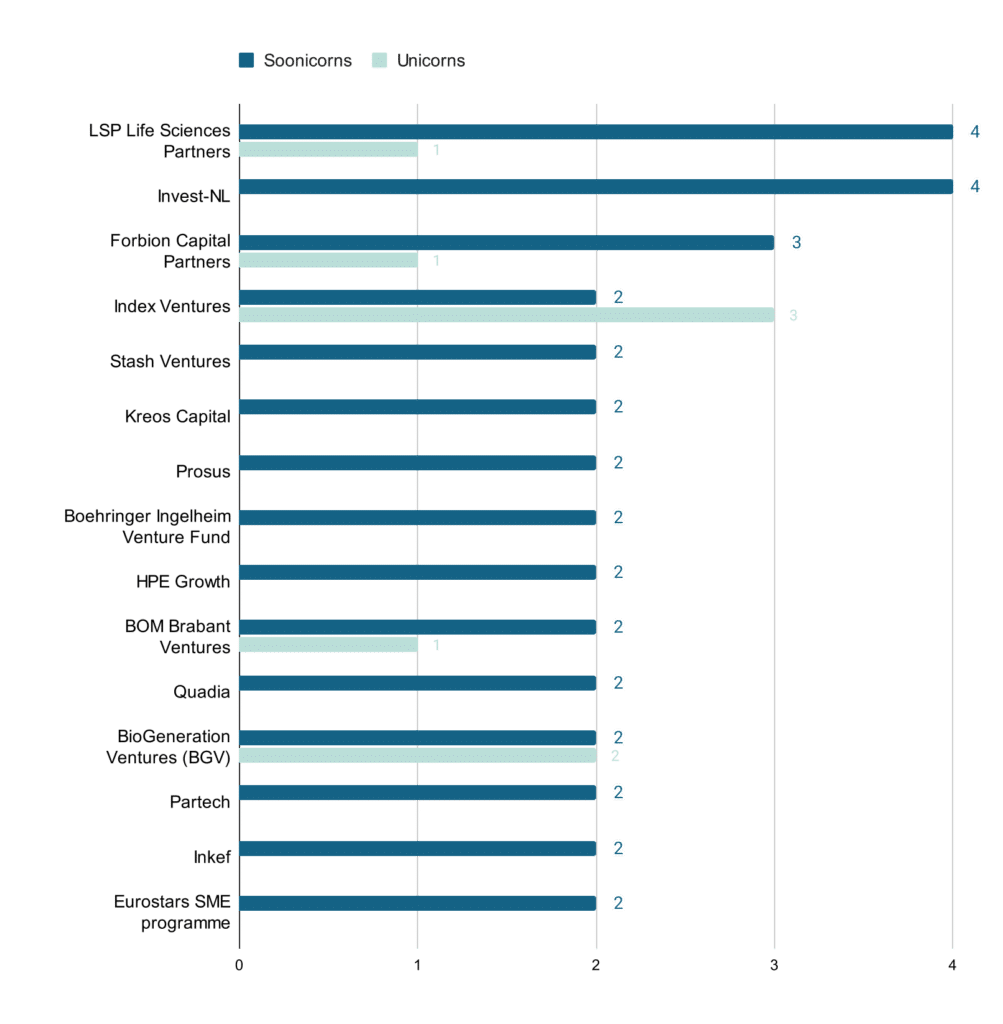

Three investors have more than one soonicorn from the Benelux region in their portfolio.

The report shows that 15 investors have more than one soonicorn in their portfolio, and three have more than two soonicorns.

LSP Life Sciences Partners and Invest-NL are the top runners with soonicorns in their portfolio ready to reach unicorn status.

“Even in the current international political and economic climate, we continue to be excited about the Benelux as one of the regions in Europe where fast-growing startups will be created at an accelerated pace. Significantly more unicorns and soonicorns will be created in the next 5

years than has been created in the past 30 years, and now we have more fundamental underlying business metrics than ever before,” comments Antler’s Partner Ronald Jan Schuurs.

“Getting this Benelux Unicorn Mapping report together has been a truly insightful project, and we hope it helps all of us understand better how these success stories are built. Antler’s business model is built on our conviction that great companies within these new venture ecosystems come from finding and backing the best people and teams and being their best possible partner from day zero,” says Schuurs.

01

From telecom veteran to Dutch Startup Visa success: The Jignesh Dave story