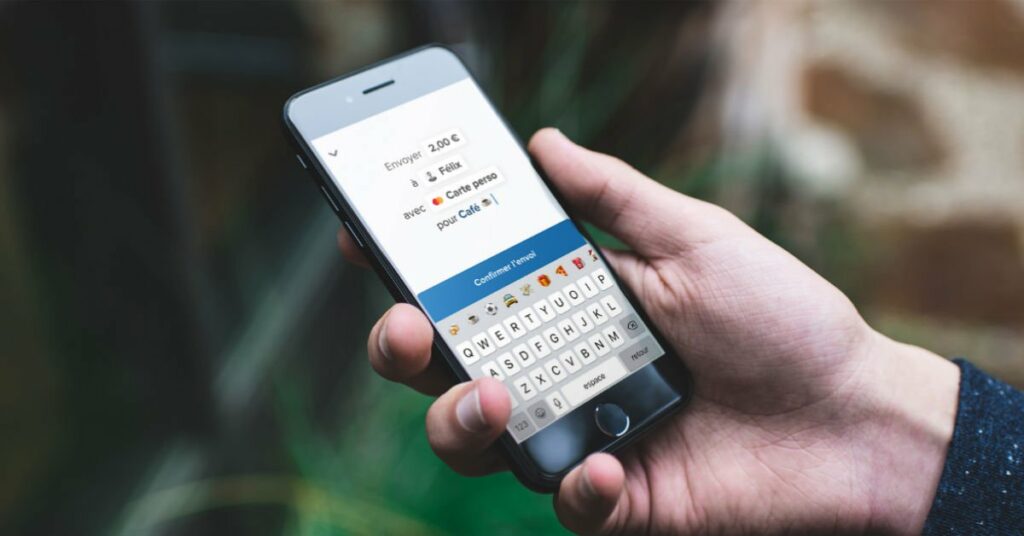

If you live in France and you are under 30 years, then there is an increased possibility that you would have heard about Lydia. Well, it is a mobile payment app, which is meant for the young users to enjoy a plethora of financial services via a single intuitive platform.

Lydia, a fast-growing Paris-based mobile payment company is one of the leading and successful B2C fintech startups in the country. Founded in 2013 by Antoine Porte and Cyril Chiche, the company is touted to have 25% of the market share among the French millennials.

Well, this fintech startup works with the vision to drive the cashless evolution in Europe. With its execution capability and engaged user base, the company intends to capture the opportunities in the industry and became a leader in the mobile financial services.

Eyes to scale its presence across Europe

In a recent development, Lydia, the French fintech startup secured €40 million Series B funding led by China-based Tencent along with participation from Open CNP by CNP Assurances, New Alpha, and XAnge. The investors will be committed to support the vision of Lydia.

With this Series B funding, the company aims to scale its mobile financial services platform. Also, it eyes to expand its presence across Europe. Lydia already exists in the European market though it is not massively used by consumers in other countries as in France.

One-stop fintech solution!

Lydia has a user base of 3 million and provides mobile P2P payment services. Of late, it has expanded its product becoming a one-stop fintech solution letting users get accounts, loans, payment cards, money pots, insurance, gift card, and a lot more in a single interface. Some of these products of Lydia have been developed in-house while the others have been provided by third-party partners via a marketplace.

One of the most interesting features is that you can share accounts with other Lydia users. Notably, the shared accounts are completely shared and anyone can top up and withdraw money from it. Also, it is possible for all the shared users to spend directly from the account and transfer money to another account.

Main image picture credits: Lydia

Stay tuned to Silicon Canals for more European technology news.

01

From telecom veteran to Dutch Startup Visa success: The Jignesh Dave story