Imagine walking into a store to buy something and discovering that the product that you want to buy is out of your budget? This is an issue that has plagued consumers for a really long-time and one of the solutions has been to pay overtime. While credit card was the solution, buy-now-pay-later (BNPL) has become a more credible option.

The downside of using a credit card to pay for a product overtime is the hidden charges or interest associated with the payment. The BNPL solution offered by in3, a Dutch fintech company based in Eindhoven, removes that interest component completely while allowing customers to make payment in three instalments.

According to ResearchAndMarkets.com, BNPL has become increasingly popular among consumers in Europe. The medium to long term growth story of BNPL industry looks strong with 30.8 per cent CAGR growth during 2022 and 2028. The same report projects 74.8 per cent growth for BNPL industry on an annual basis in the Netherlands in 2022. in3 is waiting in the wings to not only drive the growth but revitalise the industry.

A payments chief at the helm

While the likes of Klarna, Afterpay, and Affirm dominate the news cycle around the BNPL industry, in3 is among one of the fastest growing startups in this space. During the first quarter of 2020, the Dutch fintech scaleup registered triple digit growth and set the tone for the possible growth.

Whenever a startup sees such accelerated growth, the last thing you would expect to see is a change in leadership. However, Patrick van de Graaf, who co-founded in3 in 2013 as a Pay Later and Pay in 3 instalments company, handed over the reins to Hans Langenhuizen on 1 June, 2020.

Hans Langenhuizen is a notable name in the IT and payment industry, having held multiple responsible positions at Worldline, Wincor Nixdorf, Aevi, and Ingenico Payments. With the new CEO at the helm, Patrick van de Graaf switched back to the role of special ambassador.

Hans says social responsibility was one of the triggers for him to join in3. He describes in3 as a BNPL solution “with really no cost for the consumer and not as a marketing instrument but embedded in the revenue model.”

For the past two years, Hans has been focussing on keeping the momentum that has put in3 on the radar of every BNPL industry watcher. He is also keenly focussing on strengthening the partnerships that has helped in3 scale its operations in the Netherlands.

A click and go experience

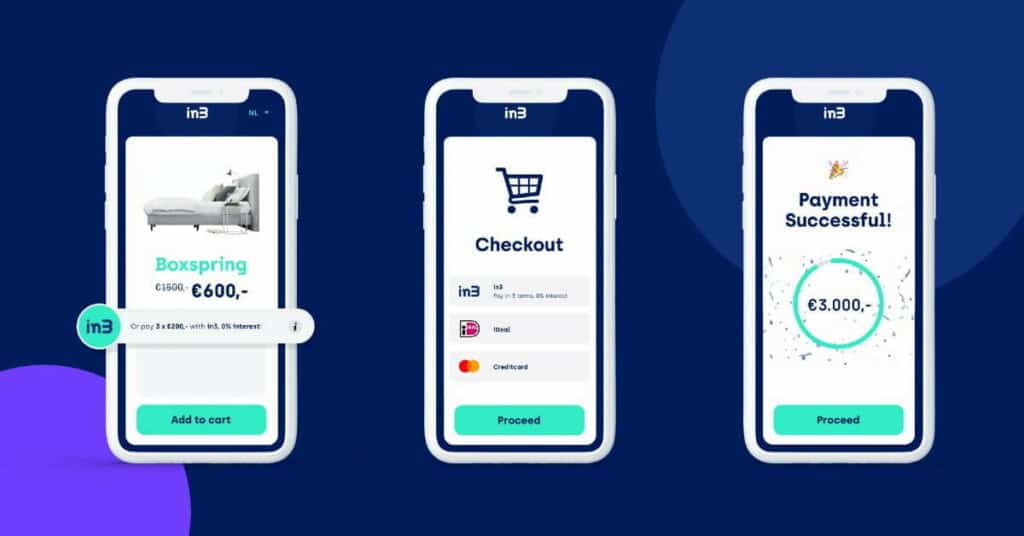

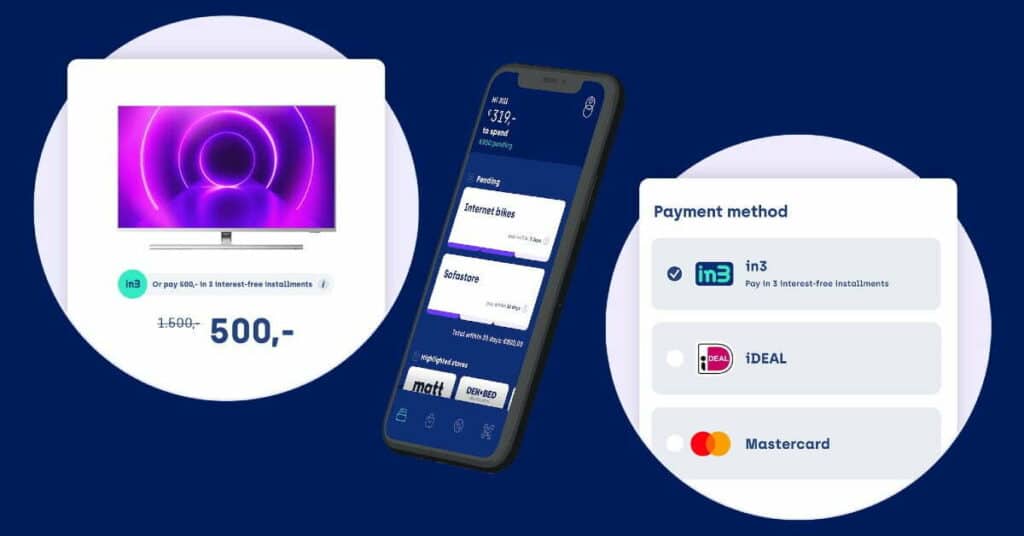

Payment remains a challenge for consumers even though there are now more options than ever. To solve this challenge, Hans says in3 works only with payment service providers (PSPs) with all the integration for the merchants done upfront. For the merchant, Hans says it is really “a click and go experience with no hassle.”

The benefit is not only restricted to merchants but also extends to consumers. “This also has a big advantage for the consumers as they can choose in3 like they would for any other payment method,” says Hans. “The process does not ask for any additional info nor any yes or no prompt. The transaction is completed within just 0.1 seconds,” he adds.

While the customer experiences a frictionless payment experience, the backend system runs credit checks without the customer even noticing. The goal here, according to Hands, is to offer a flawless payment journey.

Turning BNPL into preferred choice for consumers

At the centre of that flawless payment journey is an option to make payments in 3 instalments without interest. Hans says offering such a flexible payment term has led to 72 per cent higher checkout amount compared to other payment methods. These numbers are based on an independent research conducted by the Erasmus University Rotterdam.

Hans says BNPL is how credit cards should have been when they first became available in the market. He argues that BNPL will only work for consumers when there is no cost attached to the transactions. “In the current market, there are still too many BNPL providers earning money on late fees,” says Hans.

He thinks such an approach to be not socially responsible and one that in3 does not believe as the way forward for BNPL to become a major fintech success story. To make BNPL truly the best option for customers, in3 is betting big on partnership as opposed to building all the necessary solutions in-house.

The startup recently announced a partnership with Mollie, fulfilling the promise Hans made when he became CEO of in3 to not “fulfil any role as a PSP with immediate effect.”

“We believe in a partnership approach, so not competing against the PSP but partnering and helping each other in doing business together,” says Hans. “The combination of Mollie and in3 is so strong due to the fact that we are in a real partnership. As a strong believer in this partnership, we bring a lot to Mollie and Mollie brings a lot to us as well,” he adds.

AWS is an infrastructure lifeline

Amazon Web Services (AWS) has become the de facto choice for fintech startups operating in Europe. It has helped the likes of Biller, OneWelcome, Cevinio, and Actuals become leaders in their respective space in the fintech industry. It should thus not come as a surprise that in3 also relies on AWS.

Hans says they chose AWS because of its dedicated team that supports startups and scaleups. “At this moment we are not yet a unicorn but we need the support as if we are a unicorn due to our high growth,” he says.

in3 has been registering triple digit growth for the past few quarters and that growth requires a platform that is highly scalable. Hans says AWS offers in3 an infrastructure that is highly scalable and in turn, allows in3 to live up to its promises. Hans even calls AWS as in3’s lifeline.

For young startups, one of the immediate challenges is spending on infrastructure necessary to run a growing operation. Hans further expands on how in3 does not need to worry about infrastructure as AWS does this automatically.

Hans says, “We do not have to worry if our growth is faster than our IT infrastructure. This helps us to fully focus on growth without worrying about our IT infrastructure.”

Expansion and the path ahead

in3 has now become a major player in the BNPL ecosystem in the Netherlands. By the end of this year, in3 will have roughly thousands of merchants supporting it as a payment method online. However, in3 is live in store as well and plans to ramp up its offering with a real omnichannel solution sooner than later.

With that growth comes the opportunity to expand and Hans says the startup will go live in Germany this year. According to ResearchAndMarkets.com, open invoices or pay after delivery is a popular payment method compared to the UK, where BNPL is preferred.

By entering Germany, in3 could change the way German customers checkout while making purchases online. To establish and expand in Germany, Hans says in3 will use the $81M it raised in the form of Series B funding. The startup is also planning to open in Switzerland in 2023 and expand to the Nordics a year later.

In order to truly succeed in markets like Germany, Switzerland, and the Nordics, in3 is first building its team across various segments. Hans says they are actively hiring across customer service, business development, business intelligence, and financial intelligence units.

For Hans, the primary goal is to ensure that in3 remains socially responsible. He also says that seeing customers rate the service 9 out of 10 is success. Another success for him, which is obvious, would be to have happy merchants and payment service providers. He advises young entrepreneurs in the fintech space to think twice about rules and regulations and recommends being socially responsible because “fast money does not exist.”

Fintech Files Powered by AWS

In the new section Fintech Files, in collaboration with AWS, we are keeping tabs (pun intended) on the thriving fintech industry in the Benelux. Want to learn more about the benefits of the cloud, or talk to one of their experts? Visit AWS Startup Loft to register for the latest events, get free 1:1 support from AWS experts and discover more resources. Build and scale your (fintech) startup with $1,000 in AWS Activate credits, free tools, technical support and training to quickly get started with AWS. Learn more about AWS Startup Loft.

01

From telecom veteran to Dutch Startup Visa success: The Jignesh Dave story