London-based fintech startup Rapyd has raised a $300M (€252.6M) Series E funding round led by Target Global. The round saw participation from several new investors, including funds managed by Fidelity Management and Research Company, Altimeter Capital, Whale Rock Capital, BlackRock Funds, and Dragoneer, along with existing investors such as General Catalyst, Latitude, Durable Capital Partners, Tal Capital, Avid Ventures, and Spark Capital.

This round, reportedly, values the company at $8.75B (nearly €7.37B).

Target Global is an international investment firm headquartered in Berlin, with more than €2b in assets under management. Its portfolio includes companies such as Auto1, Docplanner, Delivery Hero, Rapyd, TravelPerk, WeFox and Zego.

Last month, the startup acquired Valitor for $100M (approx €84.5M). Meanwhile, in January 2021, the startup has secured $300M (approx €245.5M) in its Series D funding round led by Coatue – a technology-focused investment manager led by Philippe Laffont.

Fund Utilisation

The startup plans to use the funding to make a few strategic acquisitions to both support expansion in key markets and grow payment products and experiences. It is also looking for geographical expansion.

This funding will further help Rapyd to capitalise on emerging opportunities driven by the demand for digital payments, embedded finance, and scalable cloud-based payment infrastructure across all segments and verticals, and will be used to accelerate the company’s growth through a combination of organic growth, acquisitions, and strategic investments, the company mentions in a statement.

Arik Shtilman, co-founder and CEO of Rapyd says, “We plan to use the funding to continue to build out our global fintech as a service platform and invest in strengthening our network capabilities worldwide. We will continue to expand our presence across high-growth markets in Europe, Asia-Pacific, the US, and Latin America, where Rapyd’s platform can support businesses looking to grow internationally. We are doubling down on our channel partnerships strategy, strengthening our footprint across major high-growth markets, and exploring additional acquisitions that serve our strategic goals.”

About Rapyd

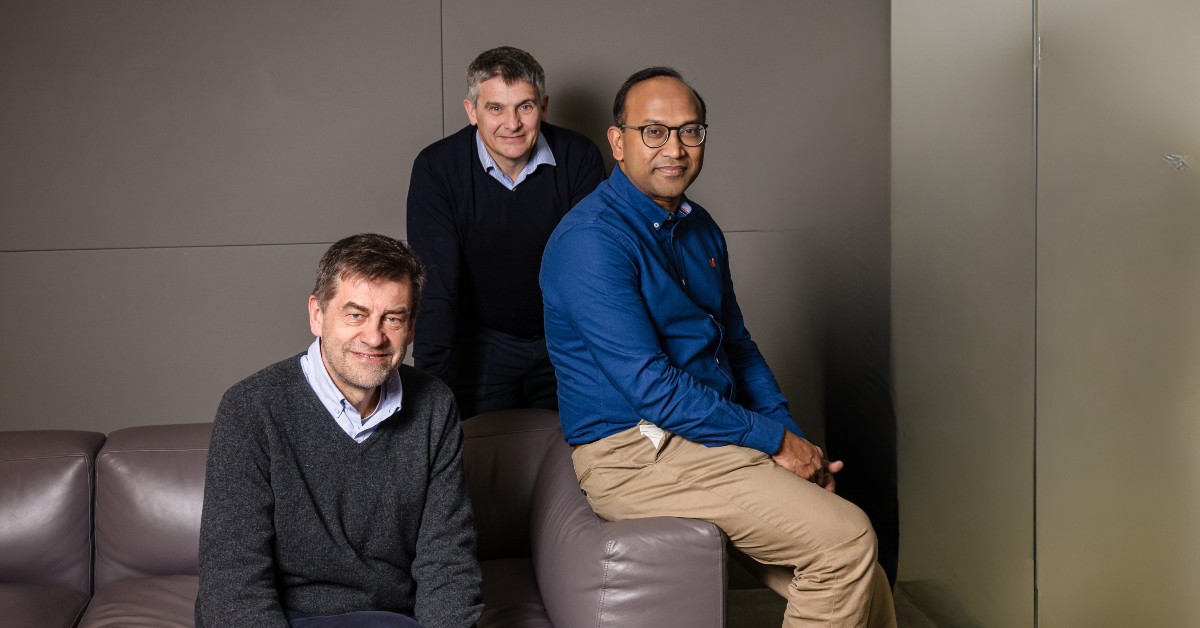

Founded by Arik Shtilman, Arkady Karpman, and Omer Priel in 2016, Rapyd is a Fintech-as-a-Service platform that helps in engaging businesses and consumers in a local and cross-border transaction in any markets.

In June, the company also unveiled a new venture arm called Rapyd Ventures, which focuses on investing in early and growth-stage businesses. Picture this, the platform works with startups after their Seed round and through Series B funding that have unique market and customer insights and are expanding on existing market traction.

Rapyd claims to bring together more than 900 payment methods in over 100 countries. Rapyd’s investors include Stripe, General Catalyst, Oak HC/FT, Coatue, Tiger Global, Durable Capital, Latitude, Target Global, and Tal Capital.

01

These are the top UK-based PR agencies for startups and scale-ups in 2025