Covid-19 hasn’t killed VC investing, but the ecosystem is definitely fighting an infection. Startups face new challenges, like difficulties in traveling, a reluctance to hold face-to-face meetings, and a general economic slowdown, forcing everyone to rewrite the playbook for startup funding.

Some are choosing to postpone fundraising, like Canadian startup Shift, which recently canceled its planned fundraising round to focus on revenue growth and refining its product because they felt they wouldn’t be able to access the value they deserve at this chaotic time.

But many others are going ahead despite the unique obstacles, striking a new path to access VC funds. If this is what you’re trying to do, then read on for some important things to keep in mind.

Covid-19 Didn’t Kill VC Funding

Q4 2019 saw an unprecedented level of investment which pushed on into Q1 2020, with $34.2 billion invested across 2,298 venture deals, and another $23 billion in late-stage deals, but that momentum is faltering.

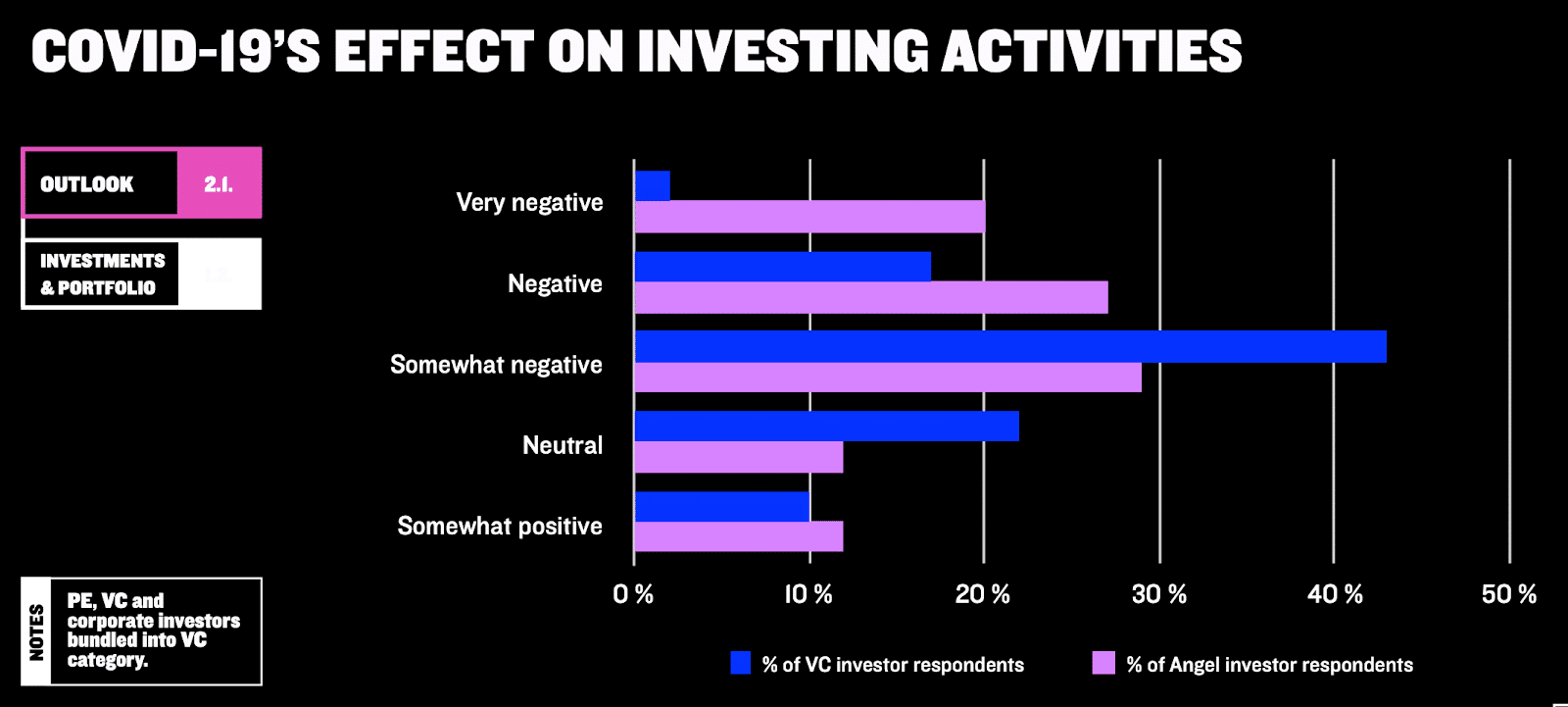

While VC funds were sitting on around $121 billion in mid-2019 and still have plenty to invest, many are cautious about where they place it. Others may not have liquidity at the moment, and 46% of funds are focusing on existing investments and don’t have much to spare for new opportunities.

Slush

SlushHowever, others scent the opportunity to snatch up great startups while the competition is down, they have more time to carry out due diligence, and deal terms are likely to be more favorable.

That said, you shouldn’t expect the same amounts you might have scored in 2019. The general opinion is that valuations have declined by a good 20-30%. Andris Berzins of Change Ventures notes that “In the previous crisis valuations went down by 30% on average. We expect the same if not lower.”

Relationships are driving funding more than ever. The PitchBook NVCA Venture Monitor, an authoritative voice on VC activity, reported that so far in 2020, only nine first-time funds closed, compared with 49 annually between 2017 and 2019. VCs are reluctant to consider unfamiliar startups with unknown founders, so you may need to pivot towards VCs with members you’ve met before, or spend more time nurturing a relationship before making your pitch.

Investment isn’t uniform across the board. Bear in mind that:

- Different locales have different investing climates. Baltic funds are more willing to invest now, while those in the US are still uncertain.

- You might not be deemed as “essential.” B2B startups are suffering more than B2C, and B2B companies that serve large enterprises are struggling more than those serving SMBs.

- Investors are directing funds towards particular sectors, with 78% shifting towards industries that benefit from the pandemic such as health, ecommerce and online education.

Yet opportunities are there for those willing to work for them. It’s just a matter of managing your cash flow until you get there.

Remote Pitches Bring Both Challenges and Benefits

Most funding pitches now take place remotely, bringing new challenges to startups seeking funding. You’ll need to research the best platform to use for your online pitch, make sure that you understand how to use it, and triple check all your links and equipment. You don’t want a dodgy internet connection or poor quality microphone to torpedo your chances.

Video conferencing makes it harder to create the trust relationship with investors that you would normally forge over several in-person meetings. It’s a particular drawback in early-stage fundraising, when investors base their decisions on their personal connection with the team.

However, you can and should take advantage of the extra benefits of pitching remotely by using a professional-grade platform like ClickMeeting. Now you can:

- Add custom branding and branded backgrounds to your video pitch to make a bigger impression.

- Take investors through your entire setup, equipment, and premises to share the unique atmosphere of your startup, which worked excellently for Studio Panika.

- Present your whole team together as a united group.

- Reach out to funds you might not otherwise have considered, because you had no way to reach them – but now that every pitch is remote, there’s no reason not to try.

Johan van Mil, founder and managing partner at Peak Capital, stresses this benefit. “With travel out of the way, the international fundraising process can happen quicker now than before,” he writes. “The opportunity for founders and investors to meet across state lines is unique – and ripe.”

During a Pandemic, You Have to be Pitch-Perfect

There was never any excuse for sloppy pitches, but today no one will put up with one. You’ll have to carry out even more practice fine-tuning your presentation, because you have to be flawless.

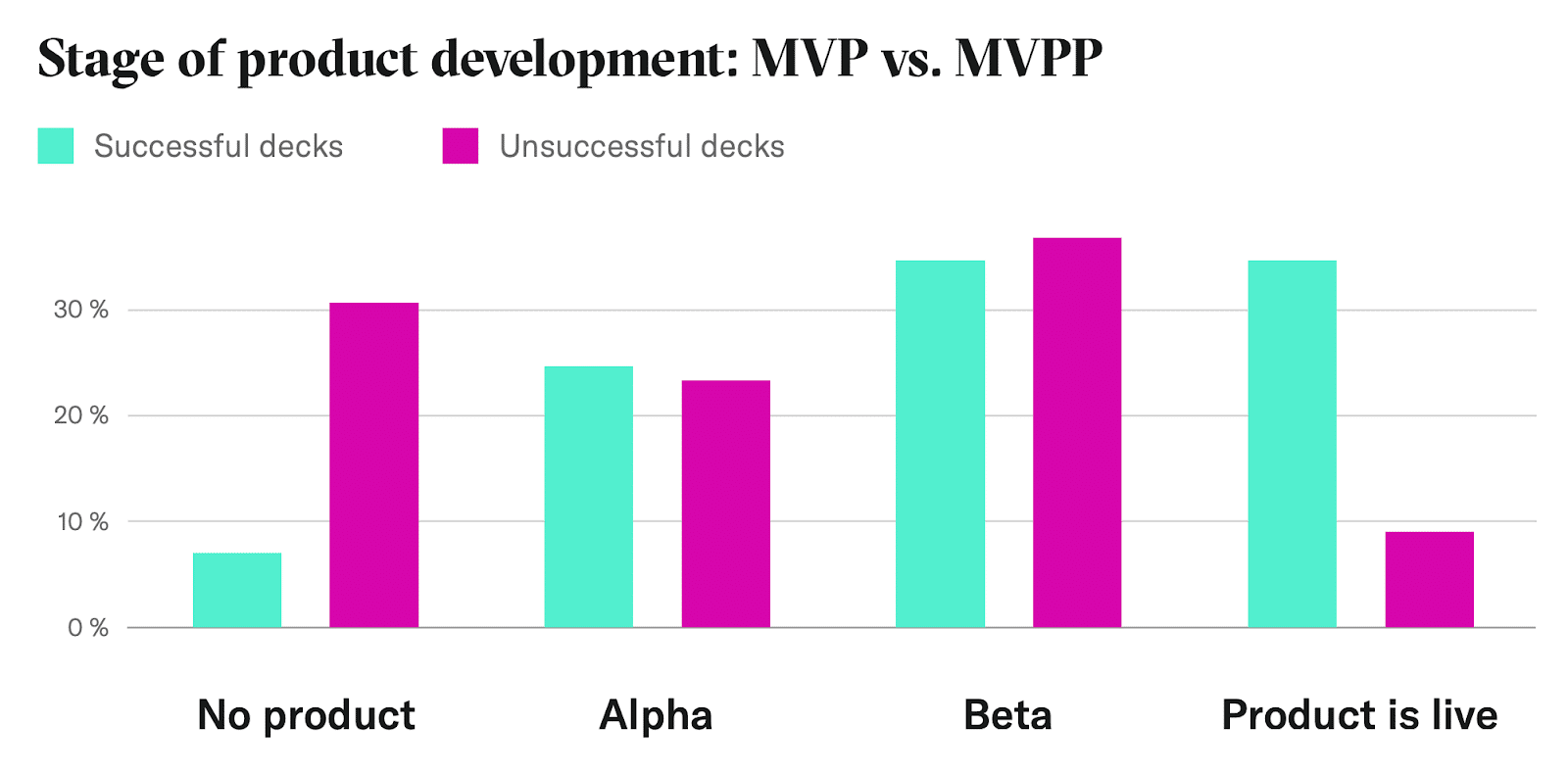

Investors currently have more time to look over possibilities and carry out due diligence. They are looking for solutions that are “must have,” not “nice to have,” so your case for your product has to be bulletproof. VCs want market-ready products and aren’t likely to accept an MVPP (minimal viable PowerPoint) right now.

Docsend

DocsendSome 92% of startups that successfully landed funds in 2019 exhibited product readiness in their pitch decks, compared to 68% of startups that failed to secure funding exhibited product readiness in their decks.

Times of Crisis Bring New Opportunities

For some startups, the Covid-19 situation strengthens their pitch and sharpens the pain point they address. You may see an opportunity for a pivot, or note that one of your previously minor features is coming to the fore.

Backstage Capital VC Founder Arlan Hamilton recommends that you “Spend the next few days observing and talking to people about what they need most. Find out what people need and that other people aren’t thinking about,” she says. “Make a list. Pen to paper. Start brainstorming a list of what people are needing right now. And that’s where you’re going to find that ‘thing.’ Then you can double down and see if that works.”

As competition drops away, you could have a unique shot at raising funds. VC partners recognize that this is an opportunity to test your ability to make it through tough times. Without question, some startups will get funding, succeed, and exceed expectations because they’ve won through adversity.

Many VCs are seeking out those startups right now. Dean Sysman, CEO and cofounder of Axonius, points out that “Times of uncertainty can be the best time to give investors confidence that you can handle tough circumstances.”

VC Funding Exists, But You’ll Have to Work for It

For some startups, this isn’t the right time to make a pitch, but others can draw on new resources to overcome the obstacles. Startup funding is a long game, and this might be your hardest round, but you were always going to have at least one round that’s tougher than others.

By leveraging the benefits of remote pitching, refining your pitch even harder, and looking for new opportunities and relationships, you can still succeed in raising funds and extending your runway so you can expand your business.

Guest post by Rohan Ayyar is Co-Founder of 99stairs, a fast growing full-service digital agency based in India. He is an experienced marketer who has worked agency side as well as in-house in the SaaS industry, developing data-driven strategies for SEO, PPC, social media, and content marketing. Rohan has been honored by the Search community at Search Engine Roundtable and listed as a Must-Follow SEO Expert on Twitter by Search Engine Watch. He is also an avid business and tech blogger, with insights featured on publications like Fast Company, Business Insider, Fortune, and Adweek.

Main image credits: elenabsl/Shutterstock

This post was originally published on Startup Grind

01

From telecom veteran to Dutch Startup Visa success: The Jignesh Dave story