“I have no idea if Bitcoin or Ethereum will go to zero. I hope they do, and soon,” Matt Stoller of the American Economic Liberties Project, recently tweeted.

With that tweet, Stoller joined a growing list of people who have emerged sceptical about crypto in recent times. Bitcoin is down almost 70 percent from its historic high while Ethereum has lost more than 70 percent in value. Similarly, crypto exchanges have laid off workers while stablecoins have become unstable.

The recent events have led us to this moment where ‘crypto winter’ is the phrase critics use without any mercy. While crypto becomes controversial, the underlying technology, called blockchain, continues to emerge as one capable of major revolutionary changes. The financial services industry is one of many industries primed to see the impact of blockchain technology.

One of the blockchain-based innovations bringing disruption to the financial services industry is asset tokenisation. The full impact of tokenisation will take a few years to witness, but it could bring transparency, cost efficiency, and interoperability to the financial trading system. One study by Roland Berger & Keyrock suggests “increased adoption of tokenisation of equity post-trading could lead to gain of around €4.6B by 2030.”

What is asset tokenisation?

Asset tokenisation is the process of converting real-world assets on-chain through smart contracts, a self-executing contract that automatically runs when predetermined conditions are met.

At the end of the process, tokens are issued to represent underlying assets. Technically speaking, anything can be tokenised, from traditional assets like equity, funds, bonds, commodities, and real estate to artworks, services, and so on.

Digital tokens can be used, owned, and transferred by the holder through a blockchain without the need for a third-party intermediary, as rules are programmed into the tokens themselves.

In addition, all the operations and transactions of the tokens will be recorded on the blockchain – a shared and immutable database – improving transparency and ensuring the integrity of the records. In addition, smart contracts set up rules about how the tokens can be exchanged and who can be the holder. People can therefore cut out third-party intermediaries, which leads to improved efficiency and transparency, reduced costs, and peer-to-peer transferability for its users.

Impact of blockchain in digitisation of financial assets

One startup at the front end of this financial revolution is Tokeny. Founded in 2017, the Luxembourg-based startup makes it easy for financial institutions and companies to dematerialise assets on the blockchain. Tony Malghem, CTO at Tokeny, says today’s financial system lacks interoperability and transferability.

He says these are “two of the most important needs for securities issuers and investors” in financial operations. Malghem adds that most processes needed to communicate and operate with counterparties are siloed and paper-based and require manual interruption, slowing down the process, which limits the transferability of assets and leads to an illiquid market. “Many institutions are not taking advantage of modern technology and solutions that can improve each of these barriers due to the technology gap,” he says.

Tokeny is bullish on the impact of blockchain in digitisation of financial assets since it answers the call to modern problems. Malghem says, “The blockchain technology acts as an immutable, streamlined, and interoperable federation that merges and automates individual processes in financial investment and asset management.”

“On the blockchain, individuals can manage their funds whenever they want and can settle funds in real-time, as opposed to traditional markets where it usually takes days or weeks to clear a settlement because there is no reconciliation need anymore, as each counterparty uses a shared infrastructure.” Malghem adds.

One of the ways that Tokeny is turning blockchain into a value and time saving opportunity is by building a compliance infrastructure. The startup offers an enterprise-grade tokenisation platform to compliantly issue, manage, and transfer securities on the blockchain network.

“At Tokeny, we make tokenisation accessible as the technology enabler for financial institutions and companies that seek to modernise their securities and financial services using blockchain technology without needing to handle any technical hurdles. ” Malghem explains.

A platform first approach

One of the factors hurting the implementation of blockchain in the financial services industry is the lack of understanding around the technology, as smart contracts rule everything in the blockchain world, compliance and control then rely on codes as well.

Tokenised securities are still financial instruments, therefore all securities regulations need to be applied. Financial institutions or companies have to ensure only eligible investors can become the holder of the tokenised assets, and it can be overwhelmed to build a platform that ensures compliance while providing user-friendly interfaces for users.

Malghem says Tokeny is uniquely positioned to help to bridge this technology gap with a non-blockchain and user-friendly platform that allow companies to interact with blockchain, manage digital assets and set compliance rules in a human-readable way. He says the lack of understanding is preventing “institutions from bringing their assets on-chain.”

As a leading global provider of technology solutions, Tokeny is enabling “securities issuers to seamlessly issue, manage and transfer digital assets on a secure and efficient blockchain infrastructure in a compliant manner. Within 4 years, it has built the most advanced and complete platform with a reputable track record of tokenising more than USD 28 billion in assets.

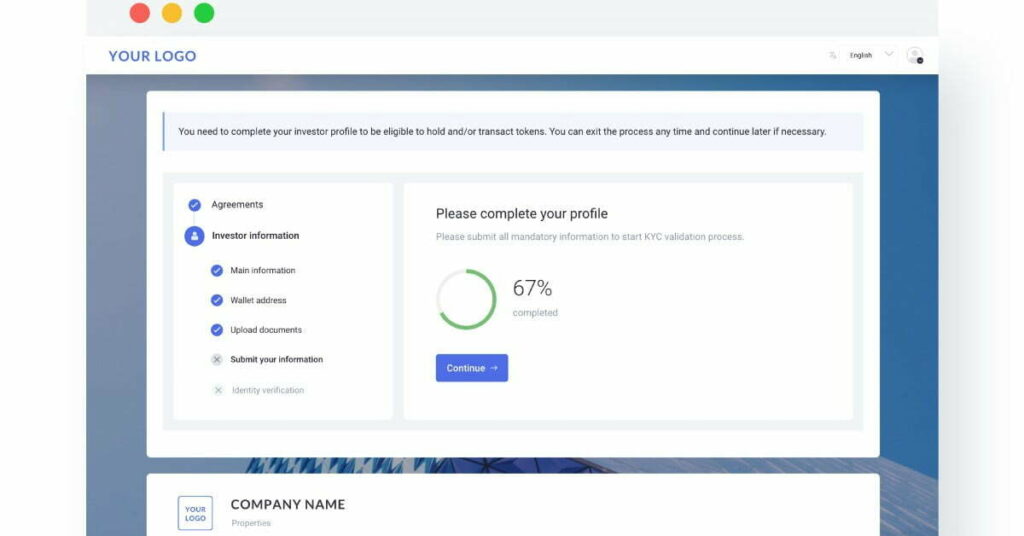

For an investor, Tokeny provides a scalable, digital, and automated platform that allows for rapid onboarding, easy portfolio management and direct communication with issuers. It has also created a “digital platform with built-in custodial wallet for users to benefit from investing and managing digitised securities without any blockchain knowledge. They just need to simply log in to the platform with their account, clicking on the buttons for desired actions, the interaction with blockchain will be handled on the back end of the platform.”

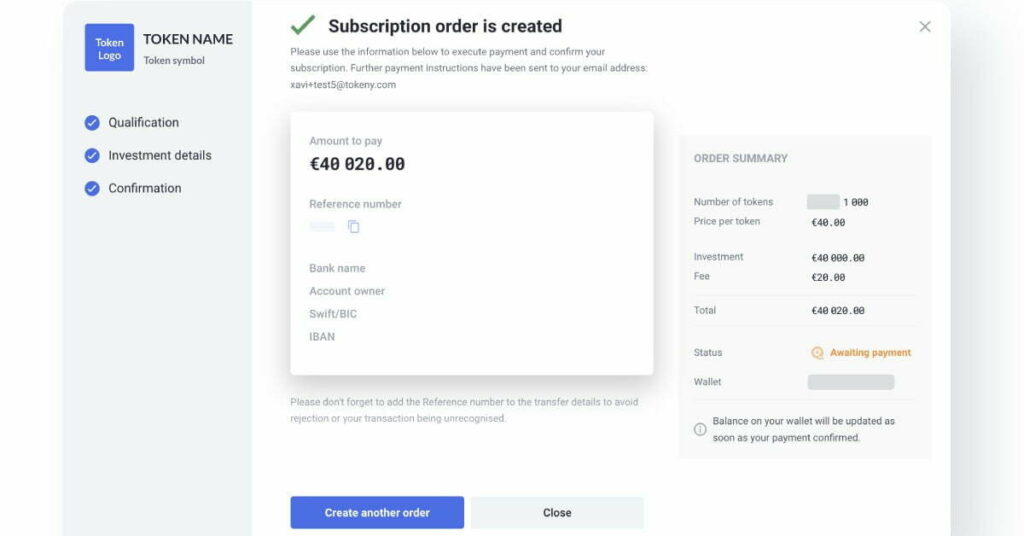

The platform offered by Tokeny manages the complete lifecycle of a token for investors, agents, and issuers. It means that not only does it cover token issuance and management, but also secondary trading.

“Assets tokenised via our solutions become a self-checking compliance validator, allowing for peer-to-peer trading. Investors can directly trade their tokens with another eligible counterpart. Issuers can even provide a secondary market solution and connect to other distribution networks, allowing their investors to reach broader audiences and increase liquidity,” says Malghem.

The team at Tokeny is aware of how the general crypto environment has been labelled as the “Wild West”, but it has a clear focus on bringing compliance and control to public blockchain. This is possible with an infrastructure Tokeny provides that uses ERC-3643, the smart contract standard for permissioned token, so that token holder rules and token offering rules can be set and embedded into the token, coupled with a digital identity system that allows for automated and on-chain compliance.

Aside from ensuring compliance, ERC-3643-based tokens guarantee ownership, since they are linked to holders’ identities rather than wallets.

A North Star for Luxembourg’s tech ecosystem

Luxembourg is one of the smallest countries in Europe, sharing borders with France, Belgium, and Germany. It is mostly known for its high GDP, great wages, and tax breaks. With a large foreign population, Luxembourg is also a melting pot of cultures, but the country is really trying to become a major startup ecosystem in the European Union. Tokeny will be the torchbearer in that effort.

Even though the startup embraces and supports remote work, Malghem says Tokeny chose Luxembourg because the country offers plenty of benefits for the blockchain ecosystem and is “globally recognised for accepting and advancing digital financial innovation.”

Luxembourg was the first country in Europe to licence virtual currency exchange platforms as payment institutions. In September 2021, the country introduced a legislation that recognised the possibility for parties to issue dematerialised securities through digital ledger technology (DLT).

While companies dealing in cryptocurrency have played coy with regulations, Malghem says Tokeny is looking forward to the implementation of the MiCA (Markets in Crypto Assets) bill and the Pilot Regime. These two legislations are meant to clarify the status of stablecoins and exchanges (MTF) on DLTs.

He emphasises that there are already very clear and well-crafted regulations in place. Tokeny, He says, always considered tokenised securities as financial instruments and has built the solutions. “We had to build solutions for issuers, so they could still handle their obligations even if the instrument is represented on DLTs,” Malghem concludes.

Partnering AWS for success

Amazon Web Services (AWS), the on-demand cloud computing platform and API solution from Amazon, has emerged as the clear winner in the fintech industry. Tokeny is no different. Malghem says the company chose AWS because of the ability to be a serverless infrastructure and “benefit from high institutional grade security standards.”

It also helps that AWS has agile functions, flexibility, and automated processes that help revolutionary startups like Tokeny to “provide and scale an enterprise-grade platform without compromising security or resources.”

While Tokeny is benefiting from the infrastructure-as-a-service solution provided by AWS, Malghem notes that the startup is also evaluating the use of AWS Marketplace. The AWS Marketplace acts as a sales channel for independent software vendors (ISVs) and other partners to sell their solutions to AWS customers.

For companies already using AWS and looking to use a blockchain platform like Tokeny, AWS Marketplace could be a channel to discover the service. “We do see the massive utility that it can provide,” says Malghem.

“AWS provides clients with the possibility to pre-purchase server resources with both the infrastructure and software being easily integrated. This would allow us to deploy a system for clients that saves time and maximises output,” Malghem explains the thinking behind the use case for AWS Marketplace.

Rebuilding confidence after crypto meltdown

It is important to understand at this point that Tokeny is not a cryptocurrency or crypto trading platform. However, with crypto being the most prominent DLT-based usages out there, Malghem does not shy away from answering questions related to the crypto industry.

The ongoing meltdown of the crypto industry (including digital assets like NFT and stablecoins) has shaken the confidence around blockchain but has not completely eroded it. He says market volatility, whether in the traditional market or in the crypto community, will cause some amount of discomfort among investors.

Tokeny is addressing these concerns directly by writing in one of their recent newsletter that such a collapse could have been predicted from their business model. The transparency and clarity that Malghem offers during our conversation is reminiscent of the business model that Tokeny promotes.

On the topic of crypto meltdown, he directly addresses the elephant in the room. Malghem says that the whole saga has led the industry into “a big shuffle to clean up bad or unsustainable projects, which is actually a great thing for the industry to become more mature”. Additionally, he sees these events as a turning point and an opportunity for regulators to set clear regulatory guidance to protect investors, which will provide institutional investors with confidence to enter the industry, leading to mass adoption.

“Compared to traditional finance and banking, the crypto and DeFi market is still relatively young. As the market continues to develop over time with plenty of ups and downs, the ecosystem will better understand past issues and learn how to tackle them in the future,” Malghem says.

When we ask him what Tokeny is doing, Malghem immediately responds with the primary purpose of the company. He says, “Investors are looking for high quality blockchain-based investment opportunities, especially ones that already have value, such as real-world assets. Our main purpose is to bring these assets on-chain in a safe, secure, and compliant way. These ideas are embedded within the tools we provide for our clients, and help enable the next wave of blockchain, which is asset tokenisation, to thrive in the ecosystem.”

Striving to become the market standard

One of the ways Tokeny forecasts how it could continue leading the tokenisation market as a technology provider is by hiring the right people. Tokeny is unique not only in terms of its business vertical but also the way it operates. Most of the team at Tokeny is fully remote and Malghem says the startup has seen “people to be more productive when given the option to work remotely.”

This is in stark contrast to leaders like Elon Musk arguing for their employees to not only return to office, but asking for them to put in minimum hours. He says the goal of Tokeny is to “have the best talent” no matter where they are located. To overcome the remote barrier, Tokeny has built an open communication channel and does weekly meetups and team building activities.

Tokeny has demonstrated that its model is capable and can be scaled as blockchain adoption grows in the financial market. To reach that scale model, the startup has recruited 12 people in the past five months and plans to continue scaling the team.

As Tokeny continues to grow, so does the number of financial institutions and companies choosing to adopt blockchain solutions. Their clients are beginning to take note of all that blockchain has to offer, and it is time for financial services providers to give them a solution.

“Currently, the market is at a stage where solutions to improve the transferability and interoperability of financial securities are rapidly growing. Large financial institutions are all starting to embrace blockchain technology thanks to a growing demand for digital assets from their clients. We are already working with many of them, with our enterprise-grade and ready-to-use infrastructure, in addition to strong institutional backing from Euronext Group, Apex Group and Inveniam, we are well positioned to be a catalyst for large-scale institutional tokenisation adoption.” says Malghem.

Fintech Files Powered by AWS

In the new section Fintech Files, in collaboration with AWS, we are keeping tabs (pun intended) on the thriving fintech industry in the Benelux. Want to learn more about the benefits of the cloud, or talk to one of their experts? Visit AWS Startup Loft to register for the latest events, get free 1:1 support from AWS experts and discover more resources. Build and scale your (fintech) startup with $1,000 in AWS Activate credits, free tools, technical support and training to quickly get started with AWS. Learn more about AWS Startup Loft.

01

From telecom veteran to Dutch Startup Visa success: The Jignesh Dave story