Netherlands-based UNIIQ, a €28.8M investment fund focusing on the proof-of-concept phase, assists West Dutch entrepreneurs in bringing their products to market quicker. The firm provides seed money to innovative businesses to help them realise their visions and bridge the gap between concept and profitable business.

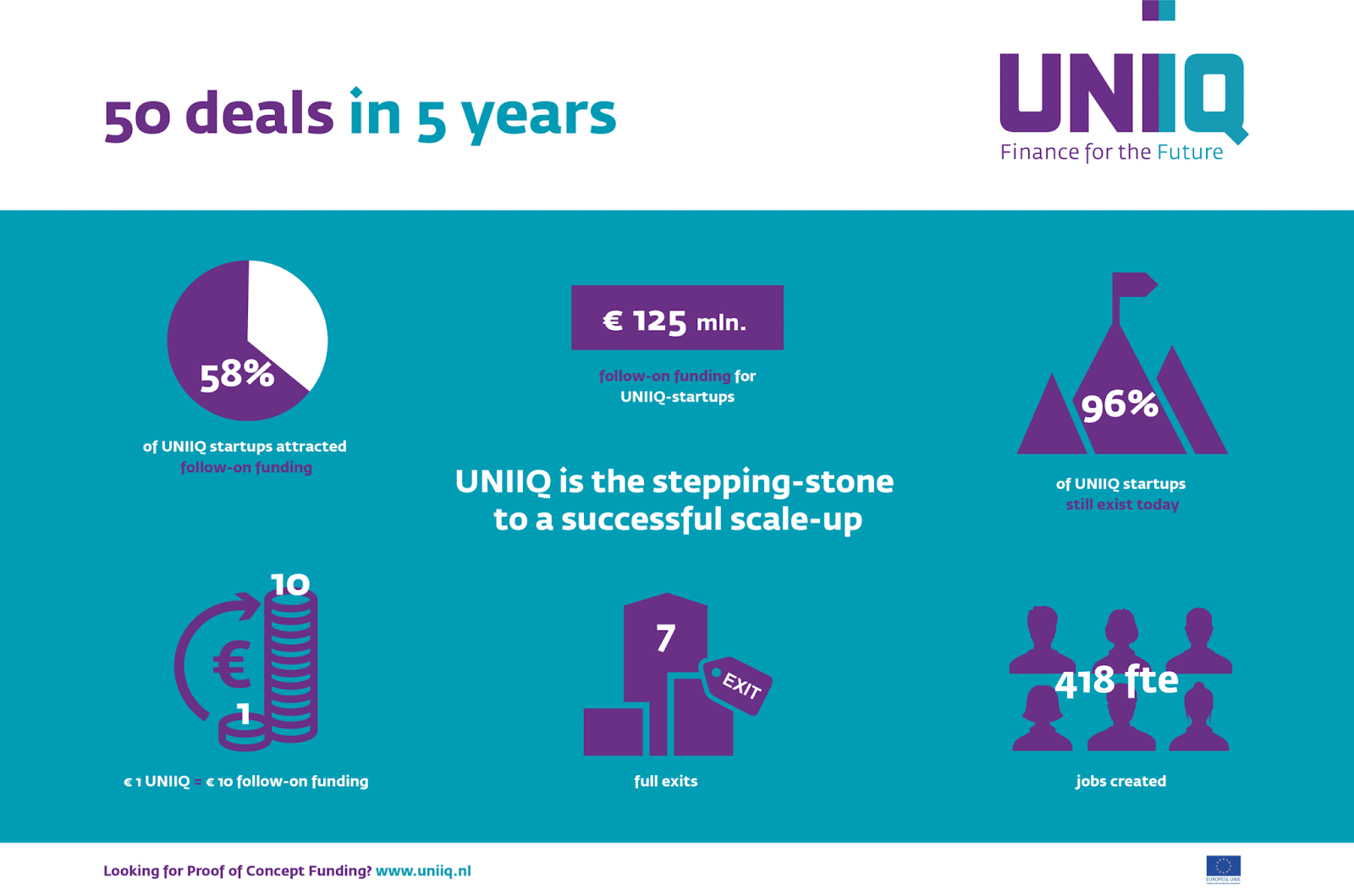

50 deals in 5 years

In a recent development, UNIIQ announced that it has completed 50 deals in 5 years. Since its inception in 2016, the firm claims to have become one of the most successful early-stage funds in Europe.

After investing in 50 companies, 96 per cent of the UNIIQ portfolio companies are still operational, and the firms have secured over €125M in follow-on capital.

€1 from UNIIQ generates over €10 in follow-on funding. And that is an unprecedentedly high multiplier. Seven complete exits have already taken place and 418 jobs have been created. This makes UNIIQ the springboard to a successful scale-up. UNIIQ startups are also known for their impact: they make the world cleaner, smarter and healthier.

According to the company, €1 invested in UNIIQ yields over €10 in follow-on funding – a record-breaking multiplier. The company has also made seven exits, resulting in the creation of 418 jobs. UNIIQ companies are recognised for their impact: they help to make the world a better place to live by making it cleaner, smarter, and healthier.

Investing successfully

UNIIQ invests risk money in West Dutch university spin-offs, startups, and established SMEs with disruptive ideas, increasing access to growth finance. A collaboration of Erasmus MC, TU Delft, Leiden University, and the regional development organisation InnovationQuarter established this fund.

UNIIQ invests substantially in deeptech and life sciences, with deep tech accounting for around 80 per cent of the portfolio almost always involving a hardware component. This is a high-risk, high-tech investment with a long return time that the market has yet to go into. UNIIQ shows that you may still make money investing in this risky period.

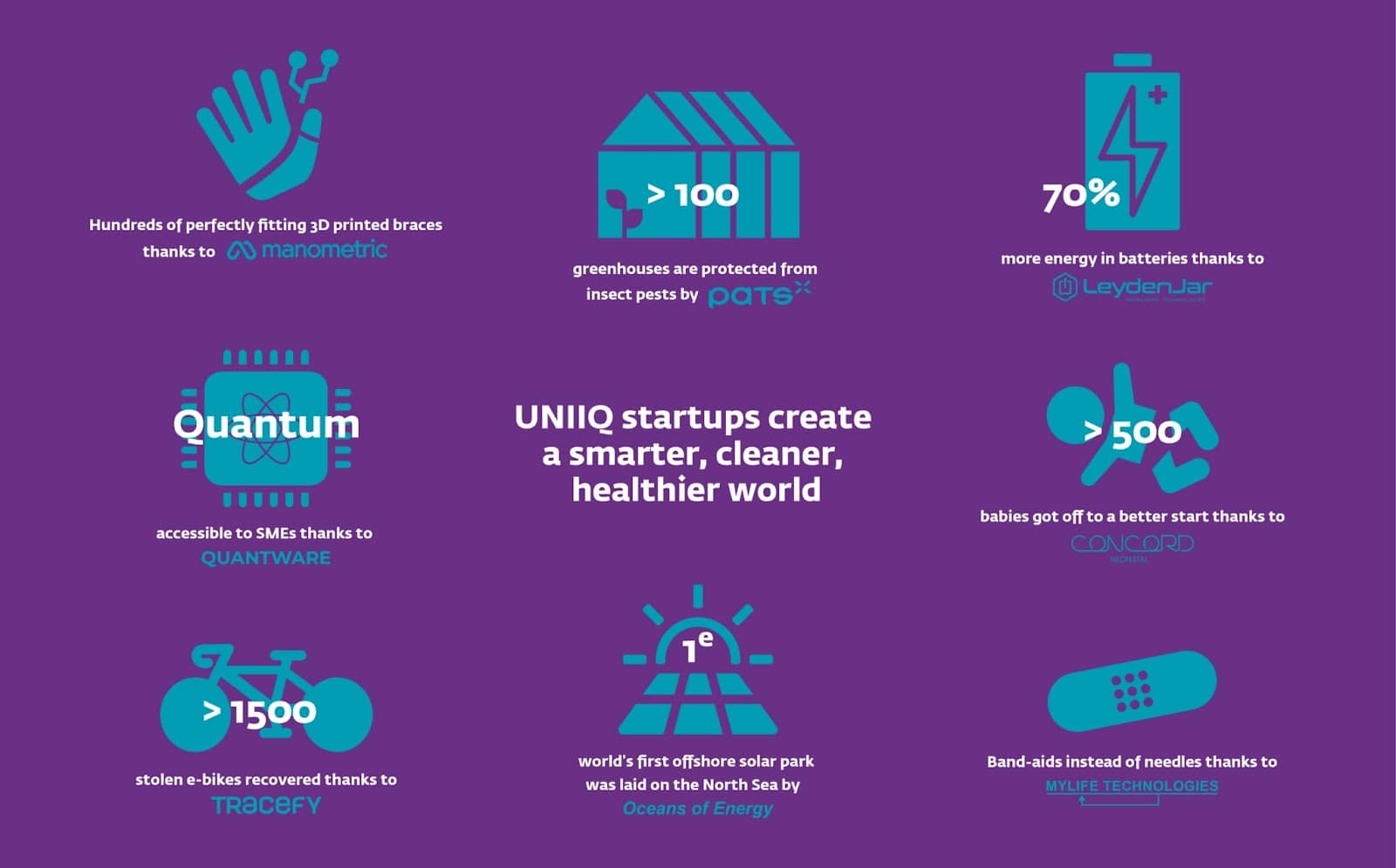

Make the world cleaner, smarter and healthier

The portfolio companies of UNIIQ are known for making the world cleaner, smarter and healthier. For instance, LeydenJar’s technology allows batteries to deliver 70 per cent more energy; Quantware’s processors make quantum research accessible to smaller businesses; and, Oceans of Energy built the world’s first offshore solar system in the North Sea.

Mayht was sold to Sonos for $100M

In April 2022, US-based Sonos acquired Mayht, a Dutch startup known for developing highly compact, powerful speaker driver technology, for $100M (approx €92M). Based out of Delft, Mayht specialises in an audio technology called Heartmotion.

In this context, fund manager Hans Dreijklufft says, “With us, the most unique, world-leading technologies see the first light of day, thanks in part to our university partners. Recently, our portfolio company Mayht was sold to Sonos for $100M. When the brothers came to us, you could still see the duct tape on the prototype, so to speak. We often see the potential of unique technology at a very early stage. And thanks to our large network of (inter)national investors, we also manage to attract follow-on funding for our companies.”

Backed IMSystems to make robots do more work and accurately

As robotics is progressing quickly, the transmission systems – the parts that allow the robot to move – haven’t changed much in the last 50 years. This resulted in robots being heavy, complicated, uncontrolled, and costly. This is where UNIIQ’s portfolio company IMSystems stepped up the game.

With its Archimedes Drive, IMSystems introduced the first breakthrough in transmission systems in half a century. The ‘heart’ of the robot now functions with far greater precision, transferring power efficiently, in a compact size and at a lower cost. It also makes the movements of robots more precise, powerful and controllable. With this drive, a production robot can do up to 40 per cent more work in the given time.

IMSystems received funding from UNIIQ and later follow-on capital through another InnovationQuarter fund, IQCapital.

01

From telecom veteran to Dutch Startup Visa success: The Jignesh Dave story