The global crisis of COVID-19 has impacted our lives to such an extent that almost all our everyday schedules are altered. Apart from disrupting the healthcare and tourism industries, the lockdown mandated to curb the spread of coronavirus has also dented the global economy. Talking of the economy, the massive impact is likely to take years to get back to normal.

Despite the impact on the economy, the tax returns have to be filed on April 30 and there is no extension of this deadline. Of course, the last minute tax filing is tedious and not advisable but if you still have to get it done, then there is a set of tax tech startups to help you with the accounting, invoicing, and other related tasks.

Given that the tax filing deadline in Europe is around the corner here are some tech startups to help you out right now.

Taxfix (Germany)

Founder/s: Lino Teuteberg, Mathis Büchi

Founded year: 2016

Funding: €100 million

Berlin-based Taxfix has built a mobile app to make tax filing simple and easy. There is a web version of the same as well. Taxfix asks you a set of simple questions to maximise your tax refunds. Once you start answering these questions, Taxfix chooses relevant questions to be asked next and hides those that do not suit your current situation. It also accepts photos of your payslip thereby eliminating the need to file forms. And, you can just submit the filing to the respective tax office and get back up to €1000 tax return on an average. Recently, Taxfix secured $65 million (nearly €59.7 million) Series C funding from Index Ventures along with existing investors.

Wundertax (Germany)

Founder/s: David Czaniecki

Founded year: 2015

Funding: €4 million

Wundertax is another fintech and accounting startup based in Berlin. The company provides online tax return filing and related services. To file tax returns using Wundertax, you need to choose your style of occupation such as employee, expat, freelancer, etc. on the first page. Then, you will be guided through a few questions that are relevant to your situation and type of employment. Do your taxes completely online in simple way anywhere and anytime with Wundertax and get an average tax return of up to €1150.

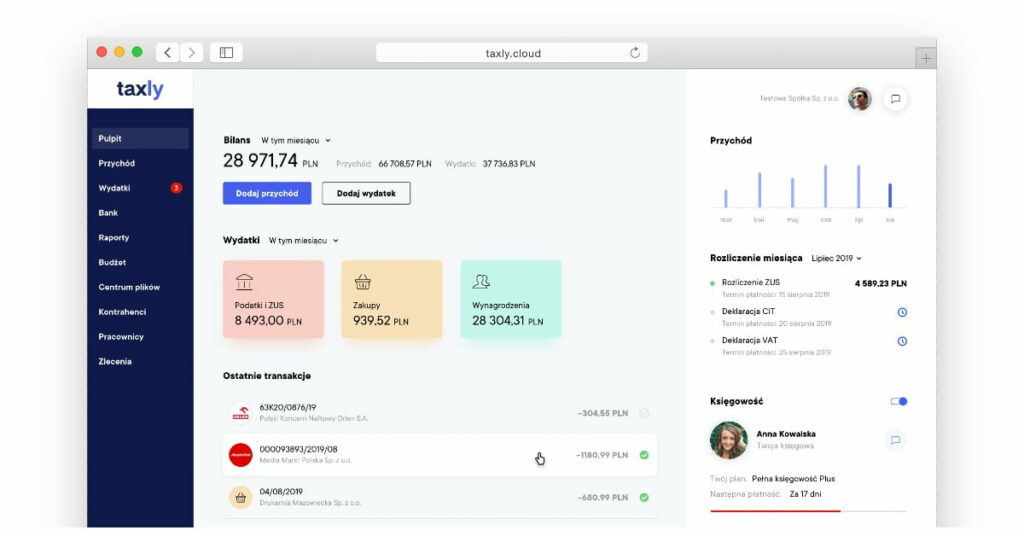

Taxly (Switzerland)

Founder/s: Daniel S. H. Kershaw, Nicolas Marrel

Founded year: 2019

Funding: NA

With Taxly, you can create and submit tax returns in just 10 minutes. The startup reimagines the Swiss tax filing process and lets you file tax in a single click. Taxly will ask you a few simple questions, find your deductions, check your tax return, and submit the same. With the integration of Artificial Intelligence, Taxly gives you the ability to file tax return claims easily and quickly. Having social awareness as its focus, this startup lets you choose to pay your Taxly fees directly to a Swiss charity fighting climate change.

Accountable (Belgium)

Founder/s: Alexis Eggermont

Founded year: 2017

Funding: €1.7 million

Belgium-based Accountable is a fintech startup that has developed a mobile app to help users become self-employed. It is not a tax refund tool but helps you connect expenses and create and manage invoices. The same is collaborated with VAT and tax deductibility information. With the Accountable app, you will be able to optimise your taxes early and manage the same seamlessly. The Accountable blog provides several useful resources and tips for students, professionals, and young entrepreneurs. What’s interesting is that Accountable makes tax advisory and accounting five times cheaper than other methods for the self-employed class.

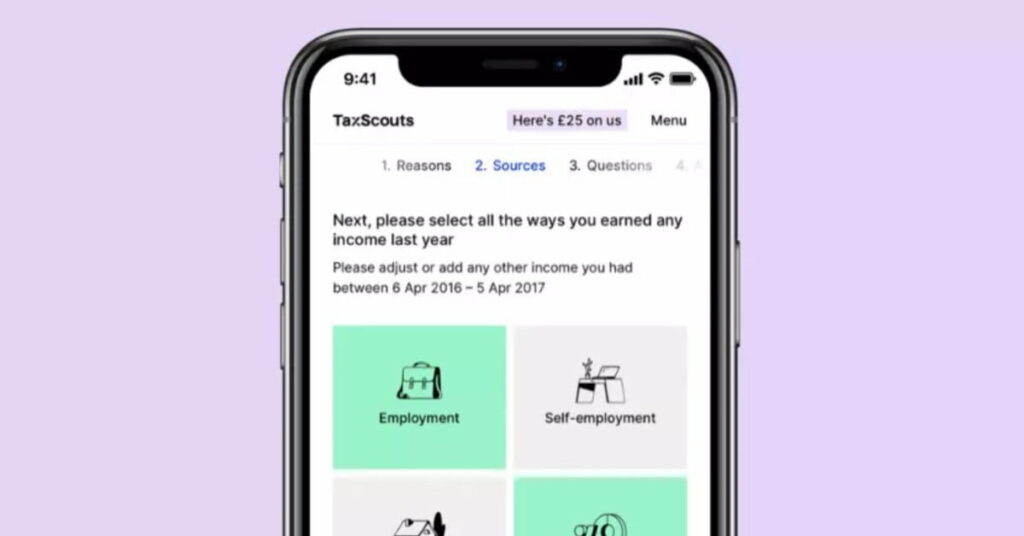

TaxScouts (UK)

Founder/s: Dan Karger, Kaupo Kõrv, Mart Abramov

Founded year: 2017

Funding: €1.8 million

London-based TaxScouts offers a personalised online tax preparation at an affordable cost by merging automation and accountants. It prevents last-mile hurry for taxpayers as it automates personal income tax preparation. For as slow as €113, taxpayers can get a simplified tax assessment that will help them understand their personal income tax situation and suggest methods that will help them get better tax returns. Back in early 2019, TaxScouts secured nearly €14 million funding to expand its team and invest in marketing and operations.

Moneybird (Netherlands)

Founder/s: Edwin Vlieg, Joost Diepenmaat

Founded year: 2008

Funding: NA

Dutch startup Moneybird lets you create and send invoices online, keep track of the same and save time. The platform is easy to use and is ideal for both service providers and freelancers. The startup frees you from the complex booking software and provides simplicity. You can create and manage invoices with fun and get your real work done. With Moneybird, entrepreneurs get an online accounting tool for managing their finances. Features include creating invoices, storing purchase invoices, scanning receipts and sending quotes.

Quipu (Spain)

Founder/s: Albert Bellonch, Roger Dobaño

Founded year: 2013

Funding: €3.4 million

Spanish startup Quipu intends to digitalise SMEs and their financial management process. Its financial management software has become a reference automating administrative process for both SMEs and startups. It digitalises all administrative processes thereby eliminating all paperwork, automatically accounting all tickets and invoices and matching invoices effortlessly from all bank accounts. It acts as a management tool enabling communication with accountants. Given that all the income and expenses are fed to Quipu automatically, it will help in tax filing by freeing you from the manual process.

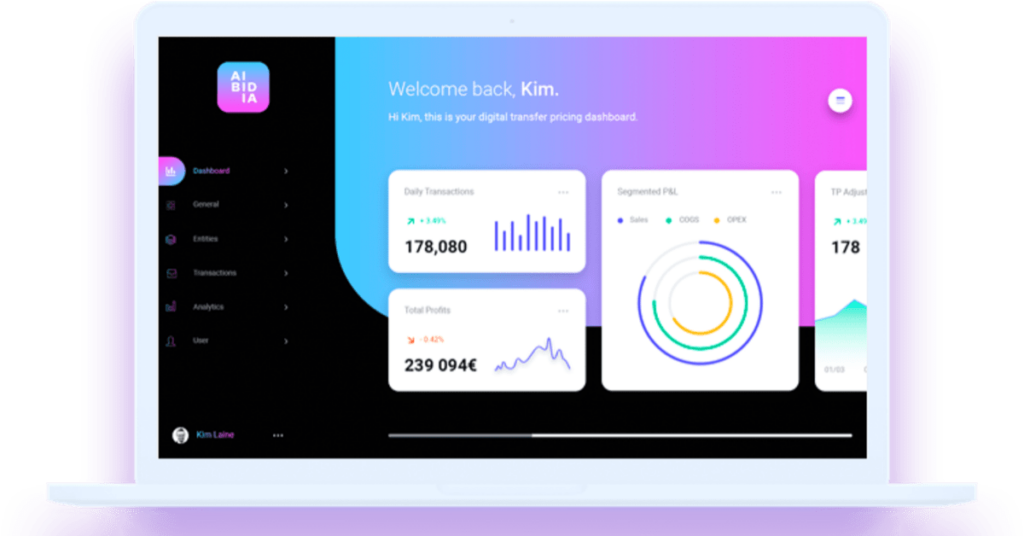

Aibidia (Finland)

Founder/s: Hannu-Tapani Leppänen

Founded year: 2014

Funding: €4.2 million

Aibidia is on a mission to digitalise international tax and shape up the way transfer pricing professionals live and work. Its digital transfer pricing software combines in-depth legal, economic, tax, AI, and business intelligence so that it can help companies automate and accelerate the involved processes. Notably, transfer pricing is the largest tax compliance category for the world’s largest corporations.

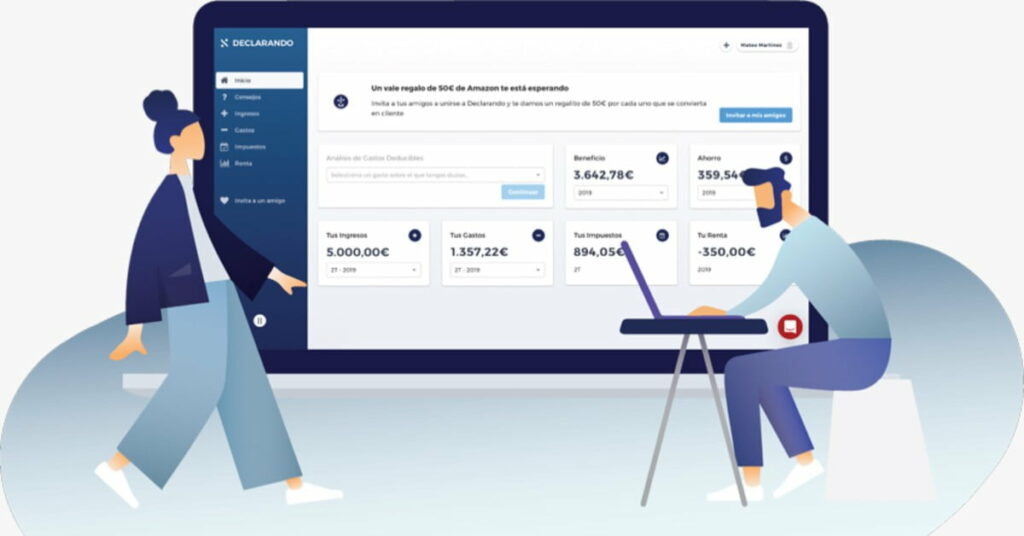

Declarando (Spain)

Founder/s: Vicente Solsona

Founded year: 2014

Funding: €540k

Spanish online tax advice platform Declarando helps freelancers sans any knowledge about tax law by saving their time and money. Freelancers in the country have to pay high taxes and fill complex paperwork. Declarando’s virtual tax advisor helps freelancers find out all the expenses that can be deducted and save up to €4000 per year on an average. With this platform, it is possible for freelancers to register with the government as autónomos in a few minutes and manage their accounting and file tax forms.

Main image picture credits: Taxfix

Stay tuned to Silicon Canals for more European technology news.

01

From telecom veteran to Dutch Startup Visa success: The Jignesh Dave story