The advancement in technology has not spared any industry including healthcare, fintech, etc. However, the mobile banking boom in Europe has been overlooked with incumbents from outside the EU enjoying a notable market share. Thanks to the existing regulatory entry barriers, these companies are being held back. With banking-as-a-service gaining traction, this issue will soon be a problem of the past.

‘Banking as a Service’ startups in Europe

Banking requirements of modern customers range from shopping, entertainment, and transport. These customers expect fintech services to be available on-demand. This has given rise to the first digital solutions that let people manage their own finances. And, this is an opportunity for European incumbents who intend to meet the expectations of modern customers.

Given that there is a surge in the digital banking services, incumbents from both within and outside the EU are likely to jump on to this bandwagon. With the implementation of Brexit, it is yet to be seen how the British banks will act. But one thing that is known is that the influx of mobile banking players will create a more diverse financial landscape enabling a better quality of services and lower banking fees. Having said that, here is a list of fast-growing ‘Banking as a Service’ providers in Europe right now as sourced from Dealroom.

TrueLayer (UK)

Founder/s: Francesco Simoneschi, Luca Martinetti

Founded year: 2016

Funding: €42.2 million

TrueLayer is an open banking API provider that offers two products meant for businesses – Payments API and Data API. It lets applications to connect securely with the bank of the end users to read their financial data, verify their identity and initiate payments. Recently, the UK-based challenger bank Revolut teamed up with TrueLayer for its Open Banking feature that will help people manage their financial life in a quick, easy, and convenient way.

Railsbank (UK)

Founder/s: Nigel Verdon, Clive Mitchell

Founded year: 2016

Funding: €12.9 million

London-based open banking and compliance platform Railsbank aims to revolutionise access to international banking by providing digitally native companies including a single global API, connect to payment schemes and the ability to create bank accounts instantly. All the transactions are in line with the compliance policy enforced by the company’s unique Compliance Firewall. Railsbank operates with the mission to deliver a seamless product to companies via a technology platform, which goes beyond legacy issues.

Yapily (UK)

Founder/s: Stefano Vaccino

Founded year: 2017

Funding: €16.6 million

Yapily is a leading enterprise connectivity platform that connects people easily to banks. The award-winning ‘API Only’ technology provider works with the mission to provide innovative products to let people connect to banks and empowers a new generation of financial services. Yapily helps companies meet increasing customer expectations in lending, banking, accounting, payments, and money management. Earlier this year, the startup secured €12 million Series A funding in a round led by Lakestar along with LocalGlobe, HV Holtzbrinck and angel investors.

Codat (UK)

Founder/s: Peter Lord, Alex Cardona, Dave Hoare

Founded year: 2017

Funding: €15.1 million

Codat, a London-based startup connects the small businesses’ data systems to fintechs, banks, and other institutions. The startup facilitates data exchange between financial institutions and small businesses so that the latter gets insurance, loans, and other financial services. Codat has a single API, which plugs into the software used by small businesses and lets outside organisations access the much-needed accounting information in real-time. In June this year, Codat secured $10 million from Index Ventures for the expansion into the US.

FintechOS (UK)

Founder/s: Teodor Blidarus, Sergiu Negut

Founded year: 2017

Funding: €14.4 million

FintechOS lets banks and insurers launch data-driven and hyper-personalised digital products that meet the expectations of modern customers. The company intends to make finance more accessible and transparent for everyone. It provides automation and instant solutions that cover all aspects of online banking and financial services. Back in late 2019, FintechOS raised £10.7 million Series A funding led by Earlybird’s Digital East fund and OTB Ventures along with existing investors Launchub Ventures and Gapminder to expand its global presence and fund its growth across Europe.

Form 3 (UK)

Founder/s: Michael Mueller

Founded year: 2016

Funding: €22.1 million

Cloud-based payment-as-a-service processing provider Form3 is touted to have resolve the issue of slow payment processing by providing a cloud-based technology to fintech companies and banks. It enables sending and receiving payments in real-time. Form3’s existing clientele includes Tandem Bank, N26, Ebury, myPOS, and LHV Bank.

Thought Machine (UK)

Founder/s: Paul Taylor

Founded year: 2014

Funding: €139 million

Thought Machine has built a core banking solution completely in the cloud. Its solution called Vault lets challenger and established banks to compete in the cloud-native era letting them attain resilience, security, and scalability. Thought Machine works with the mission to cure one of the banking industry’s primary problems: its reliance on outdated IT infrastructure. The company raised around €75 million in a Series B funding round to facilitate its global expansion.

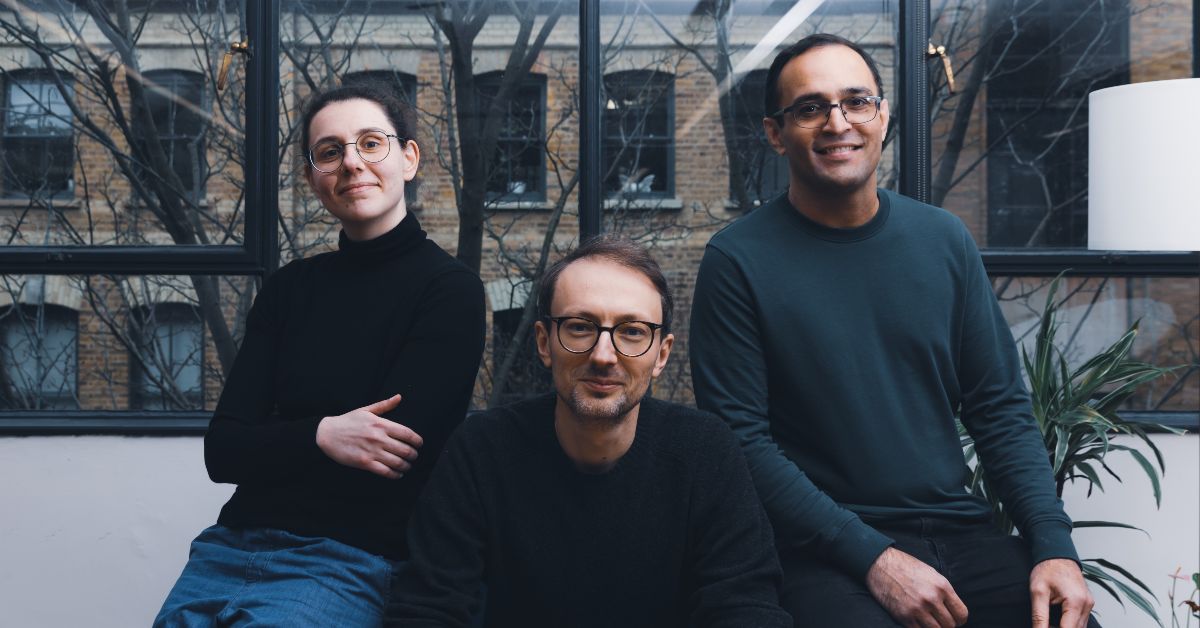

Upvest (Germany)

Founder/s: Ivan Morozov, Jesper Noehr, Martin Kassing

Founded year: 2017

Funding: €7.9 million

Berlin-based Upvest provides powerful APIs to interact with the major open-source blockchains Bitcoin and Ethereum. By providing simple REST-APIs, Upvest enables developers to build blockchain hassle-free blockchain applications faster, cheaper and more reliably. In addition, the unique infrastructure provides security by design and offers a smart solution to private key management. With this startup, fintechs can save cost and users can invest meagre amounts of even €1 and get the ability to manage investments anytime and anywhere.

Cardlay (Denmark)

Founder/s: Jørgen Christian Juul

Founded year: 2016

Funding: €17.3 million

Danish fintech startup Cardlay partnered with Eurocard, a Scandinavian issuer of corporate cards to make its solution available to the corporate card users in the Nordics. Its technology makes it possible for Eurocard to offer corporate customers an efficient solution to time-consuming challenges in handling receipts, travel expenses and business-related purchases. With this partnership, there will be integration of expense and receipt management such as an AI robot for automatic VAT reclaim developed by PwC. Notably, this is an integral part of the Eurocard services offered to businesses.

Minna Technologies (Sweden)

Founder/s: Joakim Sjöblom, Jonas Karles, Marcus Lönnberg

Founded year: 2016

Funding: €5.6 million

Sweden-based Minna Technologies is an EBA authorized FinTech partner helping retail banks deliver a powerful customer experience. Its leading subscription management solutions are live in 6 European markets powering 18.7 million active digital banking users. Initially, this company was started as an app, which lets people manage subscription offerings such as telecom, utilities, and streaming services.

Main image picture credits: Upvest

01

From telecom veteran to Dutch Startup Visa success: The Jignesh Dave story