The Dutch startup ecosystem has been flourishing with Brexit having helped the ecosystem grow further. This is because the English and Dutch laws are similar, and the UK tech founders are welcomed to start their businesses in the Netherlands. Taking the growth further, the venture capital investors are also investing in Dutch startups despite the COVID-19 pandemic crisis.

As per a study by KPMG and NL Times, Dutch startups bagged $591.2M (nearly €488M) in Q3 2020, which is over twice of the amount raised in the previous quarter of the year – $252.4M (nearly €208M). While the investments have grown in the third quarter, the overall investments this year have dropped as compared to the previous year.

Especially, industries such as healthcare, SaaS and a few others are continuing to grow. According to Dealroom, 10 SaaS-based startups in the Netherlands raised over €10M in 2020. Notably, 9 of them are from Amsterdam.

EclecticIQ

Founder/s: Joep Gommers, Raymon van der Velde

Founded year: 2014

Total funding: €40.5M

Recently, Amsterdam-based EclecticIQ raised €20M in its Series C round of funding led by Ace Management, a cyber growth investor. The round also saw participation from Capricorn Digital Growth Fund and Quest for Growth, Invest-NL, Arches Capital. Besides, existing investors, including INKEF Capital, KEEN Venture Partners, and KPN Ventures, also participated in the round.

This capital will help the company to further drive its innovation with new use cases, enables governments, large enterprises, and service providers to effectively manage threat intelligence, create situational awareness, and adopt an intelligence-led cybersecurity approach. Founded in 2014 by Joep Gommers and Raymon van der Velde, EclecticIQ is a global threat intelligence, hunting, and response technology provider. Its clients are some of the most targeted organisations, globally, claims the company.

CodeSandbox

Founder/s: Bas Buursma, Ives van Hoorne

Founded year: 2017

Total funding: €13.7M

In October, Amsterdam-based CodeSandBox raised a new round of $12.7M (nearly €10.83M) Series A funding led by EQT Ventures, bringing its total funding raised to $15M (approx €12.8M). Also, existing investors Kleiner Perkins, Arches Capital, and Vercel founder Guillermo Rauch accompanied by new angels Andreas Blixt and Daniel Gebler took part in the funding round.

This new investment will allow CodeSandBox to continue building the community, providing the tools and support to take it to new heights, including features like opinionated support for larger projects that will unlock new use cases and further existing ones.

ZIVVER

Founder/s: Rick Goud

Founded year: 2015

Total funding: €28.3M

In October, Amsterdam-based ZIVVER bagged $17M (nearly €14.4M) in a fresh round of funding led by international tech investor DN Capital along with participation from new investor SmartFin. This brings its total funding to date to over $30M (nearly €28.3M). The funding round was supported by Zivver’s other existing investors including henQ, a venture capital provider for European B2B software startups, Dawn Capital, an early-stage B2B software investor, and supplemented by an innovation credit from ABN AMRO Bank.

The fresh investment will be used to accelerate ZIVVER’s international expansion into the UK and other markets. Also, it will help in the expansion of its platform from email data protection and secure file transfer to adjacent use cases like digital signatures, secure forms, and secure video.

MessageBird

Founder/s: Adriaan Mol, Robert Vis, Rene Feiner

Founded year: 2011

Total funding: €236M

In October, the Dutch cloud communication platform MessageBird pocketed a €169.8M Series C funding round that takes its valuation to €2.5B. The funding round was led by Silicon Valley’s Spark Capital with participation from Bonnier, Glynn Capital, LGT Lightstone, Longbow, Mousse Partners and New View Capital. This investment also enables Spark Capital General Partner, Will Reed to join MessageBird’s board. Existing investors Accel, Atomico, and Y-Combinator also participated in this round.

The investment funds will be used to add new team members to MessageBird’s global team. Also, the company will expand into its core markets in Europe, Asia and Latin America and launch the Work Anywhere policy.

Mollie

Founder/s: Adriaan Mol

Founded year: 2004

Total funding: €121M

In September, Amsterdam-based Mollie, a payments-services provider attained the unicorn status by securing €90M in a Series B funding round led by TCV, a prominent growth equity investor focused on technology. Mollie will utilise these funds to accelerate its international expansion plans. Also, it plans to invest in its product and engineering division to realise its vision of becoming the most-loved payment service provider (PSP) in Europe.

Castor EDC

Founder/s: Derk Arts

Founded year: 2012

Total funding: €17.3M

In August, Castor EDC that uses AI to offer a cloud-based clinical data platform that simplifies the clinical trial process raised €10.13M in a Series A to support COVID-19 research. The round was led by Two Sigma Ventures along with Hambrecht Ducera Growth Ventures and existing investor INKEF Capital. The new funding will be utilised by the startup to strengthen its support for patient-centric, remote trials. It will also enable the company’s customers to maximise value from existing and newly generated data throughout the clinical trial process.

Roamler

Founder/s: Martijn Nijhuis, Wiggert de Haan

Founded year: 2011

Total funding: €26.2M

Roamler, an Amsterdam-based on-demand workforce platform secured €20M from Endeit Capital, Achmea Innovation Fund, and SmartFin. The fresh investment will help expand the new installation service across the world with the UK and Germany being the first ones.

Cobase

Founder/s: Jorge Schafraad

Founded year: 2017

Total funding: €17.6M

In June, Dutch startup Cobase bagged €10M in Series A round from Nordic bank Nordea and the French Crédit Agricole CIB, who will now join the main shareholder ING as its shareholders. This fresh investment will be utilised by the company for further development of its offerings and expansion of its network and connected banks.

Cobase offers a one stop, end-to-end solution for corporate customers who manage multiple bank accounts at various banks. The company’s offering provides access to all the various bank accounts via a unified single platform, making it extremely easy to manage them.

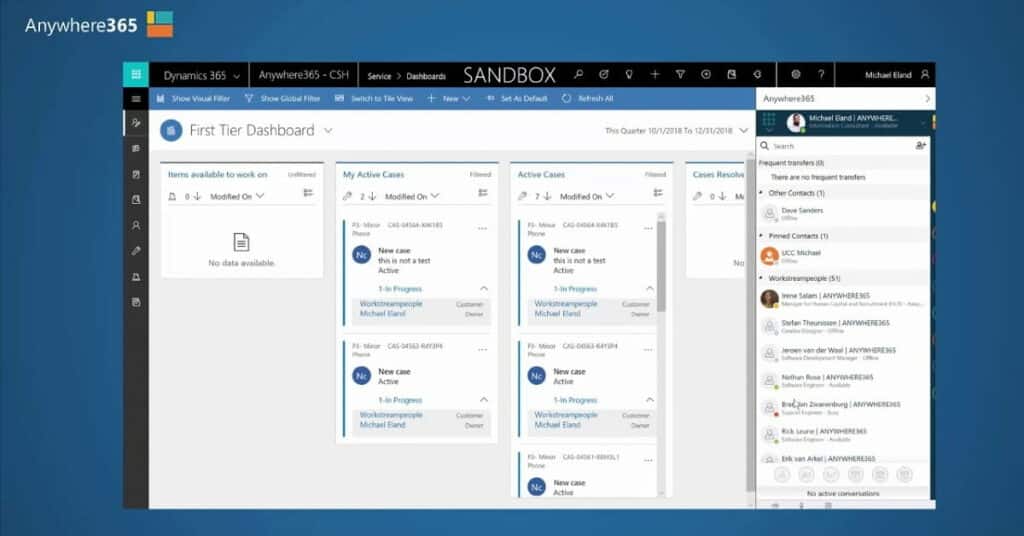

Workstreampeople (Anywhere365)

Founder/s: Gijs Geurts

Founded year: 2011

Total funding: €60M

In May, Rotterdam-based Anywhere365 bagged €20M funding from existing investor Bregal Milestone. Anywhere365 will use the new capital to continue helping businesses around the world transition from legacy systems and achieve significant efficiencies in their contact centre operations. Besides this, the company appointed senior Microsoft executive Will Blench to the Board of Directors and hired Nasdaq-experienced Finance Director Frans Koch as CFO to accelerate global expansion.

Anywhere365 is an independent supplier of omnichannel dialogue management and contact centre platform. Their solution is recognised by Gartner as a powerful native integrated Contact Centre to Microsoft Teams. It allows global companies to manage customer dialogues throughout the whole enterprise, not just the contact centre. The Anywhere365 Dialogue Cloud UCaaS platform is taking the initiative towards the next generation of solutions for operational efficiency and business results.

Pyramid Analytics

Founder/s: Avi Perez, Herbert Ochtman, Omri Kohl

Founded year: 2008

Funding: €60.5M

In March, Amsterdam-based provider of business intelligence platform closed $25M (nearly €20.6M) funding. This investment round was led by Jerusalem Venture Partners (JVP) along with participation from existing investors Sequoia Capital, Viola Growth, and Maor Investments. Pyramid Analytics intends to use the investment to expand its global presence, achieve the leadership position in the market and deepen strategic alliances with partners.

01

From telecom veteran to Dutch Startup Visa success: The Jignesh Dave story